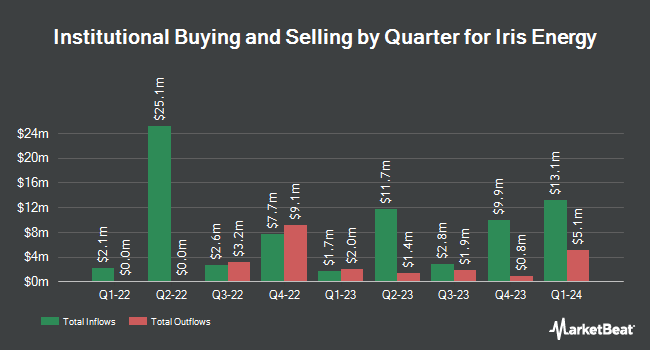

Situational Awareness LP purchased a new position in shares of IREN Limited (NASDAQ:IREN - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 3,366,130 shares of the company's stock, valued at approximately $20,500,000. IREN comprises about 2.0% of Situational Awareness LP's investment portfolio, making the stock its 12th largest holding. Situational Awareness LP owned approximately 1.79% of IREN as of its most recent filing with the SEC.

Several other hedge funds have also added to or reduced their stakes in IREN. Crewe Advisors LLC bought a new position in IREN during the 1st quarter worth $39,000. Main Management LLC bought a new position in IREN during the 4th quarter worth $49,000. Delta Financial Group Inc. bought a new position in IREN during the 1st quarter worth $61,000. R Squared Ltd increased its stake in IREN by 170.1% during the 1st quarter. R Squared Ltd now owns 10,290 shares of the company's stock worth $63,000 after acquiring an additional 6,480 shares during the period. Finally, US Bancorp DE bought a new position in IREN during the 1st quarter worth $69,000. 41.08% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities analysts have commented on the company. Wall Street Zen upgraded IREN from a "sell" rating to a "hold" rating in a research note on Saturday, July 12th. Macquarie raised their price objective on IREN from $20.00 to $33.00 and gave the stock an "outperform" rating in a research note on Friday. Cantor Fitzgerald raised their price objective on IREN from $27.00 to $41.00 and gave the stock an "overweight" rating in a research note on Friday. Canaccord Genuity Group raised their price objective on IREN from $23.00 to $37.00 and gave the stock a "buy" rating in a research note on Friday. Finally, B. Riley raised their price objective on IREN from $22.00 to $29.00 and gave the stock a "buy" rating in a research note on Friday. Eight investment analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $29.88.

Check Out Our Latest Research Report on IREN

IREN Price Performance

Shares of IREN traded up $3.44 during midday trading on Friday, hitting $26.48. The company's stock had a trading volume of 76,287,263 shares, compared to its average volume of 24,413,336. IREN Limited has a one year low of $5.13 and a one year high of $29.50. The company's fifty day simple moving average is $17.65 and its two-hundred day simple moving average is $11.28. The company has a quick ratio of 4.29, a current ratio of 4.29 and a debt-to-equity ratio of 0.53. The stock has a market capitalization of $4.97 billion, a price-to-earnings ratio of 44.88 and a beta of 4.03.

IREN Profile

(

Free Report)

IREN Limited, formerly known as Iris Energy Limited, owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

Read More

Before you consider IREN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IREN wasn't on the list.

While IREN currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.