CMG Global Holdings LLC increased its holdings in shares of SoFi Technologies, Inc. (NASDAQ:SOFI - Free Report) by 51.7% during the 2nd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 213,026 shares of the company's stock after acquiring an additional 72,637 shares during the quarter. SoFi Technologies makes up approximately 2.1% of CMG Global Holdings LLC's holdings, making the stock its 13th biggest holding. CMG Global Holdings LLC's holdings in SoFi Technologies were worth $3,879,000 as of its most recent filing with the Securities & Exchange Commission.

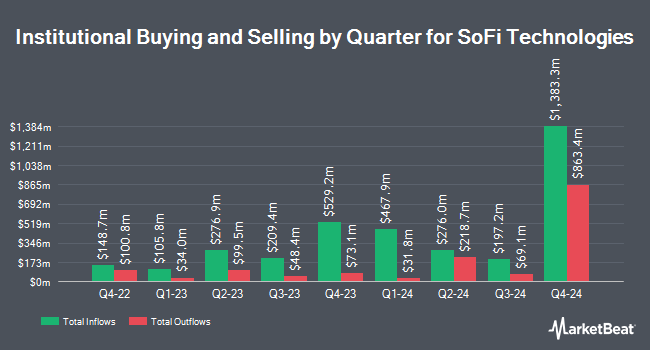

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. raised its stake in SoFi Technologies by 1.1% during the first quarter. Vanguard Group Inc. now owns 99,467,295 shares of the company's stock worth $1,156,805,000 after acquiring an additional 1,130,250 shares during the period. Sullivan Wood Capital Management LLC acquired a new stake in shares of SoFi Technologies in the 2nd quarter worth about $2,799,000. Blair William & Co. IL increased its holdings in shares of SoFi Technologies by 443.9% in the 2nd quarter. Blair William & Co. IL now owns 335,698 shares of the company's stock worth $6,113,000 after acquiring an additional 273,972 shares during the period. Nicholas Wealth LLC. acquired a new stake in shares of SoFi Technologies in the 1st quarter worth about $993,000. Finally, Quantitative Investment Management LLC acquired a new stake in shares of SoFi Technologies in the 1st quarter worth about $2,862,000. Institutional investors and hedge funds own 38.43% of the company's stock.

Insider Activity

In other news, EVP Kelli Keough sold 10,578 shares of the firm's stock in a transaction dated Wednesday, August 20th. The shares were sold at an average price of $22.13, for a total transaction of $234,091.14. Following the completion of the transaction, the executive vice president owned 234,622 shares in the company, valued at approximately $5,192,184.86. This trade represents a 4.31% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, CTO Jeremy Rishel sold 98,733 shares of the firm's stock in a transaction dated Thursday, September 18th. The shares were sold at an average price of $27.50, for a total transaction of $2,715,157.50. Following the transaction, the chief technology officer owned 759,553 shares of the company's stock, valued at approximately $20,887,707.50. This trade represents a 11.50% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 119,347 shares of company stock valued at $3,228,852. Insiders own 2.60% of the company's stock.

SoFi Technologies Stock Performance

Shares of SOFI opened at $26.54 on Monday. The firm has a 50-day moving average price of $26.13 and a 200 day moving average price of $19.27. The firm has a market capitalization of $31.78 billion, a PE ratio of 55.29, a P/E/G ratio of 3.15 and a beta of 1.92. The company has a quick ratio of 0.14, a current ratio of 0.80 and a debt-to-equity ratio of 0.57. SoFi Technologies, Inc. has a 52-week low of $8.60 and a 52-week high of $30.30.

SoFi Technologies (NASDAQ:SOFI - Get Free Report) last announced its earnings results on Tuesday, July 29th. The company reported $0.08 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.06 by $0.02. The firm had revenue of $519.37 million during the quarter, compared to analyst estimates of $801.94 million. SoFi Technologies had a net margin of 18.38% and a return on equity of 4.44%. SoFi Technologies's revenue was up 42.8% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.01 EPS. SoFi Technologies has set its FY 2025 guidance at 0.310-0.310 EPS. On average, sell-side analysts anticipate that SoFi Technologies, Inc. will post 0.26 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of research firms recently weighed in on SOFI. Cowen began coverage on shares of SoFi Technologies in a report on Friday, July 11th. They issued a "hold" rating on the stock. Citigroup increased their price objective on shares of SoFi Technologies from $18.00 to $28.00 and gave the stock a "buy" rating in a report on Wednesday, August 20th. The Goldman Sachs Group increased their price objective on shares of SoFi Technologies from $21.00 to $24.00 and gave the stock a "neutral" rating in a report on Monday, October 13th. Morgan Stanley increased their price objective on shares of SoFi Technologies from $13.00 to $18.00 and gave the stock an "underweight" rating in a report on Monday, September 29th. Finally, Keefe, Bruyette & Woods increased their target price on shares of SoFi Technologies from $14.00 to $18.00 and gave the company an "underperform" rating in a research report on Wednesday, October 15th. One investment analyst has rated the stock with a Strong Buy rating, six have given a Buy rating, twelve have assigned a Hold rating and three have assigned a Sell rating to the company. According to data from MarketBeat.com, SoFi Technologies has a consensus rating of "Hold" and a consensus target price of $20.71.

Check Out Our Latest Report on SoFi Technologies

SoFi Technologies Company Profile

(

Free Report)

SoFi Technologies, Inc provides various financial services in the United States, Latin America, and Canada. It operates through three segments: Lending, Technology Platform, and Financial Services. The company offers lending and financial services and products that allows its members to borrow, save, spend, invest, and protect money.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SoFi Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SoFi Technologies wasn't on the list.

While SoFi Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.