Strs Ohio purchased a new position in shares of Marcus Corporation (The) (NYSE:MCS - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 29,200 shares of the company's stock, valued at approximately $487,000. Strs Ohio owned about 0.09% of Marcus at the end of the most recent quarter.

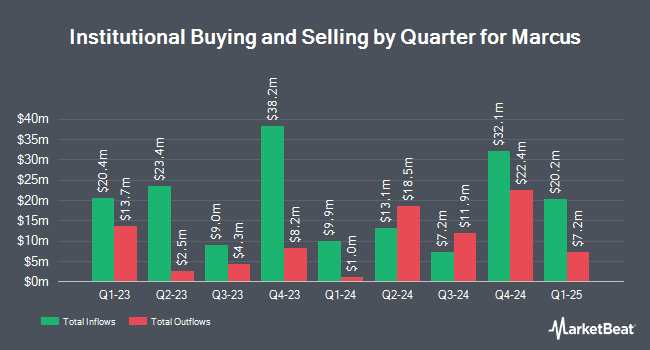

Other hedge funds have also added to or reduced their stakes in the company. Lazard Asset Management LLC lifted its holdings in Marcus by 2,908.9% during the 4th quarter. Lazard Asset Management LLC now owns 2,377 shares of the company's stock worth $51,000 after purchasing an additional 2,298 shares during the last quarter. Harbor Capital Advisors Inc. acquired a new stake in Marcus during the 1st quarter worth approximately $76,000. Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in Marcus by 38.6% during the 1st quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 8,700 shares of the company's stock worth $145,000 after purchasing an additional 2,424 shares during the last quarter. Janus Henderson Group PLC acquired a new stake in Marcus during the 4th quarter worth approximately $206,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its holdings in Marcus by 4.7% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 13,849 shares of the company's stock worth $231,000 after purchasing an additional 624 shares during the last quarter. 81.57% of the stock is owned by institutional investors and hedge funds.

Marcus Trading Down 0.7%

Shares of NYSE MCS traded down $0.11 during trading on Monday, reaching $15.53. The company had a trading volume of 191,284 shares, compared to its average volume of 214,718. The company's fifty day moving average price is $15.88 and its 200-day moving average price is $16.52. Marcus Corporation has a 12 month low of $14.13 and a 12 month high of $23.16. The stock has a market cap of $486.12 million, a P/E ratio of 34.50, a PEG ratio of 2.87 and a beta of 1.22. The company has a quick ratio of 0.39, a current ratio of 0.39 and a debt-to-equity ratio of 0.40.

Marcus (NYSE:MCS - Get Free Report) last released its quarterly earnings results on Friday, August 1st. The company reported $0.23 EPS for the quarter, beating analysts' consensus estimates of $0.19 by $0.04. The firm had revenue of $206.04 million for the quarter, compared to analyst estimates of $192.79 million. Marcus had a return on equity of 4.28% and a net margin of 1.91%. As a group, research analysts expect that Marcus Corporation will post 0.36 earnings per share for the current year.

Marcus Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 15th. Stockholders of record on Monday, August 25th were paid a $0.08 dividend. The ex-dividend date of this dividend was Monday, August 25th. This represents a $0.32 dividend on an annualized basis and a dividend yield of 2.1%. This is a positive change from Marcus's previous quarterly dividend of $0.07. Marcus's dividend payout ratio (DPR) is presently 71.11%.

Analysts Set New Price Targets

Several equities analysts have weighed in on the company. Zacks Research raised Marcus from a "strong sell" rating to a "hold" rating in a report on Thursday. Wedbush assumed coverage on Marcus in a report on Friday, July 18th. They issued an "outperform" rating and a $24.00 price objective for the company. Finally, Barrington Research reaffirmed an "outperform" rating and issued a $25.00 price objective on shares of Marcus in a report on Monday, August 4th. One equities research analyst has rated the stock with a Strong Buy rating, three have assigned a Buy rating and one has assigned a Hold rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Buy" and an average target price of $24.50.

View Our Latest Stock Report on MCS

Marcus Profile

(

Free Report)

The Marcus Corporation, together with its subsidiaries, owns and operates movie theatres, and hotels and resorts in the United States. It operates a family entertainment center and multiscreen motion picture theatres under the Big Screen Bistro, Big Screen Bistro Express, BistroPlex, and Movie Tavern by Marcus brand names.

Read More

Before you consider Marcus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marcus wasn't on the list.

While Marcus currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.