Summit Financial LLC raised its position in NIKE, Inc. (NYSE:NKE - Free Report) by 26.7% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 16,931 shares of the footwear maker's stock after buying an additional 3,570 shares during the quarter. Summit Financial LLC's holdings in NIKE were worth $1,075,000 at the end of the most recent reporting period.

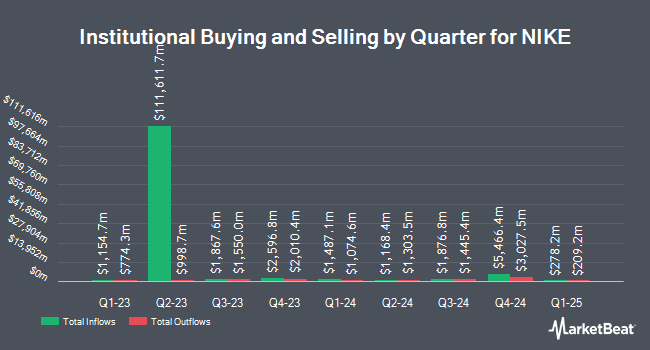

Several other hedge funds have also recently made changes to their positions in NKE. Goldman Sachs Group Inc. raised its stake in shares of NIKE by 344.2% in the first quarter. Goldman Sachs Group Inc. now owns 26,698,835 shares of the footwear maker's stock valued at $1,694,842,000 after buying an additional 20,688,013 shares during the period. Wellington Management Group LLP raised its stake in shares of NIKE by 24.9% in the first quarter. Wellington Management Group LLP now owns 45,383,916 shares of the footwear maker's stock valued at $2,880,971,000 after buying an additional 9,043,180 shares during the period. Jennison Associates LLC bought a new stake in shares of NIKE in the first quarter valued at $509,051,000. Nuveen LLC bought a new stake in shares of NIKE in the first quarter valued at $502,285,000. Finally, Vanguard Group Inc. grew its position in shares of NIKE by 4.6% in the first quarter. Vanguard Group Inc. now owns 113,151,080 shares of the footwear maker's stock valued at $7,182,831,000 after purchasing an additional 4,957,494 shares in the last quarter. 64.25% of the stock is currently owned by institutional investors.

Insider Transactions at NIKE

In other NIKE news, Chairman Mark G. Parker sold 86,078 shares of the stock in a transaction that occurred on Thursday, August 14th. The shares were sold at an average price of $75.93, for a total transaction of $6,535,902.54. Following the transaction, the chairman directly owned 744,988 shares in the company, valued at $56,566,938.84. This trade represents a 10.36% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.80% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on NKE shares. Piper Sandler lifted their price target on NIKE from $70.00 to $80.00 and gave the company an "overweight" rating in a research report on Friday, June 27th. Needham & Company LLC lifted their price target on NIKE from $66.00 to $78.00 and gave the company a "buy" rating in a research report on Friday, June 27th. Sanford C. Bernstein reiterated an "outperform" rating on shares of NIKE in a research report on Monday, August 18th. Argus upgraded NIKE to a "buy" rating in a research report on Sunday, July 6th. Finally, Wells Fargo & Company lifted their price target on NIKE from $55.00 to $60.00 and gave the company an "equal weight" rating in a research report on Wednesday, May 14th. Three research analysts have rated the stock with a Strong Buy rating, seventeen have issued a Buy rating and twelve have issued a Hold rating to the company's stock. According to data from MarketBeat.com, NIKE currently has a consensus rating of "Moderate Buy" and a consensus target price of $78.22.

Check Out Our Latest Research Report on NIKE

NIKE Price Performance

NIKE stock traded down $0.45 during midday trading on Wednesday, hitting $78.20. 12,633,901 shares of the company's stock were exchanged, compared to its average volume of 16,515,779. NIKE, Inc. has a 52-week low of $52.28 and a 52-week high of $90.62. The stock has a 50-day moving average price of $73.23 and a two-hundred day moving average price of $67.77. The company has a debt-to-equity ratio of 0.60, a quick ratio of 1.50 and a current ratio of 2.21. The company has a market cap of $115.50 billion, a P/E ratio of 36.20, a PEG ratio of 2.88 and a beta of 1.27.

NIKE (NYSE:NKE - Get Free Report) last posted its earnings results on Thursday, June 26th. The footwear maker reported $0.14 EPS for the quarter, topping the consensus estimate of $0.12 by $0.02. NIKE had a return on equity of 23.33% and a net margin of 6.95%.The business had revenue of $11.10 billion during the quarter, compared to analysts' expectations of $10.69 billion. During the same period in the previous year, the business earned $0.99 earnings per share. The firm's revenue was down 11.9% on a year-over-year basis. On average, equities research analysts forecast that NIKE, Inc. will post 2.05 earnings per share for the current year.

NIKE Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 1st. Investors of record on Tuesday, September 2nd will be given a $0.40 dividend. The ex-dividend date is Tuesday, September 2nd. This represents a $1.60 dividend on an annualized basis and a yield of 2.0%. NIKE's payout ratio is presently 74.07%.

NIKE Company Profile

(

Free Report)

NIKE, Inc, together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, accessories, and services worldwide. The company provides athletic and casual footwear, apparel, and accessories under the Jumpman trademark; and casual sneakers, apparel, and accessories under the Converse, Chuck Taylor, All Star, One Star, Star Chevron, and Jack Purcell trademarks.

Featured Stories

Before you consider NIKE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NIKE wasn't on the list.

While NIKE currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report