Royce & Associates LP decreased its position in shares of Cars.com Inc. (NYSE:CARS - Free Report) by 89.9% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 43,344 shares of the company's stock after selling 387,047 shares during the quarter. Royce & Associates LP owned 0.07% of Cars.com worth $488,000 at the end of the most recent reporting period.

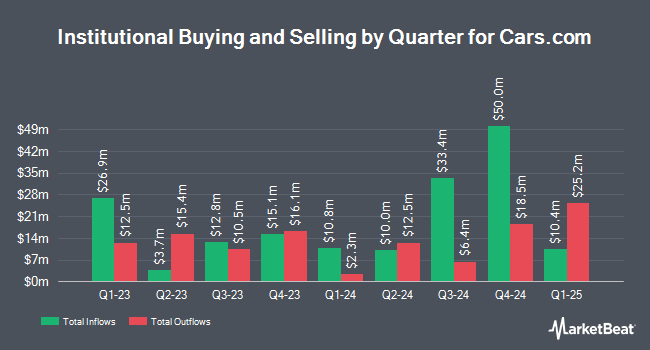

Several other institutional investors and hedge funds have also bought and sold shares of the company. Vanguard Group Inc. lifted its position in Cars.com by 1.6% during the fourth quarter. Vanguard Group Inc. now owns 7,121,007 shares of the company's stock worth $123,407,000 after purchasing an additional 115,083 shares during the period. Dimensional Fund Advisors LP raised its stake in Cars.com by 1.8% during the fourth quarter. Dimensional Fund Advisors LP now owns 3,172,706 shares of the company's stock worth $54,984,000 after acquiring an additional 55,143 shares in the last quarter. Northern Trust Corp raised its stake in Cars.com by 17.6% during the fourth quarter. Northern Trust Corp now owns 804,640 shares of the company's stock worth $13,944,000 after acquiring an additional 120,331 shares in the last quarter. Renaissance Technologies LLC raised its stake in Cars.com by 20.0% during the fourth quarter. Renaissance Technologies LLC now owns 782,425 shares of the company's stock worth $13,559,000 after acquiring an additional 130,325 shares in the last quarter. Finally, SG Capital Management LLC acquired a new position in Cars.com during the fourth quarter worth about $10,908,000. Institutional investors own 89.15% of the company's stock.

Cars.com Trading Down 3.5%

CARS stock traded down $0.45 during mid-day trading on Friday, reaching $12.43. The company's stock had a trading volume of 687,228 shares, compared to its average volume of 648,308. The company has a market cap of $789.36 million, a price-to-earnings ratio of 18.27 and a beta of 1.76. The business's 50 day moving average price is $11.68 and its 200 day moving average price is $12.78. The company has a current ratio of 1.65, a quick ratio of 1.65 and a debt-to-equity ratio of 0.93. Cars.com Inc. has a 12 month low of $9.56 and a 12 month high of $20.47.

Cars.com (NYSE:CARS - Get Free Report) last issued its earnings results on Thursday, May 8th. The company reported $0.37 earnings per share for the quarter, missing analysts' consensus estimates of $0.39 by ($0.02). The business had revenue of $179.02 million during the quarter, compared to the consensus estimate of $179.82 million. Cars.com had a return on equity of 16.86% and a net margin of 6.32%. The company's revenue for the quarter was down .7% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $0.43 earnings per share. On average, equities research analysts predict that Cars.com Inc. will post 1.19 EPS for the current year.

Insiders Place Their Bets

In other news, CEO Thomas Alex Vetter acquired 27,870 shares of Cars.com stock in a transaction on Friday, May 9th. The stock was purchased at an average price of $10.75 per share, with a total value of $299,602.50. Following the completion of the purchase, the chief executive officer owned 844,897 shares of the company's stock, valued at approximately $9,082,642.75. The trade was a 3.41% increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 2.39% of the company's stock.

Analyst Ratings Changes

Several research analysts have commented on the company. UBS Group lowered their target price on Cars.com from $13.00 to $12.00 and set a "neutral" rating for the company in a research note on Friday, May 9th. JPMorgan Chase & Co. upgraded Cars.com from a "neutral" rating to an "overweight" rating and set a $14.00 price target for the company in a research note on Thursday, July 17th. One analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $18.30.

View Our Latest Stock Analysis on Cars.com

Cars.com Company Profile

(

Free Report)

Cars.com Inc, through its subsidiaries, operates as a digital automotive marketplace that connects local car dealers to consumers in the United States. The company offers a suite of digital solutions that creates connections between individuals researching cars or looking to purchase a car with car dealerships and automotive original equipment manufacturers.

See Also

Before you consider Cars.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cars.com wasn't on the list.

While Cars.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.