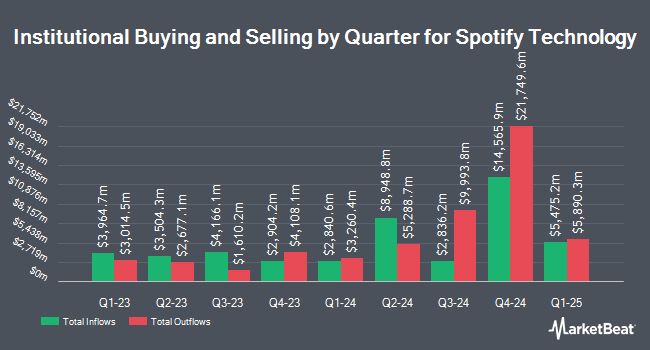

Roberts Capital Advisors LLC purchased a new stake in shares of Spotify Technology (NYSE:SPOT - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 974 shares of the company's stock, valued at approximately $536,000.

Several other large investors have also made changes to their positions in the company. Raymond James Financial Inc. lifted its stake in shares of Spotify Technology by 2.2% during the first quarter. Raymond James Financial Inc. now owns 127,102 shares of the company's stock valued at $69,910,000 after acquiring an additional 2,741 shares during the period. Cresset Asset Management LLC lifted its stake in shares of Spotify Technology by 6.2% during the first quarter. Cresset Asset Management LLC now owns 10,849 shares of the company's stock valued at $5,967,000 after acquiring an additional 632 shares during the period. State of New Jersey Common Pension Fund D lifted its stake in shares of Spotify Technology by 7.9% during the first quarter. State of New Jersey Common Pension Fund D now owns 70,986 shares of the company's stock valued at $39,044,000 after acquiring an additional 5,200 shares during the period. American Century Companies Inc. lifted its stake in shares of Spotify Technology by 40.7% during the first quarter. American Century Companies Inc. now owns 332,512 shares of the company's stock valued at $182,892,000 after acquiring an additional 96,152 shares during the period. Finally, Ethic Inc. lifted its stake in shares of Spotify Technology by 48.3% during the first quarter. Ethic Inc. now owns 20,736 shares of the company's stock valued at $11,441,000 after acquiring an additional 6,757 shares during the period. Institutional investors and hedge funds own 84.09% of the company's stock.

Analysts Set New Price Targets

Several brokerages have recently issued reports on SPOT. Deutsche Bank Aktiengesellschaft upped their price target on Spotify Technology from $700.00 to $775.00 and gave the company a "buy" rating in a research note on Wednesday, July 23rd. Guggenheim increased their target price on Spotify Technology from $725.00 to $840.00 and gave the company a "buy" rating in a research note on Wednesday, June 25th. Canaccord Genuity Group increased their target price on Spotify Technology from $775.00 to $850.00 and gave the company a "buy" rating in a research note on Wednesday, July 2nd. Rosenblatt Securities cut their target price on Spotify Technology from $703.00 to $679.00 and set a "neutral" rating on the stock in a research note on Wednesday, July 30th. Finally, KeyCorp cut their target price on Spotify Technology from $860.00 to $830.00 and set an "overweight" rating on the stock in a research note on Wednesday, July 30th. Ten investment analysts have rated the stock with a hold rating and twenty have given a buy rating to the company's stock. According to MarketBeat.com, Spotify Technology has an average rating of "Moderate Buy" and a consensus price target of $718.90.

Get Our Latest Stock Analysis on SPOT

Spotify Technology Stock Performance

NYSE:SPOT opened at $731.74 on Friday. The company has a market cap of $149.79 billion, a PE ratio of 177.61, a PEG ratio of 3.02 and a beta of 1.69. Spotify Technology has a 52-week low of $319.07 and a 52-week high of $785.00. The stock has a 50-day simple moving average of $703.27 and a 200 day simple moving average of $636.56.

Spotify Technology (NYSE:SPOT - Get Free Report) last posted its quarterly earnings data on Tuesday, July 29th. The company reported ($0.42) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.00 by ($2.42). The firm had revenue of $4.94 billion for the quarter, compared to the consensus estimate of $4.29 billion. Spotify Technology had a return on equity of 13.67% and a net margin of 4.76%. The firm's quarterly revenue was up 10.1% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.33 earnings per share. On average, research analysts predict that Spotify Technology will post 10.3 earnings per share for the current fiscal year.

About Spotify Technology

(

Free Report)

Spotify Technology SA, together with its subsidiaries, provides audio streaming subscription services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Spotify Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spotify Technology wasn't on the list.

While Spotify Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.