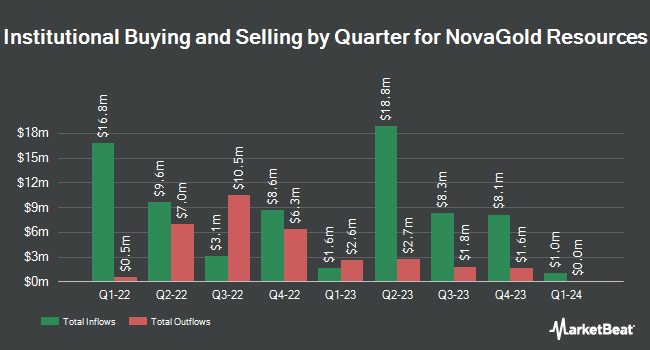

TD Asset Management Inc grew its stake in Novagold Resources Inc. (NYSEAMERICAN:NG - Free Report) TSE: NG by 19.5% during the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 836,726 shares of the mining company's stock after purchasing an additional 136,413 shares during the period. TD Asset Management Inc owned approximately 0.21% of Novagold Resources worth $3,434,000 as of its most recent filing with the Securities and Exchange Commission.

Several other large investors also recently modified their holdings of NG. Cary Street Partners Financial LLC bought a new stake in shares of Novagold Resources in the 1st quarter valued at approximately $29,000. Dauntless Investment Group LLC bought a new stake in shares of Novagold Resources in the 1st quarter valued at approximately $39,000. Cubist Systematic Strategies LLC bought a new stake in shares of Novagold Resources in the 1st quarter valued at approximately $44,000. Abel Hall LLC bought a new stake in shares of Novagold Resources in the 2nd quarter valued at approximately $47,000. Finally, Principal Financial Group Inc. grew its stake in shares of Novagold Resources by 21.0% in the 1st quarter. Principal Financial Group Inc. now owns 16,415 shares of the mining company's stock valued at $48,000 after purchasing an additional 2,848 shares during the period. 57.56% of the stock is currently owned by institutional investors.

Novagold Resources Stock Up 5.9%

NYSEAMERICAN NG opened at $10.11 on Tuesday. The firm has a market cap of $4.11 billion, a PE ratio of -40.44 and a beta of 0.77. Novagold Resources Inc. has a one year low of $2.26 and a one year high of $10.90. The stock's 50 day simple moving average is $7.74 and its 200 day simple moving average is $5.45. The company has a debt-to-equity ratio of 0.92, a current ratio of 26.91 and a quick ratio of 26.91.

Analysts Set New Price Targets

Several equities research analysts have recently weighed in on the company. B. Riley upped their price objective on Novagold Resources from $9.00 to $11.00 and gave the company a "buy" rating in a research note on Tuesday, September 30th. Citigroup upped their price objective on Novagold Resources from $7.00 to $12.50 and gave the company a "buy" rating in a research note on Wednesday, October 15th. Three research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $10.17.

View Our Latest Analysis on Novagold Resources

About Novagold Resources

(

Free Report)

NovaGold Resources Inc explores for and develops gold mineral properties in the United States. Its principal asset is the Donlin Gold project consisting of 493 mining claims covering an area of approximately 29,008 hectares located in the Kuskokwim region of southwestern Alaska. The company was formerly known as NovaCan Mining Resources (1985) Limited and changed its name to NovaGold Resources Inc in March 1987.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Novagold Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novagold Resources wasn't on the list.

While Novagold Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.