Russell Investments Group Ltd. raised its stake in ACM Research, Inc. (NASDAQ:ACMR - Free Report) by 388.3% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 142,244 shares of the specialty retailer's stock after buying an additional 113,111 shares during the quarter. Russell Investments Group Ltd. owned 0.24% of ACM Research worth $3,320,000 as of its most recent filing with the Securities and Exchange Commission.

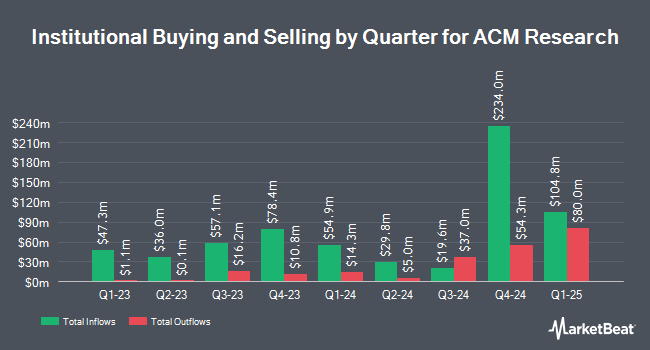

Several other hedge funds have also recently added to or reduced their stakes in ACMR. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its holdings in shares of ACM Research by 1,418.5% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,174,720 shares of the specialty retailer's stock worth $17,738,000 after acquiring an additional 1,097,358 shares in the last quarter. Federated Hermes Inc. increased its holdings in shares of ACM Research by 12,871.6% in the first quarter. Federated Hermes Inc. now owns 1,072,752 shares of the specialty retailer's stock worth $25,038,000 after acquiring an additional 1,064,482 shares in the last quarter. Triata Capital Ltd bought a new stake in shares of ACM Research in the fourth quarter worth about $15,507,000. Raiffeisen Bank International AG bought a new stake in shares of ACM Research in the fourth quarter worth about $10,549,000. Finally, Invesco Ltd. increased its holdings in shares of ACM Research by 18.2% in the first quarter. Invesco Ltd. now owns 1,339,102 shares of the specialty retailer's stock worth $31,255,000 after acquiring an additional 206,149 shares in the last quarter. Institutional investors and hedge funds own 66.75% of the company's stock.

Insider Buying and Selling

In related news, insider Jian Wang sold 30,000 shares of the stock in a transaction that occurred on Monday, August 25th. The stock was sold at an average price of $32.00, for a total transaction of $960,000.00. Following the completion of the transaction, the insider directly owned 253,158 shares of the company's stock, valued at approximately $8,101,056. This represents a 10.59% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Lisa Feng sold 15,000 shares of the stock in a transaction that occurred on Monday, July 7th. The shares were sold at an average price of $28.00, for a total value of $420,000.00. Following the transaction, the insider directly owned 50,001 shares of the company's stock, valued at $1,400,028. This trade represents a 23.08% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 116,152 shares of company stock valued at $3,454,560. 25.00% of the stock is currently owned by company insiders.

ACM Research Trading Down 3.7%

Shares of ACM Research stock traded down $1.07 during trading hours on Friday, hitting $28.22. The company's stock had a trading volume of 1,177,543 shares, compared to its average volume of 1,662,694. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.45 and a quick ratio of 1.49. The company has a market capitalization of $1.67 billion, a PE ratio of 17.10 and a beta of 1.36. ACM Research, Inc. has a 12 month low of $13.87 and a 12 month high of $32.54. The stock has a 50 day moving average of $27.93 and a 200 day moving average of $25.06.

ACM Research (NASDAQ:ACMR - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The specialty retailer reported $0.54 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.42 by $0.12. ACM Research had a return on equity of 9.57% and a net margin of 13.76%.The business had revenue of $215.37 million during the quarter, compared to the consensus estimate of $223.42 million. During the same period last year, the company earned $0.55 earnings per share. ACM Research's quarterly revenue was up 6.4% on a year-over-year basis. Analysts predict that ACM Research, Inc. will post 1.17 earnings per share for the current year.

ACM Research Company Profile

(

Free Report)

ACM Research, Inc, together with its subsidiaries, develops, manufactures, and sells single-wafer wet cleaning equipment for enhancing the manufacturing process and yield for integrated chips worldwide. It offers space alternated phase shift technology for flat and patterned wafer surfaces, which employs alternating phases of megasonic waves to deliver megasonic energy in a uniform manner on a microscopic level; timely energized bubble oscillation technology for patterned wafer surfaces at advanced process nodes, which provides cleaning for 2D and 3D patterned wafers; Tahoe technology for delivering cleaning performance using less sulfuric acid and hydrogen peroxide; and electro-chemical plating technology for advanced metal plating.

Read More

Before you consider ACM Research, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACM Research wasn't on the list.

While ACM Research currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.