SageView Advisory Group LLC reduced its stake in TruBridge, Inc. (NASDAQ:TBRG - Free Report) by 26.9% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 40,561 shares of the company's stock after selling 14,933 shares during the period. SageView Advisory Group LLC owned 0.27% of TruBridge worth $1,116,000 as of its most recent SEC filing.

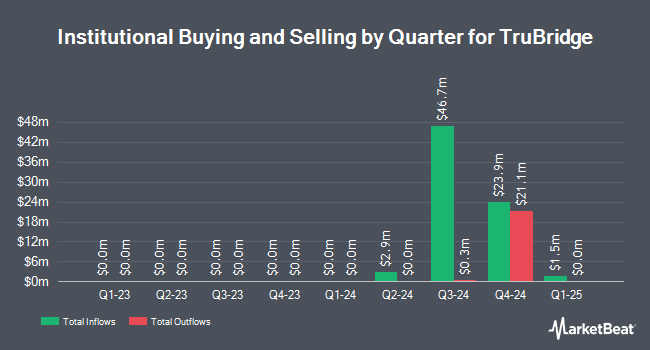

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Invesco Ltd. grew its position in TruBridge by 177.7% in the 1st quarter. Invesco Ltd. now owns 151,489 shares of the company's stock worth $4,169,000 after purchasing an additional 96,931 shares in the last quarter. Jane Street Group LLC lifted its stake in TruBridge by 211.6% in the 4th quarter. Jane Street Group LLC now owns 104,331 shares of the company's stock worth $2,057,000 after purchasing an additional 70,850 shares in the last quarter. GAMMA Investing LLC increased its holdings in shares of TruBridge by 2,652.0% in the 1st quarter. GAMMA Investing LLC now owns 60,627 shares of the company's stock worth $1,668,000 after buying an additional 58,424 shares during the last quarter. Campbell & CO Investment Adviser LLC bought a new position in shares of TruBridge in the 1st quarter worth $1,415,000. Finally, Millennium Management LLC grew its holdings in shares of TruBridge by 20.9% during the 1st quarter. Millennium Management LLC now owns 226,172 shares of the company's stock valued at $6,224,000 after purchasing an additional 39,090 shares during the last quarter. 88.64% of the stock is owned by institutional investors.

TruBridge Trading Up 1.1%

TruBridge stock traded up $0.23 during trading hours on Tuesday, reaching $20.57. The stock had a trading volume of 18,349 shares, compared to its average volume of 159,625. The stock has a market cap of $308.76 million, a PE ratio of -24.41 and a beta of 0.55. TruBridge, Inc. has a 52 week low of $11.39 and a 52 week high of $32.00. The company has a debt-to-equity ratio of 0.94, a current ratio of 1.80 and a quick ratio of 1.79. The company has a fifty day simple moving average of $20.84 and a 200-day simple moving average of $23.71.

TruBridge Company Profile

(

Free Report)

TruBridge, Inc provides healthcare solutions and services for community hospitals, clinics, and other healthcare systems in the United States and internationally. The company operates in three segments: Revenue Cycle Management (RCM), Electronic Health Record (HER), and Patient Engagement. It focuses on providing RCM solutions for care settings, regardless of primary healthcare information solutions provider along with business management, consulting, managed IT services, and analytics and business intelligence.

Featured Stories

Before you consider TruBridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TruBridge wasn't on the list.

While TruBridge currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.