Stoneridge Investment Partners LLC lowered its stake in shares of Eversource Energy (NYSE:ES - Free Report) by 83.9% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 4,522 shares of the utilities provider's stock after selling 23,612 shares during the period. Stoneridge Investment Partners LLC's holdings in Eversource Energy were worth $281,000 as of its most recent filing with the Securities & Exchange Commission.

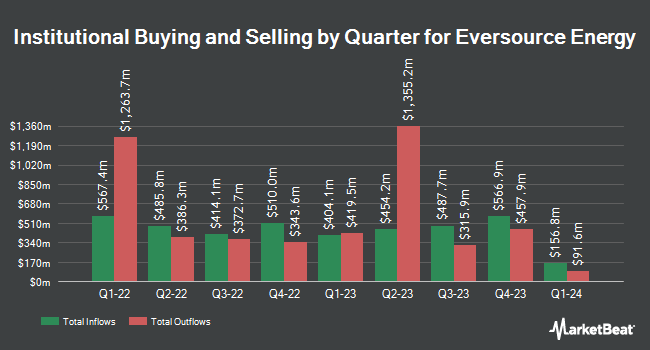

Other institutional investors and hedge funds have also modified their holdings of the company. Ballentine Partners LLC increased its stake in shares of Eversource Energy by 4.9% during the first quarter. Ballentine Partners LLC now owns 5,934 shares of the utilities provider's stock worth $369,000 after purchasing an additional 277 shares in the last quarter. Farther Finance Advisors LLC increased its stake in shares of Eversource Energy by 105.6% during the first quarter. Farther Finance Advisors LLC now owns 4,623 shares of the utilities provider's stock worth $287,000 after purchasing an additional 2,374 shares in the last quarter. Golden State Wealth Management LLC grew its stake in Eversource Energy by 233.9% during the 1st quarter. Golden State Wealth Management LLC now owns 828 shares of the utilities provider's stock valued at $52,000 after acquiring an additional 580 shares in the last quarter. Cambridge Investment Research Advisors Inc. grew its stake in Eversource Energy by 14.9% during the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 66,402 shares of the utilities provider's stock valued at $4,124,000 after acquiring an additional 8,616 shares in the last quarter. Finally, Assenagon Asset Management S.A. grew its stake in Eversource Energy by 5.6% during the 1st quarter. Assenagon Asset Management S.A. now owns 13,942 shares of the utilities provider's stock valued at $866,000 after acquiring an additional 734 shares in the last quarter. Hedge funds and other institutional investors own 79.99% of the company's stock.

Eversource Energy Trading Down 3.6%

NYSE:ES traded down $2.3860 on Monday, hitting $64.1440. The stock had a trading volume of 3,034,666 shares, compared to its average volume of 2,664,793. The company has a quick ratio of 0.63, a current ratio of 0.71 and a debt-to-equity ratio of 1.67. The stock has a market cap of $23.80 billion, a price-to-earnings ratio of 27.44, a PEG ratio of 2.50 and a beta of 0.61. The company has a fifty day moving average price of $65.00 and a two-hundred day moving average price of $62.52. Eversource Energy has a 1-year low of $52.28 and a 1-year high of $69.01.

Eversource Energy (NYSE:ES - Get Free Report) last posted its earnings results on Thursday, July 31st. The utilities provider reported $0.96 earnings per share for the quarter, beating the consensus estimate of $0.95 by $0.01. The company had revenue of $2.84 billion for the quarter, compared to analyst estimates of $3.01 billion. Eversource Energy had a net margin of 6.60% and a return on equity of 11.00%. Eversource Energy's revenue was up 12.0% on a year-over-year basis. During the same period in the previous year, the business posted $0.95 EPS. Eversource Energy has set its FY 2025 guidance at 4.670-4.820 EPS. Equities research analysts expect that Eversource Energy will post 4.75 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several analysts recently issued reports on ES shares. Mizuho upped their price objective on shares of Eversource Energy from $68.00 to $72.00 and gave the company an "outperform" rating in a research note on Wednesday, June 25th. Wall Street Zen raised shares of Eversource Energy from a "sell" rating to a "hold" rating in a research note on Friday, May 16th. Bank of America upped their price objective on shares of Eversource Energy from $62.00 to $67.00 and gave the company a "neutral" rating in a research note on Monday, July 21st. Finally, BMO Capital Markets upped their price objective on shares of Eversource Energy from $71.00 to $72.00 and gave the company a "market perform" rating in a research note on Monday, April 28th. Three research analysts have rated the stock with a Buy rating, three have assigned a Hold rating and three have issued a Sell rating to the stock. Based on data from MarketBeat, the company has an average rating of "Hold" and an average target price of $64.38.

Check Out Our Latest Report on Eversource Energy

Eversource Energy Profile

(

Free Report)

Eversource Energy, a public utility holding company, engages in the energy delivery business. The company operates through Electric Distribution, Electric Transmission, Natural Gas Distribution, and Water Distribution segments. It is involved in the transmission and distribution of electricity; solar power facilities; and distribution of natural gas.

Further Reading

Before you consider Eversource Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eversource Energy wasn't on the list.

While Eversource Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.