RWA Wealth Partners LLC grew its holdings in shares of ASML Holding N.V. (NASDAQ:ASML - Free Report) by 3.9% during the first quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 30,598 shares of the semiconductor company's stock after buying an additional 1,154 shares during the period. RWA Wealth Partners LLC's holdings in ASML were worth $20,275,000 as of its most recent filing with the SEC.

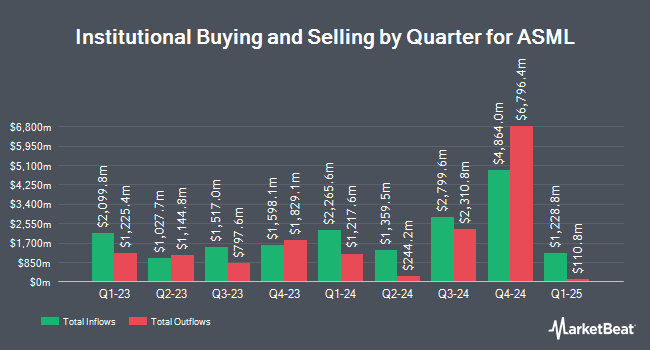

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. GAMMA Investing LLC boosted its holdings in shares of ASML by 70,115.5% during the 1st quarter. GAMMA Investing LLC now owns 1,400,800 shares of the semiconductor company's stock worth $9,282,120,000 after buying an additional 1,398,805 shares in the last quarter. Goldman Sachs Group Inc. raised its position in shares of ASML by 26.5% during the first quarter. Goldman Sachs Group Inc. now owns 952,385 shares of the semiconductor company's stock worth $631,079,000 after purchasing an additional 199,740 shares during the period. Dimensional Fund Advisors LP raised its position in shares of ASML by 0.8% during the first quarter. Dimensional Fund Advisors LP now owns 905,708 shares of the semiconductor company's stock worth $600,175,000 after purchasing an additional 7,164 shares during the period. Invesco Ltd. raised its position in shares of ASML by 101.0% during the first quarter. Invesco Ltd. now owns 731,271 shares of the semiconductor company's stock worth $484,562,000 after purchasing an additional 367,505 shares during the period. Finally, Fayez Sarofim & Co raised its position in shares of ASML by 2.7% during the first quarter. Fayez Sarofim & Co now owns 710,668 shares of the semiconductor company's stock worth $470,910,000 after purchasing an additional 18,516 shares during the period. 26.07% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently weighed in on ASML shares. Barclays reaffirmed an "equal weight" rating on shares of ASML in a research report on Tuesday, June 3rd. New Street Research raised ASML from a "neutral" rating to a "buy" rating in a research report on Thursday, July 24th. Erste Group Bank reaffirmed a "hold" rating on shares of ASML in a research report on Wednesday, July 23rd. Jefferies Financial Group lowered ASML from a "buy" rating to a "hold" rating in a research report on Thursday, June 26th. Finally, Wells Fargo & Company increased their price target on ASML from $840.00 to $890.00 and gave the company an "overweight" rating in a research report on Tuesday, July 8th. Seven research analysts have rated the stock with a hold rating, six have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $923.80.

View Our Latest Analysis on ASML

ASML Trading Down 1.7%

Shares of ASML stock opened at $742.16 on Monday. ASML Holding N.V. has a 1 year low of $578.51 and a 1 year high of $945.05. The firm has a market cap of $291.98 billion, a PE ratio of 30.97, a P/E/G ratio of 1.51 and a beta of 1.76. The stock has a fifty day moving average price of $757.89 and a 200-day moving average price of $725.49. The company has a debt-to-equity ratio of 0.21, a current ratio of 1.43 and a quick ratio of 0.81.

ASML (NASDAQ:ASML - Get Free Report) last announced its earnings results on Wednesday, July 16th. The semiconductor company reported $4.55 earnings per share (EPS) for the quarter, missing the consensus estimate of $5.94 by ($1.39). ASML had a net margin of 26.95% and a return on equity of 49.47%. The business had revenue of $8.94 billion for the quarter, compared to analysts' expectations of $8.72 billion. During the same period in the prior year, the business earned $4.01 earnings per share. The company's revenue for the quarter was up 23.2% compared to the same quarter last year. Equities research analysts anticipate that ASML Holding N.V. will post 25.17 EPS for the current year.

ASML Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, August 6th. Stockholders of record on Tuesday, July 29th were given a dividend of $1.856 per share. The ex-dividend date of this dividend was Tuesday, July 29th. This represents a $7.42 annualized dividend and a dividend yield of 1.0%. This is a boost from ASML's previous quarterly dividend of $1.64. ASML's payout ratio is 26.21%.

ASML Profile

(

Free Report)

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers. It offers advanced semiconductor equipment systems, including lithography, metrology, and inspection systems. The company also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various range of semiconductor nodes and technologies.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ASML, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASML wasn't on the list.

While ASML currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.