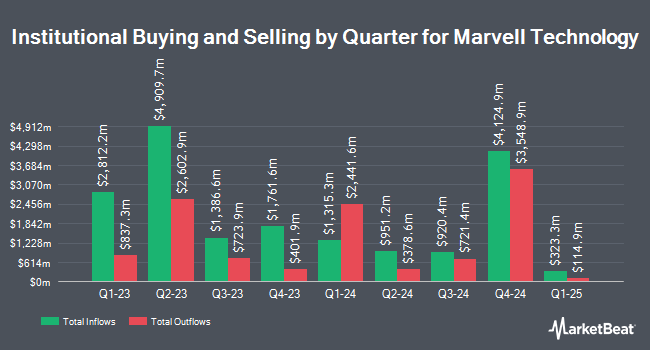

Sumitomo Mitsui Trust Group Inc. raised its position in shares of Marvell Technology, Inc. (NASDAQ:MRVL - Free Report) by 2.7% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 2,234,650 shares of the semiconductor company's stock after purchasing an additional 59,718 shares during the period. Sumitomo Mitsui Trust Group Inc. owned 0.26% of Marvell Technology worth $172,962,000 as of its most recent filing with the Securities and Exchange Commission.

Several other institutional investors and hedge funds have also bought and sold shares of the company. Retirement Planning Group LLC NY raised its position in shares of Marvell Technology by 4.0% in the second quarter. Retirement Planning Group LLC NY now owns 3,722 shares of the semiconductor company's stock worth $288,000 after buying an additional 142 shares in the last quarter. Harbor Capital Advisors Inc. raised its position in shares of Marvell Technology by 0.8% in the second quarter. Harbor Capital Advisors Inc. now owns 19,945 shares of the semiconductor company's stock worth $1,544,000 after buying an additional 151 shares in the last quarter. CHICAGO TRUST Co NA raised its position in shares of Marvell Technology by 3.5% in the second quarter. CHICAGO TRUST Co NA now owns 4,703 shares of the semiconductor company's stock worth $364,000 after buying an additional 158 shares in the last quarter. Synovus Financial Corp raised its position in Marvell Technology by 3.5% during the first quarter. Synovus Financial Corp now owns 4,791 shares of the semiconductor company's stock valued at $295,000 after purchasing an additional 161 shares in the last quarter. Finally, Mutual Advisors LLC raised its position in Marvell Technology by 1.8% during the second quarter. Mutual Advisors LLC now owns 9,405 shares of the semiconductor company's stock valued at $698,000 after purchasing an additional 163 shares in the last quarter. 83.51% of the stock is owned by institutional investors.

Marvell Technology Stock Up 1.6%

NASDAQ MRVL opened at $84.13 on Friday. The company has a debt-to-equity ratio of 0.30, a current ratio of 1.88 and a quick ratio of 1.44. The stock has a market capitalization of $72.53 billion, a PE ratio of -647.15, a PEG ratio of 1.01 and a beta of 1.94. Marvell Technology, Inc. has a 1 year low of $47.08 and a 1 year high of $127.48. The business's 50-day moving average is $77.13 and its 200 day moving average is $70.65.

Marvell Technology (NASDAQ:MRVL - Get Free Report) last posted its earnings results on Thursday, August 28th. The semiconductor company reported $0.67 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.67. The company had revenue of $2.01 billion for the quarter, compared to analysts' expectations of $2.01 billion. Marvell Technology had a positive return on equity of 11.01% and a negative net margin of 1.43%.Marvell Technology's quarterly revenue was up 57.6% on a year-over-year basis. During the same period last year, the firm earned $0.30 earnings per share. Marvell Technology has set its Q3 2026 guidance at 0.690-0.790 EPS. Sell-side analysts forecast that Marvell Technology, Inc. will post 0.91 earnings per share for the current year.

Marvell Technology Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, October 30th. Investors of record on Friday, October 10th will be paid a $0.06 dividend. The ex-dividend date of this dividend is Friday, October 10th. This represents a $0.24 annualized dividend and a dividend yield of 0.3%. Marvell Technology's dividend payout ratio (DPR) is presently -184.62%.

Marvell Technology announced that its board has authorized a stock buyback plan on Wednesday, September 24th that permits the company to buyback $5.00 billion in outstanding shares. This buyback authorization permits the semiconductor company to repurchase up to 7.8% of its shares through open market purchases. Shares buyback plans are generally an indication that the company's board believes its stock is undervalued.

Analyst Ratings Changes

A number of equities research analysts have weighed in on MRVL shares. Needham & Company LLC raised their price target on Marvell Technology from $80.00 to $95.00 and gave the company a "buy" rating in a research report on Thursday, September 25th. Summit Redstone set a $105.00 price target on Marvell Technology in a research report on Wednesday, October 15th. Jefferies Financial Group lowered their price target on Marvell Technology from $90.00 to $80.00 and set a "buy" rating on the stock in a research report on Friday, August 29th. Bank of America restated a "neutral" rating and set a $78.00 price target (down previously from $90.00) on shares of Marvell Technology in a research report on Friday, August 29th. Finally, Rosenblatt Securities lowered their price target on Marvell Technology from $124.00 to $95.00 and set a "buy" rating on the stock in a research report on Friday, August 29th. Two analysts have rated the stock with a Strong Buy rating, twenty-one have given a Buy rating and thirteen have issued a Hold rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $93.06.

Read Our Latest Analysis on MRVL

Insiders Place Their Bets

In other news, CEO Matthew J. Murphy acquired 13,600 shares of the business's stock in a transaction on Thursday, September 25th. The shares were acquired at an average cost of $77.09 per share, with a total value of $1,048,424.00. Following the transaction, the chief executive officer owned 268,637 shares in the company, valued at $20,709,226.33. The trade was a 5.33% increase in their position. The acquisition was disclosed in a filing with the SEC, which can be accessed through this link. Also, COO Chris Koopmans acquired 6,800 shares of the business's stock in a transaction on Thursday, September 25th. The shares were purchased at an average cost of $78.03 per share, for a total transaction of $530,604.00. Following the completion of the transaction, the chief operating officer owned 104,825 shares in the company, valued at approximately $8,179,494.75. This represents a 6.94% increase in their position. The disclosure for this purchase can be found here. Insiders purchased 27,200 shares of company stock valued at $2,109,632 over the last three months. Company insiders own 0.19% of the company's stock.

Marvell Technology Company Profile

(

Free Report)

Marvell Technology, Inc, together with its subsidiaries, provides data infrastructure semiconductor solutions, spanning the data center core to network edge. The company develops and scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report