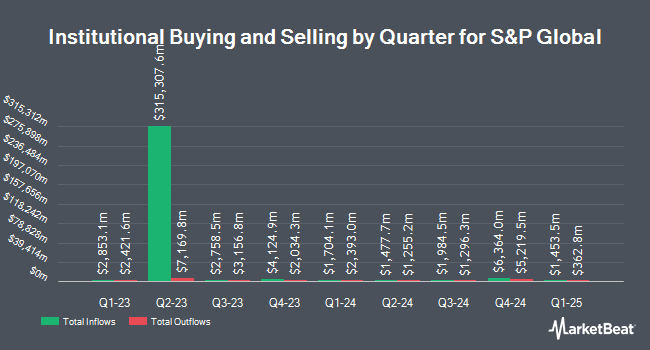

TD Asset Management Inc raised its position in shares of S&P Global Inc. (NYSE:SPGI - Free Report) by 1.1% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 158,416 shares of the business services provider's stock after purchasing an additional 1,726 shares during the quarter. TD Asset Management Inc owned 0.05% of S&P Global worth $80,491,000 as of its most recent SEC filing.

A number of other large investors have also made changes to their positions in the company. Stegent Equity Advisors Inc. lifted its holdings in S&P Global by 3.1% in the 1st quarter. Stegent Equity Advisors Inc. now owns 659 shares of the business services provider's stock worth $335,000 after purchasing an additional 20 shares in the last quarter. Invenio Wealth Partners LLC raised its holdings in shares of S&P Global by 4.0% during the 4th quarter. Invenio Wealth Partners LLC now owns 574 shares of the business services provider's stock worth $286,000 after acquiring an additional 22 shares in the last quarter. Retirement Planning Group LLC raised its holdings in shares of S&P Global by 0.4% during the 4th quarter. Retirement Planning Group LLC now owns 5,762 shares of the business services provider's stock worth $2,870,000 after acquiring an additional 22 shares in the last quarter. Burford Brothers Inc. raised its holdings in shares of S&P Global by 2.8% during the 1st quarter. Burford Brothers Inc. now owns 794 shares of the business services provider's stock worth $403,000 after acquiring an additional 22 shares in the last quarter. Finally, Proficio Capital Partners LLC raised its holdings in shares of S&P Global by 1.8% during the 1st quarter. Proficio Capital Partners LLC now owns 1,266 shares of the business services provider's stock worth $643,000 after acquiring an additional 22 shares in the last quarter. 87.17% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on SPGI. Oppenheimer upped their price objective on S&P Global from $567.00 to $592.00 and gave the stock an "outperform" rating in a report on Wednesday, July 2nd. Bank of America began coverage on S&P Global in a research report on Thursday, April 10th. They set a "buy" rating and a $600.00 target price on the stock. Morgan Stanley boosted their target price on S&P Global from $587.00 to $595.00 and gave the company an "overweight" rating in a research report on Monday, July 7th. UBS Group boosted their target price on S&P Global from $575.00 to $620.00 and gave the company a "buy" rating in a research report on Tuesday, July 8th. Finally, Wells Fargo & Company boosted their target price on S&P Global from $627.00 to $632.00 and gave the company an "overweight" rating in a research report on Thursday, July 3rd. Two research analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $601.07.

Read Our Latest Stock Report on S&P Global

Insider Buying and Selling

In other S&P Global news, EVP Sally Moore sold 500 shares of the company's stock in a transaction that occurred on Monday, May 5th. The stock was sold at an average price of $510.43, for a total transaction of $255,215.00. Following the completion of the sale, the executive vice president directly owned 5,131 shares of the company's stock, valued at $2,619,016.33. This represents a 8.88% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 0.10% of the stock is currently owned by corporate insiders.

S&P Global Stock Up 4.3%

NYSE SPGI traded up $22.66 during trading on Thursday, reaching $551.99. 1,092,462 shares of the company's stock were exchanged, compared to its average volume of 1,279,762. The stock has a market cap of $169.29 billion, a P/E ratio of 43.37, a price-to-earnings-growth ratio of 2.56 and a beta of 1.19. The company has a debt-to-equity ratio of 0.34, a quick ratio of 0.90 and a current ratio of 0.90. The company has a 50 day moving average price of $519.19 and a two-hundred day moving average price of $508.18. S&P Global Inc. has a 1 year low of $427.14 and a 1 year high of $558.86.

S&P Global (NYSE:SPGI - Get Free Report) last posted its earnings results on Thursday, July 31st. The business services provider reported $4.43 earnings per share for the quarter, beating the consensus estimate of $4.18 by $0.25. S&P Global had a return on equity of 14.68% and a net margin of 27.27%. The business had revenue of $3.76 billion during the quarter, compared to the consensus estimate of $3.65 billion. During the same period in the previous year, the business earned $4.04 EPS. The business's quarterly revenue was up 5.8% on a year-over-year basis. On average, equities research analysts anticipate that S&P Global Inc. will post 17.11 EPS for the current fiscal year.

S&P Global Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, September 10th. Shareholders of record on Tuesday, August 26th will be paid a dividend of $0.96 per share. This represents a $3.84 annualized dividend and a yield of 0.70%. The ex-dividend date of this dividend is Tuesday, August 26th. S&P Global's dividend payout ratio is presently 30.16%.

S&P Global Company Profile

(

Free Report)

S&P Global, Inc engages in the provision of transparent and independent ratings, benchmarks, analytics, and data to the capital and commodity markets worldwide. It operates through the following segments: Market Intelligence, Ratings, Commodity Insights, Mobility, Indices, and Engineering Solutions.

See Also

Before you consider S&P Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and S&P Global wasn't on the list.

While S&P Global currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.