State of Michigan Retirement System increased its stake in CoStar Group, Inc. (NASDAQ:CSGP - Free Report) by 2.5% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 123,900 shares of the technology company's stock after acquiring an additional 3,000 shares during the period. State of Michigan Retirement System's holdings in CoStar Group were worth $9,817,000 as of its most recent SEC filing.

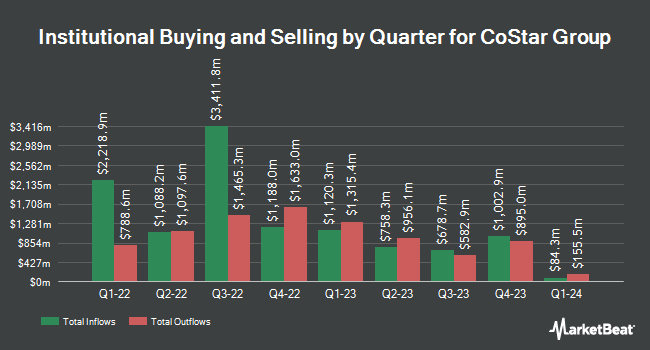

Other large investors have also modified their holdings of the company. Polen Capital Management LLC purchased a new stake in shares of CoStar Group during the 4th quarter worth about $465,134,000. Norges Bank purchased a new stake in shares of CoStar Group during the 4th quarter worth about $390,755,000. Capital International Investors boosted its stake in shares of CoStar Group by 44.9% during the 4th quarter. Capital International Investors now owns 14,032,363 shares of the technology company's stock worth $1,004,578,000 after acquiring an additional 4,345,267 shares in the last quarter. T. Rowe Price Investment Management Inc. raised its position in shares of CoStar Group by 24.6% during the 4th quarter. T. Rowe Price Investment Management Inc. now owns 6,415,895 shares of the technology company's stock worth $459,314,000 after purchasing an additional 1,267,263 shares during the last quarter. Finally, Canada Pension Plan Investment Board raised its position in shares of CoStar Group by 2,181.8% during the 4th quarter. Canada Pension Plan Investment Board now owns 1,129,307 shares of the technology company's stock worth $80,847,000 after purchasing an additional 1,079,815 shares during the last quarter. Hedge funds and other institutional investors own 96.60% of the company's stock.

CoStar Group Stock Down 1.8%

Shares of CSGP traded down $1.55 during midday trading on Tuesday, hitting $84.09. The company had a trading volume of 1,861,489 shares, compared to its average volume of 2,894,657. The company's 50 day moving average price is $78.63 and its 200 day moving average price is $77.25. The stock has a market cap of $35.48 billion, a price-to-earnings ratio of 289.97, a PEG ratio of 4.30 and a beta of 0.89. CoStar Group, Inc. has a 52 week low of $68.26 and a 52 week high of $86.42. The company has a quick ratio of 6.01, a current ratio of 6.01 and a debt-to-equity ratio of 0.12.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on the stock. JMP Securities restated a "market outperform" rating and set a $85.00 price target on shares of CoStar Group in a research report on Wednesday, April 30th. Royal Bank Of Canada reiterated a "sector perform" rating and issued a $83.00 price objective on shares of CoStar Group in a report on Tuesday, June 24th. Bank of America assumed coverage on shares of CoStar Group in a report on Friday, May 30th. They issued a "neutral" rating and a $79.00 price objective for the company. Stephens upgraded shares of CoStar Group to a "strong-buy" rating and set a $105.00 price objective for the company in a report on Monday, June 16th. Finally, Wells Fargo & Company raised their price target on shares of CoStar Group from $63.00 to $65.00 and gave the stock an "underweight" rating in a report on Wednesday, April 30th. Two analysts have rated the stock with a sell rating, four have issued a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, CoStar Group currently has an average rating of "Moderate Buy" and an average price target of $87.69.

View Our Latest Research Report on CSGP

About CoStar Group

(

Free Report)

CoStar Group, Inc provides information, analytics, and online marketplace services to the commercial real estate, hospitality, residential, and related professionals industries in the United States, Canada, Europe, the Asia Pacific, and Latin America. The company offers CoStar Property that provides inventory of office, industrial, retail, multifamily, hospitality, and student housing properties and land; CoStar Sales, a robust database of comparable commercial real estate sales transactions; CoStar Market Analytics to view and report on aggregated market and submarket trends; and CoStar Tenant, an online business-to-business prospecting and analytical tool that provides tenant information.

Featured Articles

Before you consider CoStar Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoStar Group wasn't on the list.

While CoStar Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.