Strs Ohio acquired a new stake in shares of eGain Corporation (NASDAQ:EGAN - Free Report) in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 51,600 shares of the technology company's stock, valued at approximately $250,000. Strs Ohio owned about 0.19% of eGain as of its most recent filing with the Securities and Exchange Commission (SEC).

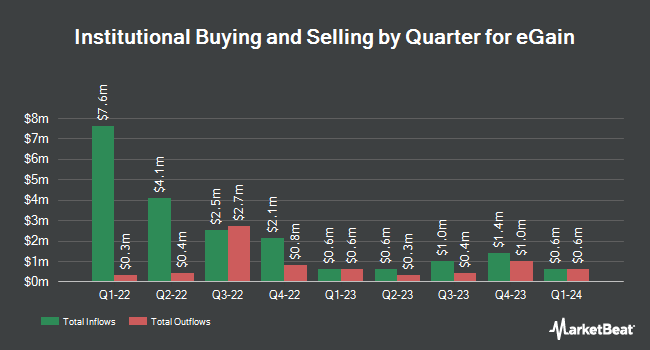

A number of other hedge funds and other institutional investors have also bought and sold shares of EGAN. Acadian Asset Management LLC boosted its stake in shares of eGain by 0.7% in the first quarter. Acadian Asset Management LLC now owns 980,840 shares of the technology company's stock worth $4,753,000 after acquiring an additional 6,429 shares during the period. Jane Street Group LLC boosted its stake in shares of eGain by 53.7% in the first quarter. Jane Street Group LLC now owns 47,726 shares of the technology company's stock worth $231,000 after acquiring an additional 16,678 shares during the period. Nuveen LLC bought a new position in shares of eGain in the first quarter worth about $296,000. Jefferies Financial Group Inc. bought a new position in shares of eGain in the first quarter worth about $83,000. Finally, Bank of New York Mellon Corp boosted its stake in shares of eGain by 8.1% in the first quarter. Bank of New York Mellon Corp now owns 139,684 shares of the technology company's stock worth $677,000 after acquiring an additional 10,486 shares during the period. Hedge funds and other institutional investors own 53.94% of the company's stock.

eGain Price Performance

NASDAQ:EGAN opened at $8.88 on Thursday. The business has a 50 day simple moving average of $6.84 and a 200-day simple moving average of $5.91. eGain Corporation has a 1 year low of $4.34 and a 1 year high of $9.64. The firm has a market capitalization of $238.61 million, a price-to-earnings ratio of 7.72 and a beta of 0.30.

eGain announced that its Board of Directors has authorized a stock repurchase program on Thursday, September 4th that allows the company to repurchase $20.00 million in outstanding shares. This repurchase authorization allows the technology company to repurchase up to 11.7% of its stock through open market purchases. Stock repurchase programs are usually an indication that the company's board believes its stock is undervalued.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen raised eGain from a "hold" rating to a "buy" rating in a research note on Saturday, September 6th. One investment analyst has rated the stock with a Buy rating, According to MarketBeat.com, eGain presently has an average rating of "Buy" and a consensus target price of $10.00.

View Our Latest Stock Report on EGAN

About eGain

(

Free Report)

eGain Corporation develops, licenses, implements, and supports customer service infrastructure software solutions in North America, Europe, the Middle East, Africa, and the Asia Pacific. It provides eGain Knowledge Hub, which helps businesses to centralize knowledge, policies, procedures, situational expertise, best-practices, while delivering guided, and personalized solutions to customers and agents; eGain Conversation Hub for digital-first, omnichannel interaction management within a modern, purpose-built desktop; and eGain Analytics Hub enables clients to measure, manage, and optimize omnichannel service operations and knowledge.

Featured Articles

Want to see what other hedge funds are holding EGAN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for eGain Corporation (NASDAQ:EGAN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider eGain, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and eGain wasn't on the list.

While eGain currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.