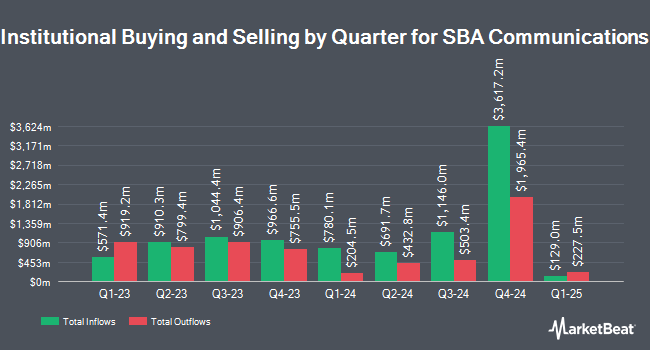

Soroban Capital Partners LP acquired a new position in SBA Communications Co. (NASDAQ:SBAC - Free Report) in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor acquired 29,747 shares of the technology company's stock, valued at approximately $6,062,000. SBA Communications makes up 0.1% of Soroban Capital Partners LP's investment portfolio, making the stock its 24th biggest position.

Other institutional investors have also added to or reduced their stakes in the company. Exchange Traded Concepts LLC grew its stake in SBA Communications by 15.1% in the fourth quarter. Exchange Traded Concepts LLC now owns 382 shares of the technology company's stock worth $78,000 after purchasing an additional 50 shares during the period. Auxano Advisors LLC grew its stake in SBA Communications by 2.3% in the fourth quarter. Auxano Advisors LLC now owns 2,431 shares of the technology company's stock worth $495,000 after purchasing an additional 54 shares during the period. DoubleLine ETF Adviser LP grew its stake in SBA Communications by 0.7% in the fourth quarter. DoubleLine ETF Adviser LP now owns 7,738 shares of the technology company's stock worth $1,577,000 after purchasing an additional 57 shares during the period. Lake Street Advisors Group LLC lifted its holdings in shares of SBA Communications by 5.8% during the fourth quarter. Lake Street Advisors Group LLC now owns 1,105 shares of the technology company's stock valued at $225,000 after purchasing an additional 61 shares during the last quarter. Finally, Orion Portfolio Solutions LLC lifted its holdings in shares of SBA Communications by 1.3% during the fourth quarter. Orion Portfolio Solutions LLC now owns 4,962 shares of the technology company's stock valued at $1,011,000 after purchasing an additional 64 shares during the last quarter. 97.35% of the stock is currently owned by institutional investors.

SBA Communications Trading Up 0.5%

NASDAQ SBAC traded up $1.25 on Friday, hitting $229.52. 400,822 shares of the company traded hands, compared to its average volume of 896,820. The company has a market capitalization of $24.66 billion, a price-to-earnings ratio of 36.20, a P/E/G ratio of 0.74 and a beta of 0.83. The business's 50 day moving average price is $225.78 and its 200-day moving average price is $216.14. SBA Communications Co. has a 52-week low of $185.44 and a 52-week high of $252.64.

SBA Communications Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, June 17th. Investors of record on Thursday, May 22nd will be given a dividend of $1.11 per share. The ex-dividend date of this dividend is Thursday, May 22nd. This represents a $4.44 annualized dividend and a yield of 1.93%. SBA Communications's dividend payout ratio (DPR) is presently 60.91%.

Analyst Ratings Changes

Several equities analysts have recently issued reports on the stock. Citigroup lifted their target price on shares of SBA Communications from $250.00 to $265.00 and gave the company a "buy" rating in a report on Tuesday, April 29th. Wall Street Zen lowered shares of SBA Communications from a "buy" rating to a "hold" rating in a report on Friday, April 18th. Barclays lifted their target price on shares of SBA Communications from $244.00 to $247.00 and gave the company an "overweight" rating in a report on Tuesday, April 29th. Raymond James reiterated a "strong-buy" rating and set a $268.00 target price (up from $265.00) on shares of SBA Communications in a report on Tuesday, April 29th. Finally, Citizens Jmp upgraded shares of SBA Communications to a "strong-buy" rating in a report on Monday, January 27th. Seven research analysts have rated the stock with a hold rating, seven have given a buy rating and two have given a strong buy rating to the company. According to MarketBeat.com, SBA Communications presently has an average rating of "Moderate Buy" and a consensus target price of $253.43.

Check Out Our Latest Report on SBA Communications

Insider Activity at SBA Communications

In other news, VP Joshua Koenig sold 2,209 shares of the stock in a transaction on Friday, March 7th. The shares were sold at an average price of $224.18, for a total value of $495,213.62. Following the completion of the sale, the vice president now directly owns 6,079 shares of the company's stock, valued at $1,362,790.22. This represents a 26.65% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Jack Langer sold 5,000 shares of the stock in a transaction on Thursday, May 1st. The stock was sold at an average price of $240.59, for a total transaction of $1,202,950.00. Following the completion of the sale, the director now directly owns 10,522 shares of the company's stock, valued at approximately $2,531,487.98. This trade represents a 32.21% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.92% of the stock is owned by company insiders.

About SBA Communications

(

Free Report)

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. With a portfolio of more than 39,000 communications sites throughout the Americas, Africa and in Asia, SBA is listed on NASDAQ under the symbol SBAC.

Further Reading

Before you consider SBA Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SBA Communications wasn't on the list.

While SBA Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.