Vanguard Group Inc. grew its position in shares of Rocket Companies, Inc. (NYSE:RKT - Free Report) by 2.2% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 12,793,549 shares of the company's stock after acquiring an additional 273,475 shares during the quarter. Vanguard Group Inc. owned about 0.64% of Rocket Companies worth $154,418,000 as of its most recent filing with the Securities & Exchange Commission.

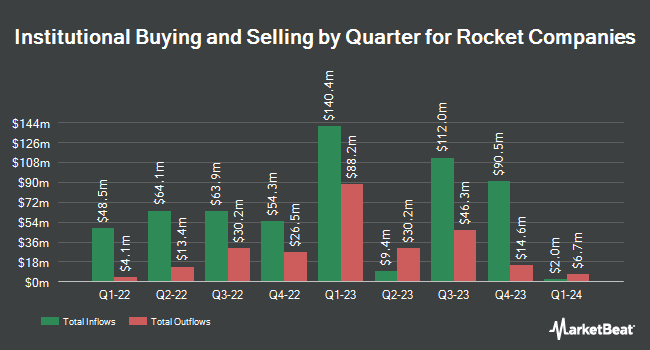

Several other hedge funds and other institutional investors have also recently modified their holdings of RKT. Wellington Management Group LLP increased its holdings in shares of Rocket Companies by 174.5% during the fourth quarter. Wellington Management Group LLP now owns 4,705,177 shares of the company's stock valued at $52,980,000 after acquiring an additional 2,990,837 shares in the last quarter. Nuveen Asset Management LLC increased its holdings in shares of Rocket Companies by 52.7% during the fourth quarter. Nuveen Asset Management LLC now owns 8,122,148 shares of the company's stock valued at $91,455,000 after acquiring an additional 2,804,090 shares in the last quarter. Point72 Asset Management L.P. bought a new stake in shares of Rocket Companies during the fourth quarter valued at approximately $14,113,000. BNP Paribas Financial Markets bought a new stake in shares of Rocket Companies during the fourth quarter valued at approximately $11,037,000. Finally, Bank of New York Mellon Corp increased its holdings in shares of Rocket Companies by 148.3% during the first quarter. Bank of New York Mellon Corp now owns 1,163,399 shares of the company's stock valued at $14,042,000 after acquiring an additional 694,779 shares in the last quarter. Institutional investors own 4.59% of the company's stock.

Rocket Companies Stock Performance

RKT stock traded up $1.6680 during midday trading on Friday, hitting $19.2480. The company's stock had a trading volume of 30,186,176 shares, compared to its average volume of 20,172,010. The stock's 50-day moving average price is $15.49 and its 200 day moving average price is $13.92. The company has a quick ratio of 18.74, a current ratio of 18.74 and a debt-to-equity ratio of 2.36. Rocket Companies, Inc. has a 1 year low of $10.06 and a 1 year high of $21.38. The stock has a market cap of $40.51 billion, a price-to-earnings ratio of -384.96 and a beta of 2.28.

Rocket Companies (NYSE:RKT - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The company reported $0.04 earnings per share for the quarter, topping the consensus estimate of $0.03 by $0.01. Rocket Companies had a positive return on equity of 3.18% and a negative net margin of 0.01%.The business had revenue of $1.36 billion for the quarter, compared to analysts' expectations of $1.28 billion. During the same quarter in the previous year, the firm earned $0.06 earnings per share. The business's revenue was up 4.5% on a year-over-year basis. Rocket Companies has set its Q3 2025 guidance at EPS. On average, equities analysts forecast that Rocket Companies, Inc. will post 0.15 EPS for the current year.

Analyst Ratings Changes

RKT has been the topic of several analyst reports. Keefe, Bruyette & Woods lifted their target price on Rocket Companies from $14.00 to $15.00 and gave the company a "market perform" rating in a research report on Tuesday, August 5th. UBS Group set a $16.00 target price on Rocket Companies and gave the company a "neutral" rating in a research report on Tuesday, August 5th. Jefferies Financial Group lifted their target price on Rocket Companies from $11.50 to $14.00 and gave the company a "hold" rating in a research report on Tuesday, July 22nd. Morgan Stanley initiated coverage on Rocket Companies in a research report on Thursday, August 14th. They set an "equal weight" rating and a $16.00 target price on the stock. Finally, BTIG Research raised Rocket Companies to a "strong-buy" rating in a research report on Tuesday. One equities research analyst has rated the stock with a Strong Buy rating, one has given a Buy rating, nine have given a Hold rating and two have assigned a Sell rating to the stock. Based on data from MarketBeat.com, Rocket Companies has an average rating of "Hold" and an average price target of $15.81.

Get Our Latest Research Report on Rocket Companies

About Rocket Companies

(

Free Report)

Rocket Companies, Inc, a fintech holding company, provides mortgage lending, title and settlement services, and other financial technology services in the United States and Canada. It operates through two segments, Direct to Consumer and Partner Network. The company's solutions include Rocket Mortgage, a mortgage lender; Amrock that provides title insurance, property valuation, and settlement services; Rocket Homes, a home search platform and real estate agent referral network, which offers technology-enabled services to support the home buying and selling experience; and Rocket Loans, an online-based personal loans business.

Recommended Stories

Before you consider Rocket Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Companies wasn't on the list.

While Rocket Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.