Tcfg Wealth Management LLC bought a new position in shares of Texas Pacific Land Corporation (NYSE:TPL - Free Report) during the 2nd quarter, according to its most recent 13F filing with the SEC. The fund bought 325 shares of the financial services provider's stock, valued at approximately $343,000.

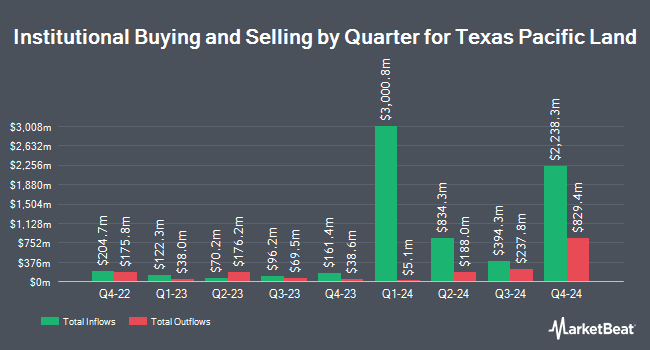

Other institutional investors also recently made changes to their positions in the company. Hemington Wealth Management boosted its position in shares of Texas Pacific Land by 66.7% during the 1st quarter. Hemington Wealth Management now owns 20 shares of the financial services provider's stock worth $26,000 after purchasing an additional 8 shares in the last quarter. Golden State Wealth Management LLC boosted its position in shares of Texas Pacific Land by 110.0% during the 1st quarter. Golden State Wealth Management LLC now owns 21 shares of the financial services provider's stock worth $28,000 after purchasing an additional 11 shares in the last quarter. Zions Bancorporation National Association UT purchased a new stake in shares of Texas Pacific Land in the 1st quarter worth about $28,000. Allworth Financial LP boosted its position in shares of Texas Pacific Land by 42.1% in the 1st quarter. Allworth Financial LP now owns 27 shares of the financial services provider's stock worth $36,000 after buying an additional 8 shares in the last quarter. Finally, GW&K Investment Management LLC boosted its position in shares of Texas Pacific Land by 237.5% in the 1st quarter. GW&K Investment Management LLC now owns 27 shares of the financial services provider's stock worth $36,000 after buying an additional 19 shares in the last quarter. 59.94% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other news, Director Eric L. Oliver bought 100 shares of the business's stock in a transaction that occurred on Thursday, August 21st. The stock was purchased at an average price of $881.27 per share, with a total value of $88,127.00. Following the purchase, the director owned 393,600 shares of the company's stock, valued at $346,867,872. This trade represents a 0.03% increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available through this link. Insiders own 6.90% of the company's stock.

Texas Pacific Land Trading Down 1.6%

Shares of TPL stock opened at $960.06 on Wednesday. The firm has a 50-day moving average price of $920.43 and a 200 day moving average price of $1,093.27. Texas Pacific Land Corporation has a twelve month low of $845.56 and a twelve month high of $1,769.14. The company has a market capitalization of $22.06 billion, a price-to-earnings ratio of 47.86 and a beta of 1.12.

Texas Pacific Land (NYSE:TPL - Get Free Report) last announced its earnings results on Wednesday, August 6th. The financial services provider reported $5.05 earnings per share for the quarter, missing the consensus estimate of $5.48 by ($0.43). Texas Pacific Land had a net margin of 62.16% and a return on equity of 39.47%. The firm had revenue of $187.54 million during the quarter, compared to analyst estimates of $198.00 million.

Texas Pacific Land Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, September 16th. Investors of record on Tuesday, September 2nd were paid a $1.60 dividend. The ex-dividend date of this dividend was Tuesday, September 2nd. This represents a $6.40 annualized dividend and a yield of 0.7%. Texas Pacific Land's payout ratio is presently 31.90%.

Analyst Upgrades and Downgrades

Separately, Weiss Ratings reiterated a "hold (c+)" rating on shares of Texas Pacific Land in a research report on Saturday, September 27th. One research analyst has rated the stock with a Hold rating, According to data from MarketBeat, the company currently has an average rating of "Hold".

Get Our Latest Stock Report on Texas Pacific Land

Texas Pacific Land Profile

(

Free Report)

Texas Pacific Land Corporation engages in the land and resource management, and water services and operations businesses. The company owns a 1/128th nonparticipating perpetual oil and gas royalty interest (NPRI) under approximately 85,000 acres of land; a 1/16th NPRI under approximately 371,000 acres of land; and approximately 4,000 additional net royalty acres, total of approximately 195,000 NRA located in the western part of Texas.

Read More

Want to see what other hedge funds are holding TPL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Texas Pacific Land Corporation (NYSE:TPL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Texas Pacific Land, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Pacific Land wasn't on the list.

While Texas Pacific Land currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.