Skandinaviska Enskilda Banken AB publ bought a new stake in shares of Celestica, Inc. (NYSE:CLS - Free Report) TSE: CLS during the 1st quarter, according to the company in its most recent disclosure with the SEC. The fund bought 11,900 shares of the technology company's stock, valued at approximately $940,000.

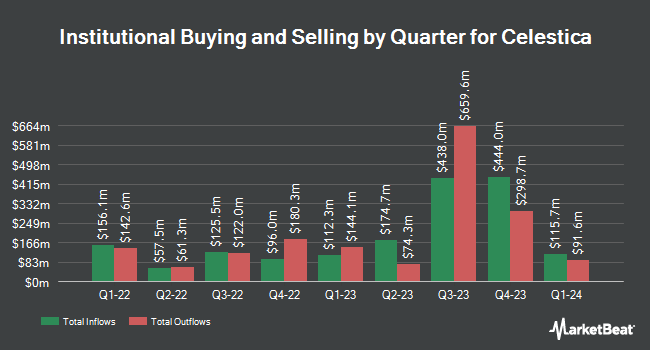

Several other hedge funds also recently modified their holdings of CLS. CoreCap Advisors LLC lifted its position in shares of Celestica by 5.4% in the fourth quarter. CoreCap Advisors LLC now owns 1,760 shares of the technology company's stock worth $162,000 after buying an additional 90 shares during the last quarter. First National Bank of Hutchinson lifted its stake in shares of Celestica by 2.5% in the 1st quarter. First National Bank of Hutchinson now owns 4,914 shares of the technology company's stock valued at $387,000 after purchasing an additional 120 shares during the period. Private Trust Co. NA lifted its stake in shares of Celestica by 14.1% in the 1st quarter. Private Trust Co. NA now owns 993 shares of the technology company's stock valued at $78,000 after purchasing an additional 123 shares during the period. Csenge Advisory Group increased its position in shares of Celestica by 7.1% in the 1st quarter. Csenge Advisory Group now owns 2,593 shares of the technology company's stock valued at $218,000 after buying an additional 171 shares in the last quarter. Finally, Pinpoint Asset Management Ltd increased its position in shares of Celestica by 109.6% in the 4th quarter. Pinpoint Asset Management Ltd now owns 348 shares of the technology company's stock valued at $32,000 after buying an additional 182 shares in the last quarter. 67.38% of the stock is currently owned by institutional investors and hedge funds.

Celestica Stock Performance

NYSE CLS traded up $0.37 during trading hours on Wednesday, hitting $202.37. 6,608,297 shares of the company's stock traded hands, compared to its average volume of 3,699,972. The business's fifty day moving average price is $142.85 and its two-hundred day moving average price is $114.71. The company has a current ratio of 1.44, a quick ratio of 0.85 and a debt-to-equity ratio of 0.48. The firm has a market capitalization of $23.27 billion, a P/E ratio of 43.80 and a beta of 1.81. Celestica, Inc. has a 52 week low of $40.25 and a 52 week high of $214.47.

Wall Street Analyst Weigh In

CLS has been the subject of a number of research reports. Royal Bank Of Canada increased their target price on Celestica from $185.00 to $225.00 and gave the stock an "outperform" rating in a report on Wednesday. CIBC cut their price objective on shares of Celestica from $150.00 to $120.00 and set an "outperformer" rating for the company in a research report on Tuesday, April 15th. BNP Paribas raised shares of Celestica to a "strong-buy" rating in a report on Wednesday, June 11th. JPMorgan Chase & Co. lifted their price objective on shares of Celestica from $170.00 to $225.00 and gave the company an "overweight" rating in a research note on Wednesday. Finally, BMO Capital Markets reiterated an "outperform" rating and set a $130.00 price target (up previously from $118.00) on shares of Celestica in a report on Thursday, May 22nd. Three equities research analysts have rated the stock with a hold rating, nine have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $168.92.

Read Our Latest Analysis on Celestica

Celestica Company Profile

(

Free Report)

Celestica Inc provides supply chain solutions in North America, Europe, and Asia. It operates through two segments: Advanced Technology Solutions, and Connectivity & Cloud Solutions. The company offers a range of product manufacturing and related supply chain services, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.

Read More

Before you consider Celestica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celestica wasn't on the list.

While Celestica currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.