Cresset Asset Management LLC cut its holdings in shares of Sony Corporation (NYSE:SONY - Free Report) by 41.1% in the first quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 29,650 shares of the company's stock after selling 20,667 shares during the quarter. Cresset Asset Management LLC's holdings in Sony were worth $753,000 at the end of the most recent quarter.

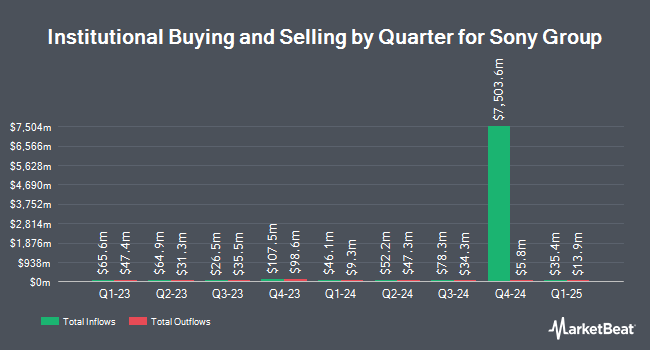

Several other institutional investors have also made changes to their positions in the company. Aristotle Capital Management LLC lifted its holdings in shares of Sony by 393.7% during the 4th quarter. Aristotle Capital Management LLC now owns 52,771,882 shares of the company's stock valued at $1,116,653,000 after buying an additional 42,083,842 shares during the last quarter. Bank of America Corp DE increased its position in shares of Sony by 377.7% during the fourth quarter. Bank of America Corp DE now owns 23,804,970 shares of the company's stock valued at $503,713,000 after purchasing an additional 18,821,902 shares during the period. Northern Trust Corp increased its position in shares of Sony by 609.6% during the fourth quarter. Northern Trust Corp now owns 7,587,683 shares of the company's stock valued at $160,555,000 after purchasing an additional 6,518,412 shares during the period. Royal Bank of Canada grew its position in Sony by 416.6% in the fourth quarter. Royal Bank of Canada now owns 5,796,210 shares of the company's stock valued at $122,649,000 after acquiring an additional 4,674,249 shares during the period. Finally, Dimensional Fund Advisors LP grew its position in Sony by 404.5% in the fourth quarter. Dimensional Fund Advisors LP now owns 2,765,343 shares of the company's stock valued at $58,515,000 after acquiring an additional 2,217,167 shares during the period. 14.05% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen lowered Sony from a "buy" rating to a "hold" rating in a research note on Thursday, May 22nd. One analyst has rated the stock with a Strong Buy rating, four have given a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat.com, Sony currently has a consensus rating of "Buy" and a consensus price target of $28.00.

Read Our Latest Stock Analysis on SONY

Sony Stock Performance

Shares of SONY traded down $0.10 during mid-day trading on Wednesday, reaching $27.79. The company's stock had a trading volume of 2,320,842 shares, compared to its average volume of 5,129,540. Sony Corporation has a 1-year low of $17.42 and a 1-year high of $29.16. The stock has a market cap of $168.03 billion, a P/E ratio of 22.05 and a beta of 0.91. The business has a 50-day simple moving average of $25.70 and a two-hundred day simple moving average of $25.03. The company has a current ratio of 1.09, a quick ratio of 1.03 and a debt-to-equity ratio of 0.16.

Sony (NYSE:SONY - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The company reported $0.30 EPS for the quarter, topping analysts' consensus estimates of $0.24 by $0.06. Sony had a return on equity of 13.88% and a net margin of 9.14%.The firm had revenue of $17.79 billion for the quarter, compared to analyst estimates of $18.88 billion. During the same quarter last year, the company earned $189.90 EPS. Sony has set its FY 2025 guidance at EPS. As a group, equities research analysts anticipate that Sony Corporation will post 1.23 earnings per share for the current fiscal year.

Sony Profile

(

Free Report)

Sony Group Corporation designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally. The company distributes software titles and add-on content through digital networks; network services related to game, video, and music content; and home gaming consoles, packaged and game software, and peripheral devices.

Read More

Before you consider Sony, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sony wasn't on the list.

While Sony currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.