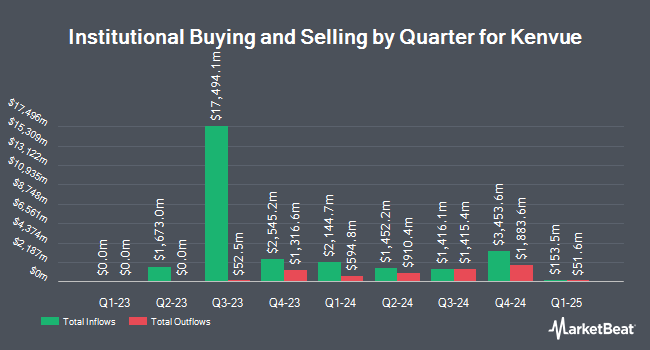

Royal Bank of Canada trimmed its stake in Kenvue Inc. (NYSE:KVUE - Free Report) by 11.2% during the first quarter, according to its most recent disclosure with the SEC. The fund owned 5,646,156 shares of the company's stock after selling 710,749 shares during the quarter. Royal Bank of Canada owned approximately 0.29% of Kenvue worth $135,396,000 as of its most recent SEC filing.

A number of other hedge funds also recently added to or reduced their stakes in the stock. Starboard Value LP acquired a new position in Kenvue during the fourth quarter worth about $467,864,000. Vanguard Group Inc. increased its stake in Kenvue by 4.9% in the 1st quarter. Vanguard Group Inc. now owns 229,144,387 shares of the company's stock worth $5,494,882,000 after purchasing an additional 10,600,682 shares in the last quarter. Nuveen LLC purchased a new position in Kenvue in the 1st quarter worth about $187,123,000. Independent Franchise Partners LLP increased its stake in Kenvue by 159.3% in the 1st quarter. Independent Franchise Partners LLP now owns 9,379,037 shares of the company's stock worth $224,909,000 after purchasing an additional 5,761,288 shares in the last quarter. Finally, Goldman Sachs Group Inc. increased its stake in Kenvue by 34.2% in the 1st quarter. Goldman Sachs Group Inc. now owns 19,670,179 shares of the company's stock worth $471,691,000 after purchasing an additional 5,011,431 shares in the last quarter. 97.64% of the stock is currently owned by institutional investors.

Kenvue Stock Performance

KVUE traded down $1.91 on Friday, hitting $18.64. The company had a trading volume of 135,326,130 shares, compared to its average volume of 13,801,933. The company's fifty day moving average price is $21.37 and its 200 day moving average price is $22.38. Kenvue Inc. has a 1-year low of $17.15 and a 1-year high of $25.17. The company has a debt-to-equity ratio of 0.66, a current ratio of 0.98 and a quick ratio of 0.68. The stock has a market cap of $35.76 billion, a price-to-earnings ratio of 25.18, a price-to-earnings-growth ratio of 2.67 and a beta of 0.83.

Kenvue (NYSE:KVUE - Get Free Report) last posted its earnings results on Thursday, August 7th. The company reported $0.29 earnings per share for the quarter, topping the consensus estimate of $0.28 by $0.01. Kenvue had a return on equity of 20.06% and a net margin of 9.37%.The firm had revenue of $3.84 billion during the quarter, compared to analyst estimates of $3.94 billion. During the same period in the previous year, the company earned $0.32 EPS. The company's revenue for the quarter was down 4.0% on a year-over-year basis. Kenvue has set its FY 2025 guidance at 1.000-1.050 EPS. Equities analysts predict that Kenvue Inc. will post 1.14 earnings per share for the current fiscal year.

Kenvue Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, August 27th. Shareholders of record on Wednesday, August 13th were given a $0.2075 dividend. The ex-dividend date of this dividend was Wednesday, August 13th. This represents a $0.83 annualized dividend and a yield of 4.5%. This is an increase from Kenvue's previous quarterly dividend of $0.21. Kenvue's dividend payout ratio (DPR) is presently 112.16%.

Analyst Ratings Changes

A number of equities analysts recently weighed in on the company. Bank of America dropped their price target on Kenvue from $27.00 to $25.00 and set a "buy" rating on the stock in a research note on Tuesday, July 15th. Royal Bank Of Canada dropped their price target on Kenvue from $24.00 to $22.00 and set a "sector perform" rating on the stock in a research note on Friday, August 8th. JPMorgan Chase & Co. dropped their price target on Kenvue from $27.00 to $26.00 and set an "overweight" rating on the stock in a research note on Friday, July 25th. UBS Group dropped their price target on Kenvue from $25.00 to $23.00 and set a "neutral" rating on the stock in a research note on Thursday, July 17th. Finally, Citigroup dropped their price target on Kenvue from $24.50 to $22.00 and set a "neutral" rating on the stock in a research note on Tuesday, July 15th. Five equities research analysts have rated the stock with a Buy rating, seven have assigned a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $24.38.

View Our Latest Report on Kenvue

About Kenvue

(

Free Report)

Kenvue Inc operates as a consumer health company worldwide. The company operates through three segments: Self Care, Skin Health and Beauty, and Essential Health. The Self Care segment offers cough, cold and allergy, pain care, digestive health, smoking cessation, eye care, and other products under the Tylenol, Motrin, Benadryl, Nicorette, Zarbee's, ORSLTM, Rhinocort, Calpol, and Zyrtec brands.

Recommended Stories

Before you consider Kenvue, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kenvue wasn't on the list.

While Kenvue currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.