Elevation Wealth Partners LLC cut its holdings in shares of Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) by 20.5% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 4,529 shares of the construction company's stock after selling 1,169 shares during the quarter. Elevation Wealth Partners LLC's holdings in Sterling Infrastructure were worth $1,045,000 at the end of the most recent reporting period.

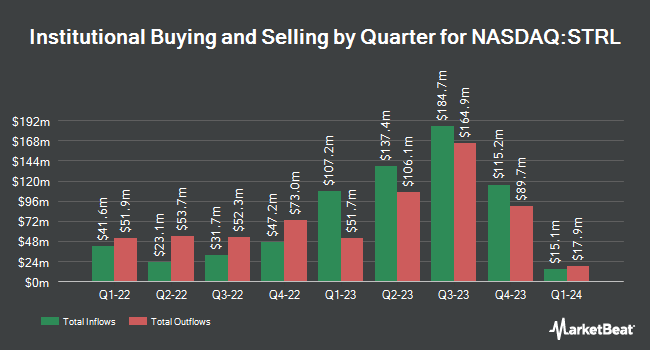

Several other large investors have also recently made changes to their positions in STRL. Ieq Capital LLC grew its position in shares of Sterling Infrastructure by 94.8% in the 1st quarter. Ieq Capital LLC now owns 8,144 shares of the construction company's stock valued at $922,000 after buying an additional 3,963 shares during the last quarter. Wealth Enhancement Advisory Services LLC grew its holdings in Sterling Infrastructure by 38.6% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 4,804 shares of the construction company's stock valued at $544,000 after purchasing an additional 1,337 shares during the period. Envestnet Asset Management Inc. lifted its position in shares of Sterling Infrastructure by 30.3% during the first quarter. Envestnet Asset Management Inc. now owns 78,454 shares of the construction company's stock worth $8,882,000 after purchasing an additional 18,254 shares in the last quarter. D.A. Davidson & CO. grew its position in shares of Sterling Infrastructure by 5.0% during the first quarter. D.A. Davidson & CO. now owns 2,424 shares of the construction company's stock worth $274,000 after acquiring an additional 116 shares during the last quarter. Finally, Hudson Edge Investment Partners Inc. acquired a new stake in Sterling Infrastructure in the first quarter worth about $823,000. 80.95% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at Sterling Infrastructure

In related news, General Counsel Mark D. Wolf sold 3,500 shares of the company's stock in a transaction that occurred on Tuesday, June 24th. The stock was sold at an average price of $225.87, for a total value of $790,545.00. Following the transaction, the general counsel directly owned 29,315 shares in the company, valued at approximately $6,621,379.05. This represents a 10.67% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. 3.70% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on the stock. DA Davidson lifted their price target on shares of Sterling Infrastructure from $265.00 to $355.00 and gave the stock a "buy" rating in a research note on Wednesday, August 6th. Wall Street Zen raised Sterling Infrastructure from a "buy" rating to a "strong-buy" rating in a research note on Saturday, September 13th. Finally, Zacks Research upgraded Sterling Infrastructure from a "hold" rating to a "strong-buy" rating in a report on Friday, September 5th. One analyst has rated the stock with a Strong Buy rating and two have given a Buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus price target of $355.00.

View Our Latest Stock Report on STRL

Sterling Infrastructure Trading Up 3.5%

Shares of NASDAQ:STRL traded up $12.07 during trading on Friday, hitting $360.65. The company had a trading volume of 462,391 shares, compared to its average volume of 633,905. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.42 and a quick ratio of 1.42. The company has a fifty day simple moving average of $280.40 and a two-hundred day simple moving average of $206.39. Sterling Infrastructure, Inc. has a one year low of $96.34 and a one year high of $363.08. The stock has a market cap of $10.97 billion, a price-to-earnings ratio of 39.18, a price-to-earnings-growth ratio of 2.37 and a beta of 1.35.

Sterling Infrastructure Profile

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

Featured Articles

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.