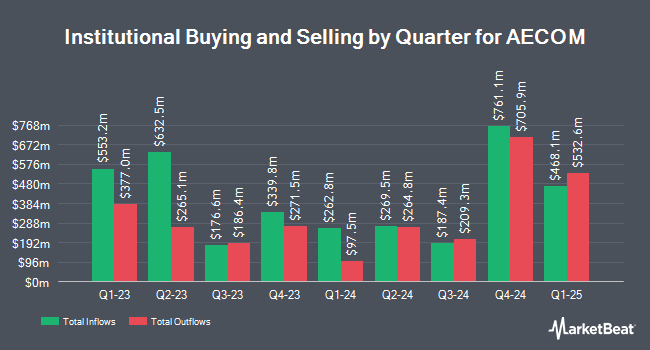

Russell Investments Group Ltd. lowered its holdings in AECOM (NYSE:ACM - Free Report) by 20.0% during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 181,172 shares of the construction company's stock after selling 45,285 shares during the quarter. Russell Investments Group Ltd. owned 0.14% of AECOM worth $16,784,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its position in shares of AECOM by 34.7% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 2,680,258 shares of the construction company's stock worth $286,305,000 after purchasing an additional 691,020 shares during the period. Northern Trust Corp boosted its position in shares of AECOM by 53.5% during the 4th quarter. Northern Trust Corp now owns 1,664,893 shares of the construction company's stock worth $177,844,000 after purchasing an additional 580,078 shares during the period. Dimensional Fund Advisors LP boosted its position in shares of AECOM by 8.5% during the 4th quarter. Dimensional Fund Advisors LP now owns 1,205,920 shares of the construction company's stock worth $128,820,000 after purchasing an additional 94,880 shares during the period. Deutsche Bank AG boosted its position in shares of AECOM by 2.7% during the 1st quarter. Deutsche Bank AG now owns 1,144,329 shares of the construction company's stock worth $106,114,000 after purchasing an additional 29,748 shares during the period. Finally, AGF Management Ltd. boosted its position in shares of AECOM by 10.7% during the 1st quarter. AGF Management Ltd. now owns 964,757 shares of the construction company's stock worth $89,462,000 after purchasing an additional 92,864 shares during the period. Hedge funds and other institutional investors own 85.41% of the company's stock.

Insider Buying and Selling

In related news, CEO Troy Rudd sold 53,097 shares of the firm's stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $119.56, for a total value of $6,348,277.32. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 0.41% of the company's stock.

Analyst Ratings Changes

A number of brokerages have issued reports on ACM. Royal Bank Of Canada boosted their price target on shares of AECOM from $123.00 to $126.00 and gave the stock an "outperform" rating in a research note on Wednesday, May 7th. Citigroup reiterated a "buy" rating and issued a $137.00 price target (up previously from $122.00) on shares of AECOM in a research report on Monday, July 28th. Barclays lifted their target price on AECOM from $120.00 to $130.00 and gave the company an "overweight" rating in a research note on Tuesday, August 12th. KeyCorp boosted their target price on shares of AECOM from $129.00 to $131.00 and gave the stock an "overweight" rating in a research report on Wednesday, August 6th. Finally, Wall Street Zen raised AECOM from a "hold" rating to a "buy" rating in a research note on Saturday, August 9th. Nine research analysts have rated the stock with a Buy rating, Based on data from MarketBeat, AECOM has a consensus rating of "Buy" and a consensus price target of $128.44.

Get Our Latest Report on AECOM

AECOM Stock Up 2.5%

ACM traded up $3.0070 on Friday, reaching $124.5870. The company's stock had a trading volume of 191,222 shares, compared to its average volume of 973,603. The business's 50 day moving average is $114.92 and its 200 day moving average is $105.28. The stock has a market cap of $16.50 billion, a price-to-earnings ratio of 27.13, a price-to-earnings-growth ratio of 1.78 and a beta of 0.99. AECOM has a 1 year low of $85.00 and a 1 year high of $124.44. The company has a debt-to-equity ratio of 0.91, a current ratio of 1.17 and a quick ratio of 1.17.

AECOM (NYSE:ACM - Get Free Report) last posted its earnings results on Monday, August 4th. The construction company reported $1.34 EPS for the quarter, beating the consensus estimate of $1.25 by $0.09. The company had revenue of $1.94 billion during the quarter, compared to analyst estimates of $4.33 billion. AECOM had a return on equity of 27.87% and a net margin of 3.82%.The business's revenue was up 6.2% compared to the same quarter last year. During the same period in the prior year, the company earned $1.16 earnings per share. AECOM has set its FY 2025 guidance at 5.200-5.300 EPS. As a group, research analysts forecast that AECOM will post 5.1 EPS for the current fiscal year.

AECOM Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, July 18th. Stockholders of record on Wednesday, July 2nd were given a dividend of $0.26 per share. The ex-dividend date of this dividend was Wednesday, July 2nd. This represents a $1.04 dividend on an annualized basis and a dividend yield of 0.8%. AECOM's payout ratio is 22.66%.

About AECOM

(

Free Report)

AECOM, together with its subsidiaries, provides professional infrastructure consulting services worldwide. It operates in three segments: Americas, International, and AECOM Capital. The company offers planning, consulting, architectural and engineering design, construction and program management, and investment and development services to public and private clients.

See Also

Before you consider AECOM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AECOM wasn't on the list.

While AECOM currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.