BROOKFIELD Corp ON grew its stake in shares of SBA Communications Corporation (NASDAQ:SBAC - Free Report) by 1.8% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,008,947 shares of the technology company's stock after acquiring an additional 17,702 shares during the period. SBA Communications accounts for 1.3% of BROOKFIELD Corp ON's holdings, making the stock its 12th largest position. BROOKFIELD Corp ON owned about 0.94% of SBA Communications worth $221,978,000 as of its most recent filing with the Securities & Exchange Commission.

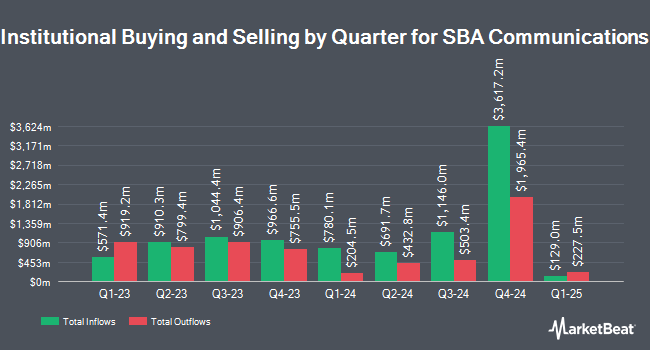

Several other institutional investors and hedge funds also recently made changes to their positions in SBAC. Independence Bank of Kentucky acquired a new stake in SBA Communications during the 1st quarter worth approximately $28,000. Stone House Investment Management LLC bought a new position in SBA Communications during the 1st quarter worth $33,000. Allworth Financial LP lifted its holdings in shares of SBA Communications by 62.0% during the first quarter. Allworth Financial LP now owns 162 shares of the technology company's stock worth $36,000 after buying an additional 62 shares in the last quarter. Geneos Wealth Management Inc. boosted its position in shares of SBA Communications by 105.0% in the first quarter. Geneos Wealth Management Inc. now owns 164 shares of the technology company's stock valued at $36,000 after acquiring an additional 84 shares during the period. Finally, NBC Securities Inc. boosted its position in shares of SBA Communications by 1,575.0% in the first quarter. NBC Securities Inc. now owns 201 shares of the technology company's stock valued at $44,000 after acquiring an additional 189 shares during the period. Institutional investors and hedge funds own 97.35% of the company's stock.

Analyst Ratings Changes

A number of research analysts have issued reports on the stock. Barclays decreased their target price on shares of SBA Communications from $257.00 to $226.00 and set an "overweight" rating on the stock in a research report on Monday. Wells Fargo & Company increased their price target on SBA Communications from $225.00 to $235.00 and gave the stock an "equal weight" rating in a research report on Tuesday, August 5th. Raymond James Financial set a $265.00 price objective on SBA Communications and gave the stock a "strong-buy" rating in a research note on Tuesday, August 5th. Scotiabank initiated coverage on SBA Communications in a research report on Thursday, July 17th. They set a "sector perform" rating and a $252.00 target price for the company. Finally, UBS Group increased their target price on SBA Communications from $280.00 to $285.00 and gave the stock a "buy" rating in a report on Tuesday, July 8th. Two investment analysts have rated the stock with a Strong Buy rating, seven have given a Buy rating and eight have assigned a Hold rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $251.63.

View Our Latest Report on SBAC

SBA Communications Trading Up 1.5%

Shares of SBAC traded up $3.00 on Wednesday, reaching $202.18. The company's stock had a trading volume of 379,226 shares, compared to its average volume of 920,983. SBA Communications Corporation has a twelve month low of $186.81 and a twelve month high of $252.64. The stock has a market capitalization of $21.71 billion, a PE ratio of 25.71, a PEG ratio of 1.87 and a beta of 0.80. The firm has a fifty day moving average of $218.31 and a 200-day moving average of $223.85.

SBA Communications (NASDAQ:SBAC - Get Free Report) last posted its earnings results on Monday, August 4th. The technology company reported $3.17 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.10 by $0.07. SBA Communications had a net margin of 31.19% and a negative return on equity of 16.83%. The firm had revenue of $698.98 million during the quarter, compared to analyst estimates of $670.73 million. During the same quarter in the prior year, the business posted $3.29 EPS. The business's revenue was up 5.8% compared to the same quarter last year. SBA Communications has set its FY 2025 guidance at EPS. As a group, equities analysts anticipate that SBA Communications Corporation will post 12.57 EPS for the current fiscal year.

SBA Communications Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, September 18th. Investors of record on Thursday, August 21st will be given a dividend of $1.11 per share. This represents a $4.44 dividend on an annualized basis and a dividend yield of 2.2%. The ex-dividend date of this dividend is Thursday, August 21st. SBA Communications's dividend payout ratio (DPR) is presently 56.42%.

SBA Communications Company Profile

(

Free Report)

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

Featured Stories

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.