Skandinaviska Enskilda Banken AB publ boosted its holdings in shares of HP Inc. (NYSE:HPQ - Free Report) by 24.7% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 780,233 shares of the computer maker's stock after purchasing an additional 154,402 shares during the period. Skandinaviska Enskilda Banken AB publ owned about 0.08% of HP worth $21,605,000 at the end of the most recent reporting period.

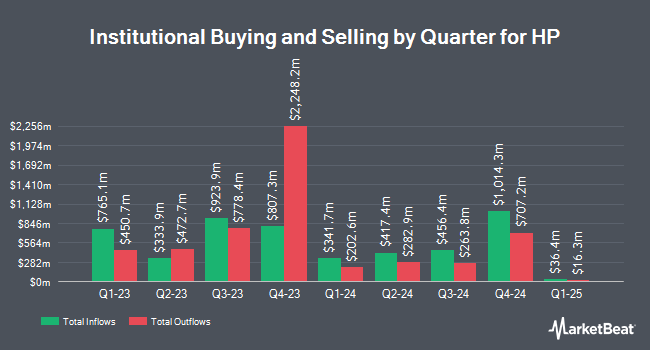

A number of other hedge funds also recently bought and sold shares of HPQ. Geode Capital Management LLC grew its holdings in shares of HP by 2.3% during the 4th quarter. Geode Capital Management LLC now owns 25,350,016 shares of the computer maker's stock worth $825,398,000 after acquiring an additional 579,525 shares during the period. Northern Trust Corp grew its holdings in shares of HP by 15.8% during the 4th quarter. Northern Trust Corp now owns 12,844,795 shares of the computer maker's stock worth $419,126,000 after acquiring an additional 1,755,942 shares during the period. Invesco Ltd. grew its holdings in shares of HP by 7.3% during the 4th quarter. Invesco Ltd. now owns 9,511,218 shares of the computer maker's stock worth $310,351,000 after acquiring an additional 643,192 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in shares of HP by 8.2% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 9,289,164 shares of the computer maker's stock worth $303,105,000 after acquiring an additional 707,742 shares during the period. Finally, Norges Bank purchased a new position in shares of HP during the 4th quarter worth approximately $229,320,000. Hedge funds and other institutional investors own 77.53% of the company's stock.

Analyst Ratings Changes

HPQ has been the topic of several recent research reports. TD Cowen cut their price target on HP from $38.00 to $28.00 and set a "hold" rating on the stock in a research note on Thursday, May 29th. Citigroup cut their price target on HP from $29.00 to $27.50 and set a "neutral" rating on the stock in a research note on Thursday, May 29th. KGI Securities initiated coverage on HP in a research note on Thursday, May 29th. They issued a "neutral" rating on the stock. Morgan Stanley cut their price target on HP from $29.00 to $26.00 and set an "equal weight" rating on the stock in a research note on Thursday, May 29th. Finally, Bank of America cut their price target on HP from $35.00 to $33.00 and set a "neutral" rating on the stock in a research note on Wednesday, May 28th. One analyst has rated the stock with a sell rating, twelve have assigned a hold rating and three have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $29.54.

Check Out Our Latest Research Report on HP

HP Trading Down 0.7%

HPQ stock traded down $0.17 during midday trading on Wednesday, hitting $25.50. The company's stock had a trading volume of 2,259,712 shares, compared to its average volume of 8,260,663. The company has a market cap of $23.95 billion, a PE ratio of 9.83, a P/E/G ratio of 2.09 and a beta of 1.27. HP Inc. has a 12 month low of $21.21 and a 12 month high of $39.79. The firm's 50-day moving average is $25.41 and its 200-day moving average is $27.78.

HP (NYSE:HPQ - Get Free Report) last released its quarterly earnings results on Wednesday, May 28th. The computer maker reported $0.71 earnings per share for the quarter, missing the consensus estimate of $0.80 by ($0.09). The firm had revenue of $13.22 billion for the quarter, compared to the consensus estimate of $13.09 billion. HP had a net margin of 4.64% and a negative return on equity of 244.99%. HP's quarterly revenue was up 3.3% compared to the same quarter last year. During the same period in the previous year, the company earned $0.82 earnings per share. Analysts expect that HP Inc. will post 3.56 earnings per share for the current year.

HP Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, October 1st. Stockholders of record on Wednesday, September 10th will be issued a dividend of $0.2894 per share. The ex-dividend date is Wednesday, September 10th. This represents a $1.16 annualized dividend and a dividend yield of 4.54%. HP's payout ratio is 44.40%.

About HP

(

Free Report)

HP Inc provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide. It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets.

Read More

Before you consider HP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HP wasn't on the list.

While HP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.