Howland Capital Management LLC lifted its position in Stryker Corporation (NYSE:SYK - Free Report) by 11.1% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 97,132 shares of the medical technology company's stock after acquiring an additional 9,671 shares during the period. Stryker accounts for approximately 1.6% of Howland Capital Management LLC's investment portfolio, making the stock its 19th biggest holding. Howland Capital Management LLC's holdings in Stryker were worth $36,238,000 at the end of the most recent reporting period.

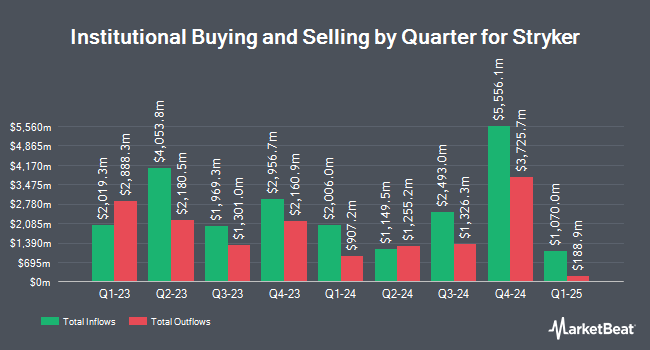

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Elefante Mark B purchased a new stake in Stryker in the fourth quarter valued at approximately $337,000. Mogy Joel R Investment Counsel Inc. lifted its stake in Stryker by 3.4% during the 1st quarter. Mogy Joel R Investment Counsel Inc. now owns 98,216 shares of the medical technology company's stock valued at $36,561,000 after acquiring an additional 3,218 shares during the period. Ferguson Wellman Capital Management Inc. lifted its stake in Stryker by 1.9% during the 1st quarter. Ferguson Wellman Capital Management Inc. now owns 174,871 shares of the medical technology company's stock valued at $65,096,000 after acquiring an additional 3,341 shares during the period. Harbor Capital Advisors Inc. purchased a new stake in shares of Stryker in the 1st quarter valued at $1,840,000. Finally, Mar Vista Investment Partners LLC increased its stake in shares of Stryker by 10.2% in the first quarter. Mar Vista Investment Partners LLC now owns 90,187 shares of the medical technology company's stock worth $33,572,000 after acquiring an additional 8,353 shares during the period. Hedge funds and other institutional investors own 77.09% of the company's stock.

Insider Activity at Stryker

In other Stryker news, Director Ronda E. Stryker sold 200,000 shares of the firm's stock in a transaction on Tuesday, May 6th. The stock was sold at an average price of $376.96, for a total value of $75,392,000.00. Following the transaction, the director owned 3,417,326 shares in the company, valued at approximately $1,288,195,208.96. This trade represents a 5.53% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Insiders own 5.90% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms recently issued reports on SYK. BTIG Research restated a "buy" rating on shares of Stryker in a research report on Monday, July 14th. Citigroup reiterated a "buy" rating and set a $455.00 price objective (up previously from $443.00) on shares of Stryker in a research note on Thursday, May 22nd. Roth Mkm upped their target price on Stryker from $405.00 to $456.00 and gave the stock a "buy" rating in a research note on Friday, May 2nd. Evercore ISI raised their target price on Stryker from $390.00 to $415.00 and gave the stock an "outperform" rating in a report on Tuesday, July 8th. Finally, Wall Street Zen raised Stryker from a "hold" rating to a "buy" rating in a report on Friday, July 18th. Four analysts have rated the stock with a hold rating and sixteen have given a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $428.55.

Check Out Our Latest Analysis on Stryker

Stryker Stock Performance

NYSE:SYK opened at $393.37 on Friday. The stock has a market capitalization of $150.15 billion, a PE ratio of 53.16, a P/E/G ratio of 2.97 and a beta of 0.91. The company has a fifty day moving average of $387.43 and a two-hundred day moving average of $380.19. The company has a debt-to-equity ratio of 0.69, a quick ratio of 1.00 and a current ratio of 1.64. Stryker Corporation has a fifty-two week low of $314.93 and a fifty-two week high of $406.19.

Stryker (NYSE:SYK - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The medical technology company reported $3.13 earnings per share for the quarter, beating analysts' consensus estimates of $3.07 by $0.06. Stryker had a net margin of 12.31% and a return on equity of 23.74%. The firm had revenue of $6.02 billion for the quarter, compared to analyst estimates of $5.92 billion. During the same period last year, the company posted $2.81 EPS. Stryker's quarterly revenue was up 11.1% compared to the same quarter last year. As a group, research analysts forecast that Stryker Corporation will post 13.47 earnings per share for the current fiscal year.

Stryker Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, July 31st. Investors of record on Monday, June 30th were given a dividend of $0.84 per share. This represents a $3.36 annualized dividend and a dividend yield of 0.9%. The ex-dividend date was Monday, June 30th. Stryker's payout ratio is presently 45.41%.

About Stryker

(

Free Report)

Stryker Corporation operates as a medical technology company. The company operates through two segments, MedSurg and Neurotechnology, and Orthopaedics and Spine. The Orthopaedics and Spine segment provides implants for use in total joint replacements, such as hip, knee and shoulder, and trauma and extremities surgeries.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Stryker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stryker wasn't on the list.

While Stryker currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.