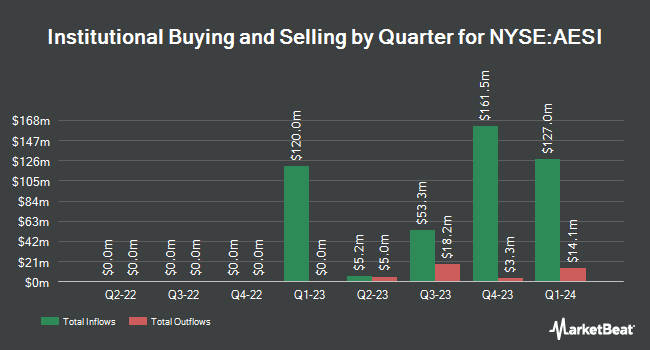

Royce & Associates LP increased its position in shares of Atlas Energy Solutions Inc. (NYSE:AESI - Free Report) by 63.4% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 367,680 shares of the company's stock after purchasing an additional 142,680 shares during the period. Royce & Associates LP owned approximately 0.30% of Atlas Energy Solutions worth $6,559,000 as of its most recent SEC filing.

Several other large investors have also recently added to or reduced their stakes in AESI. Quarry LP purchased a new position in Atlas Energy Solutions in the fourth quarter valued at about $27,000. Tower Research Capital LLC TRC boosted its position in Atlas Energy Solutions by 307.9% during the fourth quarter. Tower Research Capital LLC TRC now owns 1,387 shares of the company's stock worth $31,000 after acquiring an additional 1,047 shares during the last quarter. Larson Financial Group LLC boosted its position in Atlas Energy Solutions by 201.8% during the first quarter. Larson Financial Group LLC now owns 1,968 shares of the company's stock worth $35,000 after acquiring an additional 1,316 shares during the last quarter. Fifth Third Bancorp boosted its position in Atlas Energy Solutions by 1,240.1% during the first quarter. Fifth Third Bancorp now owns 1,970 shares of the company's stock worth $35,000 after acquiring an additional 1,823 shares during the last quarter. Finally, Canton Hathaway LLC acquired a new stake in Atlas Energy Solutions during the first quarter worth approximately $73,000. 34.59% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities research analysts recently issued reports on AESI shares. The Goldman Sachs Group dropped their price target on shares of Atlas Energy Solutions from $22.00 to $15.00 and set a "neutral" rating on the stock in a research note on Thursday, April 10th. Piper Sandler reaffirmed a "neutral" rating and set a $16.00 price target on shares of Atlas Energy Solutions in a research note on Tuesday, July 15th. Citigroup dropped their price target on shares of Atlas Energy Solutions from $18.00 to $14.00 and set a "neutral" rating on the stock in a research note on Tuesday, May 13th. Stifel Nicolaus dropped their price target on shares of Atlas Energy Solutions from $15.00 to $14.50 and set a "buy" rating on the stock in a research note on Wednesday, July 16th. Finally, Royal Bank Of Canada dropped their price target on shares of Atlas Energy Solutions from $21.00 to $17.00 and set an "outperform" rating on the stock in a research note on Wednesday, May 7th. Seven research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to MarketBeat.com, Atlas Energy Solutions presently has an average rating of "Hold" and a consensus target price of $19.11.

Get Our Latest Research Report on AESI

Atlas Energy Solutions Stock Performance

Shares of NYSE AESI traded down $0.50 during midday trading on Wednesday, hitting $13.42. The company's stock had a trading volume of 235,014 shares, compared to its average volume of 1,728,651. Atlas Energy Solutions Inc. has a 1-year low of $11.76 and a 1-year high of $26.86. The firm's fifty day moving average price is $13.61 and its 200-day moving average price is $16.43. The company has a debt-to-equity ratio of 0.38, a quick ratio of 1.40 and a current ratio of 1.62. The firm has a market cap of $1.66 billion, a P/E ratio of 43.34 and a beta of 1.20.

Atlas Energy Solutions (NYSE:AESI - Get Free Report) last posted its earnings results on Monday, May 5th. The company reported $0.08 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.18 by ($0.10). The firm had revenue of $297.59 million for the quarter, compared to analyst estimates of $291.13 million. Atlas Energy Solutions had a net margin of 2.96% and a return on equity of 4.99%. The company's revenue for the quarter was up 54.5% on a year-over-year basis. During the same period in the previous year, the firm earned $0.26 earnings per share. On average, sell-side analysts forecast that Atlas Energy Solutions Inc. will post 0.83 EPS for the current fiscal year.

Atlas Energy Solutions Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, May 22nd. Shareholders of record on Thursday, May 15th were paid a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a yield of 7.45%. The ex-dividend date of this dividend was Thursday, May 15th. Atlas Energy Solutions's payout ratio is 322.58%.

Insider Transactions at Atlas Energy Solutions

In related news, Director Douglas G. Rogers purchased 7,000 shares of the company's stock in a transaction on Wednesday, May 14th. The shares were bought at an average cost of $13.27 per share, for a total transaction of $92,890.00. Following the transaction, the director owned 10,000 shares of the company's stock, valued at $132,700. This represents a 233.33% increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is available through this link. Also, Chairman Ben M. Brigham bought 9,635 shares of the company's stock in a transaction that occurred on Wednesday, May 14th. The stock was acquired at an average price of $13.38 per share, for a total transaction of $128,916.30. Following the completion of the acquisition, the chairman directly owned 572,397 shares in the company, valued at approximately $7,658,671.86. This represents a 1.71% increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders own 15.98% of the company's stock.

Atlas Energy Solutions Company Profile

(

Free Report)

Atlas Energy Solutions Inc engages in the production, processing, and sale of mesh and sand that are used as a proppant during the well completion process in the Permian Basin of Texas and New Mexico. The company provides transportation and logistics, storage solutions, and contract labor services. It sells its products and services to oil and natural gas exploration and production companies, and oilfield services companies.

Further Reading

Before you consider Atlas Energy Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlas Energy Solutions wasn't on the list.

While Atlas Energy Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.