Skandinaviska Enskilda Banken AB publ trimmed its holdings in Monolithic Power Systems, Inc. (NASDAQ:MPWR - Free Report) by 43.6% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 28,058 shares of the semiconductor company's stock after selling 21,662 shares during the period. Skandinaviska Enskilda Banken AB publ owned approximately 0.06% of Monolithic Power Systems worth $16,265,000 as of its most recent filing with the Securities and Exchange Commission.

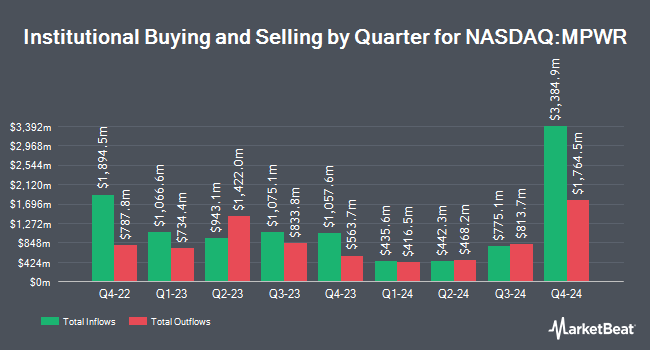

Other hedge funds have also bought and sold shares of the company. Wealth Enhancement Advisory Services LLC grew its stake in Monolithic Power Systems by 13.3% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 3,719 shares of the semiconductor company's stock valued at $2,157,000 after buying an additional 438 shares in the last quarter. OneDigital Investment Advisors LLC purchased a new position in Monolithic Power Systems in the 1st quarter valued at approximately $204,000. Praxis Investment Management Inc. purchased a new position in Monolithic Power Systems in the 1st quarter valued at approximately $980,000. Jackson Wealth Management LLC grew its stake in Monolithic Power Systems by 29.5% in the 1st quarter. Jackson Wealth Management LLC now owns 2,896 shares of the semiconductor company's stock valued at $1,680,000 after buying an additional 659 shares in the last quarter. Finally, DAVENPORT & Co LLC grew its stake in Monolithic Power Systems by 52.6% in the 1st quarter. DAVENPORT & Co LLC now owns 653 shares of the semiconductor company's stock valued at $379,000 after buying an additional 225 shares in the last quarter. 93.46% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of research firms recently weighed in on MPWR. Stifel Nicolaus reduced their price objective on shares of Monolithic Power Systems from $1,100.00 to $880.00 and set a "buy" rating for the company in a research note on Thursday, April 17th. Needham & Company LLC reiterated a "buy" rating and issued a $800.00 price objective on shares of Monolithic Power Systems in a research note on Friday, May 2nd. Wells Fargo & Company boosted their price target on shares of Monolithic Power Systems from $695.00 to $730.00 and gave the company an "equal weight" rating in a research report on Wednesday, July 16th. Loop Capital boosted their price target on shares of Monolithic Power Systems from $760.00 to $800.00 and gave the company a "buy" rating in a research report on Wednesday, July 23rd. Finally, Citigroup boosted their price target on shares of Monolithic Power Systems from $700.00 to $785.00 and gave the company a "buy" rating in a research report on Wednesday, June 4th. Two research analysts have rated the stock with a hold rating and ten have given a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $805.67.

Read Our Latest Stock Analysis on MPWR

Monolithic Power Systems Stock Up 1.6%

Shares of NASDAQ MPWR traded up $11.50 during mid-day trading on Wednesday, reaching $735.87. 137,178 shares of the company were exchanged, compared to its average volume of 808,880. Monolithic Power Systems, Inc. has a 52 week low of $438.86 and a 52 week high of $959.64. The stock has a market capitalization of $35.23 billion, a PE ratio of 19.59, a PEG ratio of 2.93 and a beta of 1.20. The company's 50 day moving average price is $711.06 and its 200 day moving average price is $647.47.

Monolithic Power Systems (NASDAQ:MPWR - Get Free Report) last posted its quarterly earnings data on Thursday, May 1st. The semiconductor company reported $4.04 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $4.00 by $0.04. Monolithic Power Systems had a net margin of 76.59% and a return on equity of 19.80%. The company had revenue of $637.55 million during the quarter, compared to the consensus estimate of $633.43 million. During the same period in the previous year, the firm posted $2.81 EPS. The firm's revenue was up 39.2% compared to the same quarter last year. On average, sell-side analysts predict that Monolithic Power Systems, Inc. will post 13.2 earnings per share for the current year.

Monolithic Power Systems Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, July 15th. Shareholders of record on Monday, June 30th were paid a $1.56 dividend. This represents a $6.24 annualized dividend and a yield of 0.85%. The ex-dividend date of this dividend was Monday, June 30th. Monolithic Power Systems's dividend payout ratio is presently 16.56%.

Insiders Place Their Bets

In other news, Director Kuo Wei Herbert Chang sold 100 shares of the company's stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $698.00, for a total transaction of $69,800.00. Following the completion of the transaction, the director directly owned 676 shares of the company's stock, valued at approximately $471,848. This represents a 12.89% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, EVP Maurice Sciammas sold 12,000 shares of the company's stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $701.00, for a total transaction of $8,412,000.00. Following the transaction, the executive vice president directly owned 4,015 shares of the company's stock, valued at approximately $2,814,515. This trade represents a 74.93% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 18,200 shares of company stock valued at $13,046,800 over the last three months. Insiders own 3.40% of the company's stock.

Monolithic Power Systems Company Profile

(

Free Report)

Monolithic Power Systems, Inc engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets. The company provides direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as cloud-based CPU servers, server artificial intelligence applications, storage applications, commercial notebooks, digital cockpit, power sources, home appliances, 4G and 5G infrastructure, and satellite communications applications.

Featured Stories

Before you consider Monolithic Power Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monolithic Power Systems wasn't on the list.

While Monolithic Power Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report