Siemens Fonds Invest GmbH purchased a new stake in DICK'S Sporting Goods, Inc. (NYSE:DKS - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm purchased 14,788 shares of the sporting goods retailer's stock, valued at approximately $3,384,000.

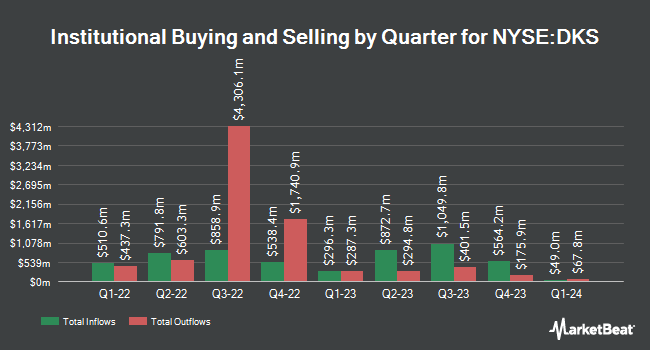

A number of other hedge funds and other institutional investors have also modified their holdings of DKS. Park Square Financial Group LLC acquired a new position in shares of DICK'S Sporting Goods in the 4th quarter valued at $27,000. New Wave Wealth Advisors LLC acquired a new stake in DICK'S Sporting Goods during the 4th quarter worth about $28,000. Ancora Advisors LLC acquired a new stake in DICK'S Sporting Goods during the 4th quarter worth about $28,000. Rialto Wealth Management LLC acquired a new stake in DICK'S Sporting Goods during the 4th quarter worth about $30,000. Finally, Bessemer Group Inc. boosted its position in DICK'S Sporting Goods by 108.6% during the 4th quarter. Bessemer Group Inc. now owns 146 shares of the sporting goods retailer's stock worth $33,000 after acquiring an additional 76 shares during the period. Institutional investors and hedge funds own 89.83% of the company's stock.

DICK'S Sporting Goods Stock Performance

NYSE DKS traded up $4.08 during trading on Thursday, hitting $181.20. The company's stock had a trading volume of 2,424,845 shares, compared to its average volume of 1,255,459. The company has a quick ratio of 0.56, a current ratio of 1.72 and a debt-to-equity ratio of 0.48. The firm has a 50 day moving average price of $188.47 and a 200 day moving average price of $209.94. The firm has a market cap of $14.47 billion, a P/E ratio of 12.95, a price-to-earnings-growth ratio of 2.47 and a beta of 1.16. DICK'S Sporting Goods, Inc. has a 52 week low of $166.37 and a 52 week high of $254.60.

DICK'S Sporting Goods (NYSE:DKS - Get Free Report) last issued its quarterly earnings results on Wednesday, May 28th. The sporting goods retailer reported $3.37 EPS for the quarter, hitting the consensus estimate of $3.37. The company had revenue of $3.16 billion for the quarter, compared to the consensus estimate of $3.12 billion. DICK'S Sporting Goods had a return on equity of 42.00% and a net margin of 8.65%. Equities research analysts forecast that DICK'S Sporting Goods, Inc. will post 13.89 earnings per share for the current fiscal year.

DICK'S Sporting Goods Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, June 27th. Stockholders of record on Friday, June 13th will be given a dividend of $1.2125 per share. This represents a $4.85 dividend on an annualized basis and a dividend yield of 2.68%. The ex-dividend date is Friday, June 13th. DICK'S Sporting Goods's dividend payout ratio is presently 34.54%.

DICK'S Sporting Goods announced that its Board of Directors has approved a stock buyback plan on Tuesday, March 11th that authorizes the company to repurchase $3.00 billion in outstanding shares. This repurchase authorization authorizes the sporting goods retailer to reacquire up to 18.5% of its shares through open market purchases. Shares repurchase plans are often an indication that the company's board of directors believes its shares are undervalued.

Wall Street Analysts Forecast Growth

DKS has been the subject of a number of research reports. Argus raised their price objective on DICK'S Sporting Goods from $255.00 to $280.00 and gave the stock a "buy" rating in a research report on Wednesday, January 29th. DA Davidson decreased their price objective on DICK'S Sporting Goods from $273.00 to $230.00 and set a "buy" rating for the company in a research report on Thursday. Barclays raised their price objective on DICK'S Sporting Goods from $217.00 to $232.00 and gave the stock an "overweight" rating in a research report on Thursday. Gordon Haskett lowered DICK'S Sporting Goods from a "buy" rating to a "reduce" rating and set a $170.00 price objective for the company. in a research report on Friday, May 16th. Finally, Robert W. Baird decreased their price objective on DICK'S Sporting Goods from $230.00 to $185.00 and set a "neutral" rating for the company in a research report on Friday, May 16th. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $223.53.

Get Our Latest Stock Report on DICK'S Sporting Goods

DICK'S Sporting Goods Company Profile

(

Free Report)

Dick's Sporting Goods, Inc engages in the retailing of an extensive assortment of authentic sports equipment, apparel, footwear, and accessories. It also offers its products both online and through mobile applications. The company was founded by Richard T. Stack in 1948 and is headquartered in Coraopolis, PA.

Further Reading

Before you consider DICK'S Sporting Goods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DICK'S Sporting Goods wasn't on the list.

While DICK'S Sporting Goods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.