Vestcor Inc trimmed its holdings in shares of SBA Communications Corporation (NASDAQ:SBAC - Free Report) by 34.6% in the first quarter, according to its most recent filing with the SEC. The firm owned 24,768 shares of the technology company's stock after selling 13,081 shares during the period. Vestcor Inc's holdings in SBA Communications were worth $5,449,000 as of its most recent filing with the SEC.

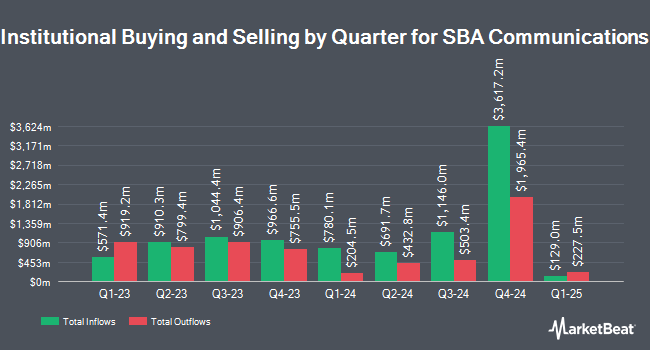

A number of other hedge funds and other institutional investors also recently made changes to their positions in SBAC. Dodge & Cox grew its position in SBA Communications by 352.5% in the fourth quarter. Dodge & Cox now owns 7,346,255 shares of the technology company's stock valued at $1,497,167,000 after acquiring an additional 5,722,740 shares during the period. Geode Capital Management LLC boosted its stake in shares of SBA Communications by 2.5% in the 4th quarter. Geode Capital Management LLC now owns 2,886,158 shares of the technology company's stock valued at $586,827,000 after purchasing an additional 71,023 shares in the last quarter. Deutsche Bank AG increased its position in shares of SBA Communications by 5.9% during the 4th quarter. Deutsche Bank AG now owns 2,411,920 shares of the technology company's stock worth $491,549,000 after purchasing an additional 134,624 shares in the last quarter. Diamond Hill Capital Management Inc. lifted its holdings in SBA Communications by 7.3% during the 1st quarter. Diamond Hill Capital Management Inc. now owns 1,996,773 shares of the technology company's stock valued at $439,310,000 after purchasing an additional 135,682 shares during the last quarter. Finally, Victory Capital Management Inc. boosted its position in SBA Communications by 11.5% in the first quarter. Victory Capital Management Inc. now owns 1,986,133 shares of the technology company's stock valued at $436,969,000 after buying an additional 204,902 shares in the last quarter. 97.35% of the stock is owned by institutional investors.

SBA Communications Stock Performance

SBAC traded up $2.15 during trading on Monday, reaching $230.72. 343,173 shares of the company's stock were exchanged, compared to its average volume of 854,236. The company's fifty day moving average price is $231.25 and its 200-day moving average price is $222.92. The firm has a market capitalization of $24.79 billion, a PE ratio of 31.65, a P/E/G ratio of 1.89 and a beta of 0.77. SBA Communications Corporation has a fifty-two week low of $192.55 and a fifty-two week high of $252.64.

Analyst Upgrades and Downgrades

Several analysts have weighed in on SBAC shares. Scotiabank initiated coverage on shares of SBA Communications in a report on Thursday, July 17th. They set a "sector perform" rating and a $252.00 price objective for the company. BMO Capital Markets raised their price target on SBA Communications from $230.00 to $240.00 and gave the company a "market perform" rating in a report on Tuesday, April 29th. Morgan Stanley boosted their price objective on SBA Communications from $255.00 to $260.00 and gave the stock an "equal weight" rating in a research note on Tuesday, July 22nd. Citigroup increased their target price on SBA Communications from $250.00 to $265.00 and gave the stock a "buy" rating in a report on Tuesday, April 29th. Finally, Bank of America started coverage on shares of SBA Communications in a research report on Monday, May 19th. They set a "buy" rating and a $260.00 price target on the stock. Eight investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, SBA Communications currently has a consensus rating of "Moderate Buy" and an average price target of $257.19.

Read Our Latest Stock Report on SBA Communications

SBA Communications Company Profile

(

Free Report)

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

Read More

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.