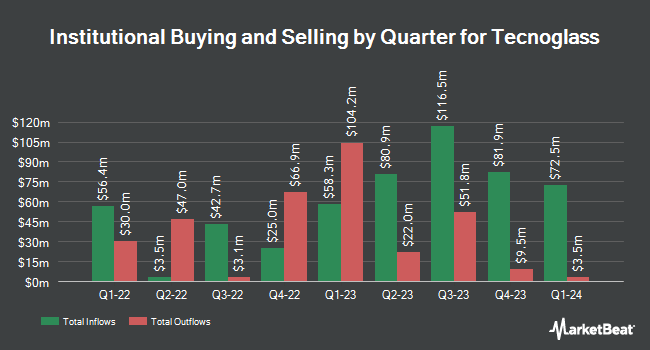

one8zero8 LLC lowered its holdings in shares of Tecnoglass Inc. (NASDAQ:TGLS - Free Report) by 4.7% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 96,381 shares of the company's stock after selling 4,743 shares during the period. Tecnoglass accounts for 1.6% of one8zero8 LLC's investment portfolio, making the stock its 12th largest holding. one8zero8 LLC owned 0.21% of Tecnoglass worth $6,896,000 as of its most recent SEC filing.

A number of other large investors have also recently bought and sold shares of TGLS. Cooke & Bieler LP lifted its stake in shares of Tecnoglass by 1.6% in the 1st quarter. Cooke & Bieler LP now owns 797,882 shares of the company's stock worth $57,088,000 after acquiring an additional 12,642 shares during the period. Kingsview Wealth Management LLC acquired a new stake in shares of Tecnoglass in the 1st quarter worth $3,134,000. Verdence Capital Advisors LLC lifted its stake in shares of Tecnoglass by 49.0% in the 1st quarter. Verdence Capital Advisors LLC now owns 7,028 shares of the company's stock worth $503,000 after acquiring an additional 2,311 shares during the period. SkyOak Wealth LLC acquired a new stake in shares of Tecnoglass in the 1st quarter worth $244,000. Finally, Linden Thomas Advisory Services LLC lifted its stake in shares of Tecnoglass by 12.0% in the 1st quarter. Linden Thomas Advisory Services LLC now owns 16,346 shares of the company's stock worth $1,170,000 after acquiring an additional 1,749 shares during the period. Institutional investors and hedge funds own 37.35% of the company's stock.

Tecnoglass Price Performance

Shares of TGLS traded down $0.40 during trading hours on Monday, reaching $76.83. The company had a trading volume of 294,432 shares, compared to its average volume of 353,865. The firm has a 50 day simple moving average of $80.06 and a 200-day simple moving average of $75.88. The company has a current ratio of 2.21, a quick ratio of 1.63 and a debt-to-equity ratio of 0.20. The company has a market capitalization of $3.61 billion, a price-to-earnings ratio of 24.01 and a beta of 1.78. Tecnoglass Inc. has a 12-month low of $46.47 and a 12-month high of $90.34.

Tecnoglass (NASDAQ:TGLS - Get Free Report) last announced its quarterly earnings results on Thursday, May 8th. The company reported $0.92 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.82 by $0.10. Tecnoglass had a net margin of 17.82% and a return on equity of 27.71%. Tecnoglass's revenue was up 15.4% on a year-over-year basis. During the same period in the prior year, the firm posted $0.66 earnings per share. Research analysts expect that Tecnoglass Inc. will post 3.53 earnings per share for the current year.

Tecnoglass Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, July 31st. Shareholders of record on Monday, June 30th will be issued a dividend of $0.15 per share. The ex-dividend date of this dividend is Monday, June 30th. This represents a $0.60 annualized dividend and a yield of 0.78%. Tecnoglass's dividend payout ratio (DPR) is currently 16.22%.

Analyst Ratings Changes

Separately, B. Riley began coverage on shares of Tecnoglass in a research note on Friday, May 16th. They issued a "buy" rating and a $100.00 target price for the company. Four research analysts have rated the stock with a hold rating, two have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $83.00.

Check Out Our Latest Analysis on TGLS

Tecnoglass Company Profile

(

Free Report)

Tecnoglass Inc manufactures, supplies, and installs architectural glass, windows, and associated aluminum and vinyl products for commercial and residential construction markets in Colombia, the United States, Panama, and internationally. The company provides low emissivity, laminated/thermo-laminated, thermo-acoustic, tempered, silk-screened, curved, and digital print glass products.

Read More

Before you consider Tecnoglass, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tecnoglass wasn't on the list.

While Tecnoglass currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.