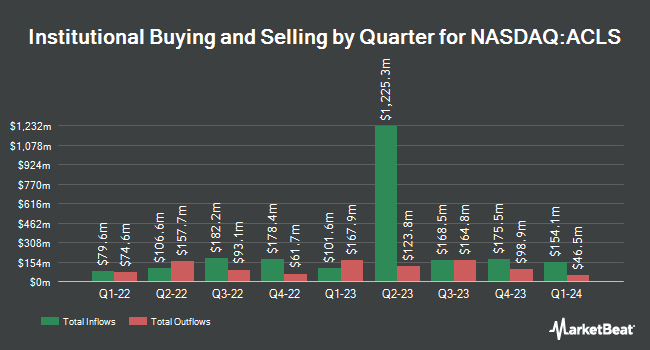

State of Wyoming lessened its position in shares of Axcelis Technologies, Inc. (NASDAQ:ACLS - Free Report) by 85.3% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The firm owned 822 shares of the semiconductor company's stock after selling 4,751 shares during the quarter. State of Wyoming's holdings in Axcelis Technologies were worth $41,000 at the end of the most recent reporting period.

Other institutional investors have also modified their holdings of the company. Nisa Investment Advisors LLC grew its position in shares of Axcelis Technologies by 97.5% in the first quarter. Nisa Investment Advisors LLC now owns 796 shares of the semiconductor company's stock valued at $40,000 after purchasing an additional 393 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank grew its position in shares of Axcelis Technologies by 15.0% in the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 10,497 shares of the semiconductor company's stock valued at $521,000 after purchasing an additional 1,368 shares during the period. Charles Schwab Investment Management Inc. grew its position in shares of Axcelis Technologies by 4.3% in the first quarter. Charles Schwab Investment Management Inc. now owns 386,007 shares of the semiconductor company's stock valued at $19,173,000 after purchasing an additional 16,071 shares during the period. Wealth Enhancement Advisory Services LLC acquired a new stake in shares of Axcelis Technologies in the fourth quarter valued at about $298,000. Finally, Mackenzie Financial Corp lifted its stake in shares of Axcelis Technologies by 7.8% in the first quarter. Mackenzie Financial Corp now owns 6,346 shares of the semiconductor company's stock worth $315,000 after buying an additional 459 shares in the last quarter. Institutional investors and hedge funds own 89.98% of the company's stock.

Analysts Set New Price Targets

ACLS has been the topic of several research reports. B. Riley raised their price target on shares of Axcelis Technologies from $58.00 to $75.00 and gave the stock a "neutral" rating in a research note on Wednesday, June 18th. DA Davidson lifted their price objective on shares of Axcelis Technologies from $75.00 to $90.00 and gave the company a "buy" rating in a report on Wednesday, August 6th. Two investment analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company's stock. According to data from MarketBeat, Axcelis Technologies has an average rating of "Hold" and a consensus price target of $90.00.

Check Out Our Latest Report on ACLS

Axcelis Technologies Price Performance

Shares of NASDAQ:ACLS traded up $2.51 on Tuesday, reaching $89.81. 572,282 shares of the company were exchanged, compared to its average volume of 400,123. The company has a current ratio of 6.01, a quick ratio of 4.26 and a debt-to-equity ratio of 0.04. Axcelis Technologies, Inc. has a 1-year low of $40.40 and a 1-year high of $110.17. The firm has a market cap of $2.82 billion, a price-to-earnings ratio of 18.37 and a beta of 1.73. The company has a 50-day moving average of $78.06 and a 200-day moving average of $64.77.

Axcelis Technologies (NASDAQ:ACLS - Get Free Report) last posted its quarterly earnings results on Tuesday, August 5th. The semiconductor company reported $1.13 earnings per share for the quarter, topping analysts' consensus estimates of $0.73 by $0.40. The business had revenue of $194.54 million for the quarter, compared to analysts' expectations of $185.15 million. Axcelis Technologies had a net margin of 17.69% and a return on equity of 16.26%. The business's revenue for the quarter was down 24.2% on a year-over-year basis. During the same period in the prior year, the company posted $1.55 EPS. Axcelis Technologies has set its Q3 2025 guidance at 1.000-1.000 EPS. Equities analysts forecast that Axcelis Technologies, Inc. will post 2.55 earnings per share for the current fiscal year.

About Axcelis Technologies

(

Free Report)

Axcelis Technologies, Inc designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and Asia Pacific. The company offers high energy, high current, and medium current implanters for various application requirements.

See Also

Before you consider Axcelis Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axcelis Technologies wasn't on the list.

While Axcelis Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.