LPL Financial LLC grew its position in Sanofi (NASDAQ:SNY - Free Report) by 18.4% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 1,520,721 shares of the company's stock after purchasing an additional 236,625 shares during the period. LPL Financial LLC owned approximately 0.06% of Sanofi worth $84,339,000 as of its most recent SEC filing.

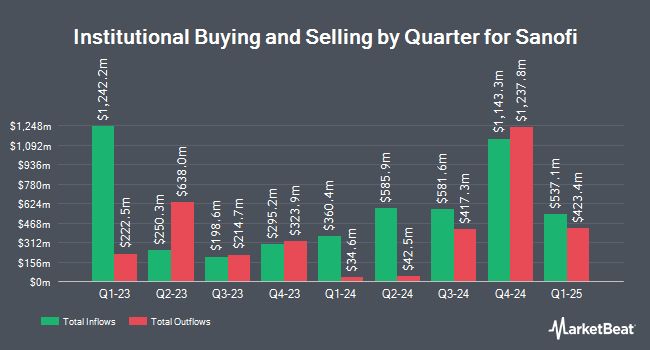

Several other large investors also recently made changes to their positions in the company. Bessemer Group Inc. boosted its holdings in Sanofi by 59.8% during the fourth quarter. Bessemer Group Inc. now owns 647 shares of the company's stock worth $32,000 after buying an additional 242 shares in the last quarter. Golden State Wealth Management LLC increased its position in Sanofi by 619.3% during the first quarter. Golden State Wealth Management LLC now owns 633 shares of the company's stock worth $35,000 after buying an additional 545 shares during the last quarter. UMB Bank n.a. grew its holdings in Sanofi by 30.7% during the first quarter. UMB Bank n.a. now owns 1,124 shares of the company's stock valued at $62,000 after purchasing an additional 264 shares during the last quarter. Wayfinding Financial LLC acquired a new position in Sanofi during the 1st quarter worth $63,000. Finally, Tsfg LLC lifted its holdings in shares of Sanofi by 1,107.0% during the first quarter. Tsfg LLC now owns 1,207 shares of the company's stock worth $67,000 after buying an additional 1,107 shares during the last quarter. Institutional investors and hedge funds own 14.04% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on SNY. Hsbc Global Res upgraded Sanofi to a "strong-buy" rating in a research report on Monday, April 28th. Morgan Stanley set a $56.00 target price on shares of Sanofi in a research report on Monday, June 2nd. Barclays reaffirmed an "overweight" rating on shares of Sanofi in a research note on Wednesday, July 2nd. Guggenheim reissued a "buy" rating on shares of Sanofi in a research note on Tuesday, June 3rd. Finally, BNP Paribas assumed coverage on shares of Sanofi in a report on Tuesday, April 15th. They issued an "outperform" rating and a $65.00 price objective on the stock. Three investment analysts have rated the stock with a hold rating, three have assigned a buy rating and three have assigned a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Buy" and a consensus target price of $62.00.

View Our Latest Analysis on Sanofi

Sanofi Price Performance

NASDAQ:SNY traded up $1.11 during trading hours on Friday, reaching $46.75. 2,518,877 shares of the company were exchanged, compared to its average volume of 2,122,035. Sanofi has a 1-year low of $44.73 and a 1-year high of $60.12. The company has a market capitalization of $114.65 billion, a P/E ratio of 11.10, a P/E/G ratio of 1.05 and a beta of 0.48. The company has a debt-to-equity ratio of 0.16, a current ratio of 1.37 and a quick ratio of 0.69. The business has a 50 day moving average of $49.21 and a 200 day moving average of $52.09.

About Sanofi

(

Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

See Also

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.