Sound View Wealth Advisors Group LLC grew its stake in shares of CME Group Inc. (NASDAQ:CME - Free Report) by 58.5% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 3,855 shares of the financial services provider's stock after acquiring an additional 1,423 shares during the period. Sound View Wealth Advisors Group LLC's holdings in CME Group were worth $1,023,000 at the end of the most recent reporting period.

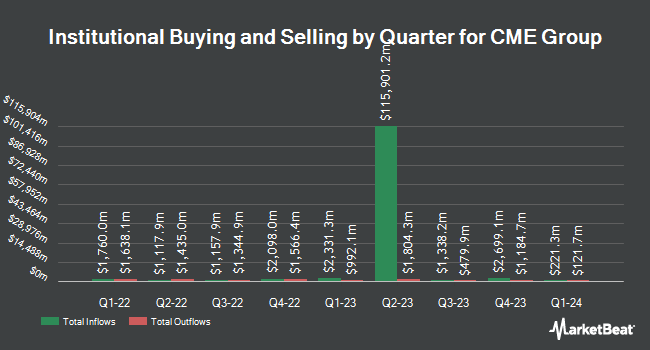

A number of other large investors have also recently made changes to their positions in CME. Price T Rowe Associates Inc. MD boosted its holdings in CME Group by 89.9% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 8,280,785 shares of the financial services provider's stock valued at $1,923,047,000 after purchasing an additional 3,921,278 shares during the period. FIL Ltd raised its position in shares of CME Group by 1.5% in the fourth quarter. FIL Ltd now owns 4,081,391 shares of the financial services provider's stock worth $947,821,000 after buying an additional 61,908 shares in the last quarter. Northern Trust Corp raised its position in shares of CME Group by 11.4% in the fourth quarter. Northern Trust Corp now owns 3,943,454 shares of the financial services provider's stock worth $915,788,000 after buying an additional 403,920 shares in the last quarter. Janus Henderson Group PLC boosted its stake in CME Group by 24.7% during the fourth quarter. Janus Henderson Group PLC now owns 3,135,753 shares of the financial services provider's stock valued at $728,260,000 after buying an additional 621,713 shares during the period. Finally, Massachusetts Financial Services Co. MA grew its position in CME Group by 29.9% during the first quarter. Massachusetts Financial Services Co. MA now owns 2,818,590 shares of the financial services provider's stock worth $747,744,000 after buying an additional 648,591 shares in the last quarter. 87.75% of the stock is owned by institutional investors.

CME Group Stock Performance

NASDAQ CME opened at $278.28 on Friday. The company has a 50-day simple moving average of $276.14 and a two-hundred day simple moving average of $263.55. CME Group Inc. has a 12-month low of $193.25 and a 12-month high of $290.79. The firm has a market cap of $100.28 billion, a price-to-earnings ratio of 26.94, a PEG ratio of 4.93 and a beta of 0.44. The company has a quick ratio of 1.02, a current ratio of 1.02 and a debt-to-equity ratio of 0.12.

CME Group (NASDAQ:CME - Get Free Report) last issued its earnings results on Wednesday, July 23rd. The financial services provider reported $2.96 earnings per share for the quarter, beating the consensus estimate of $2.91 by $0.05. CME Group had a return on equity of 14.60% and a net margin of 58.48%. The company had revenue of $1.69 billion during the quarter, compared to analysts' expectations of $1.68 billion. During the same period in the prior year, the business posted $2.56 EPS. CME Group's quarterly revenue was up 10.4% compared to the same quarter last year. On average, equities analysts forecast that CME Group Inc. will post 10.49 EPS for the current year.

CME Group Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Wednesday, June 25th. Investors of record on Monday, June 9th were paid a $1.25 dividend. This represents a $5.00 annualized dividend and a dividend yield of 1.8%. The ex-dividend date of this dividend was Monday, June 9th. CME Group's payout ratio is presently 48.40%.

Analysts Set New Price Targets

A number of equities analysts have weighed in on CME shares. Keefe, Bruyette & Woods upped their target price on CME Group from $265.00 to $273.00 and gave the stock a "market perform" rating in a research note on Thursday, April 24th. Barclays set a $298.00 price objective on shares of CME Group and gave the stock an "equal weight" rating in a research report on Thursday, July 24th. Morgan Stanley raised their target price on shares of CME Group from $301.00 to $304.00 and gave the company an "overweight" rating in a research note on Thursday, April 24th. JPMorgan Chase & Co. cut their price target on shares of CME Group from $223.00 to $211.00 and set an "underweight" rating for the company in a research note on Thursday, April 24th. Finally, UBS Group reissued a "neutral" rating and issued a $305.00 price target on shares of CME Group in a report on Thursday, July 24th. Four research analysts have rated the stock with a sell rating, nine have given a hold rating and four have given a buy rating to the company. According to MarketBeat, CME Group currently has a consensus rating of "Hold" and a consensus target price of $261.93.

Read Our Latest Stock Report on CME Group

Insider Buying and Selling

In related news, Director Charles P. Carey sold 3,000 shares of the company's stock in a transaction on Thursday, May 15th. The shares were sold at an average price of $272.56, for a total transaction of $817,680.00. Following the completion of the sale, the director directly owned 5,400 shares in the company, valued at $1,471,824. This represents a 35.71% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Daniel G. Kaye sold 500 shares of the firm's stock in a transaction on Thursday, May 22nd. The stock was sold at an average price of $282.42, for a total transaction of $141,210.00. Following the completion of the sale, the director directly owned 3,668 shares in the company, valued at approximately $1,035,916.56. This trade represents a 12.00% decrease in their position. The disclosure for this sale can be found here. Insiders sold 10,400 shares of company stock valued at $2,881,130 over the last quarter. Company insiders own 0.30% of the company's stock.

About CME Group

(

Free Report)

CME Group Inc, together with its subsidiaries, operates contract markets for the trading of futures and options on futures contracts worldwide. It offers futures and options products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals, as well as fixed income and foreign currency trading services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CME Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CME Group wasn't on the list.

While CME Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report