Skandinaviska Enskilda Banken AB publ boosted its position in shares of Tesla, Inc. (NASDAQ:TSLA - Free Report) by 22.3% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,164,886 shares of the electric vehicle producer's stock after acquiring an additional 212,395 shares during the period. Tesla accounts for 1.5% of Skandinaviska Enskilda Banken AB publ's holdings, making the stock its 11th biggest position. Skandinaviska Enskilda Banken AB publ's holdings in Tesla were worth $301,973,000 at the end of the most recent quarter.

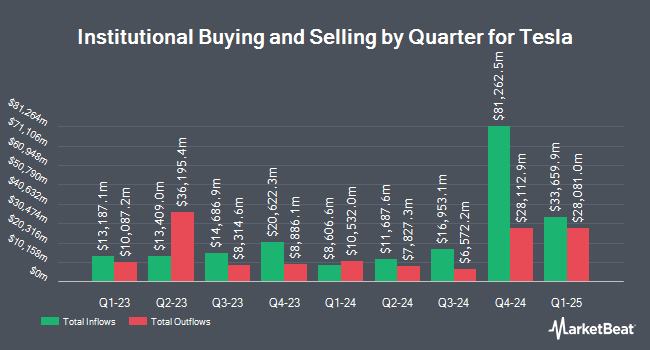

A number of other hedge funds and other institutional investors also recently bought and sold shares of TSLA. Rinkey Investments increased its stake in Tesla by 3.5% during the 4th quarter. Rinkey Investments now owns 860 shares of the electric vehicle producer's stock worth $347,000 after buying an additional 29 shares during the period. True Wealth Design LLC lifted its stake in shares of Tesla by 79.5% in the fourth quarter. True Wealth Design LLC now owns 70 shares of the electric vehicle producer's stock valued at $28,000 after purchasing an additional 31 shares during the period. Aldebaran Financial Inc. increased its holdings in Tesla by 3.1% during the 4th quarter. Aldebaran Financial Inc. now owns 1,174 shares of the electric vehicle producer's stock valued at $490,000 after acquiring an additional 35 shares in the last quarter. Acorn Wealth Advisors LLC increased its holdings in Tesla by 1.9% during the 1st quarter. Acorn Wealth Advisors LLC now owns 1,901 shares of the electric vehicle producer's stock valued at $493,000 after acquiring an additional 36 shares in the last quarter. Finally, Capital Management Associates Inc boosted its stake in shares of Tesla by 3.4% during the 1st quarter. Capital Management Associates Inc now owns 1,166 shares of the electric vehicle producer's stock worth $302,000 after purchasing an additional 38 shares during the last quarter. Hedge funds and other institutional investors own 66.20% of the company's stock.

Analyst Ratings Changes

TSLA has been the topic of several research reports. Barclays cut their price target on shares of Tesla from $325.00 to $275.00 and set an "equal weight" rating on the stock in a report on Monday, April 21st. China Renaissance reissued a "hold" rating and set a $349.00 target price on shares of Tesla in a research report on Friday. Royal Bank Of Canada dropped their price target on shares of Tesla from $314.00 to $307.00 and set an "outperform" rating for the company in a research note on Wednesday, April 23rd. Cfra Research lowered shares of Tesla from a "moderate buy" rating to a "hold" rating in a research note on Tuesday, April 22nd. Finally, Piper Sandler reiterated an "overweight" rating and set a $400.00 target price on shares of Tesla in a research note on Tuesday, June 10th. Ten equities research analysts have rated the stock with a sell rating, fifteen have given a hold rating, seventeen have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $302.75.

View Our Latest Research Report on Tesla

Insiders Place Their Bets

In other news, Director Kimbal Musk sold 91,588 shares of the company's stock in a transaction dated Tuesday, May 27th. The shares were sold at an average price of $357.39, for a total value of $32,732,635.32. Following the completion of the sale, the director directly owned 1,463,220 shares of the company's stock, valued at approximately $522,940,195.80. This represents a 5.89% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Vaibhav Taneja sold 6,000 shares of the stock in a transaction dated Monday, June 2nd. The stock was sold at an average price of $341.02, for a total transaction of $2,046,120.00. Following the transaction, the chief financial officer directly owned 1,950 shares of the company's stock, valued at $664,989. This represents a 75.47% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 835,509 shares of company stock valued at $279,420,485. Corporate insiders own 20.70% of the company's stock.

Tesla Stock Performance

TSLA traded up $11.85 during midday trading on Monday, hitting $327.91. 74,598,612 shares of the company were exchanged, compared to its average volume of 108,238,672. Tesla, Inc. has a 1-year low of $182.00 and a 1-year high of $488.54. The company has a current ratio of 2.04, a quick ratio of 1.55 and a debt-to-equity ratio of 0.07. The firm has a market capitalization of $1.06 trillion, a price-to-earnings ratio of 189.27, a price-to-earnings-growth ratio of 9.93 and a beta of 2.39. The company's 50 day simple moving average is $324.70 and its 200 day simple moving average is $313.53.

Tesla (NASDAQ:TSLA - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The electric vehicle producer reported $0.40 earnings per share for the quarter, missing analysts' consensus estimates of $0.43 by ($0.03). Tesla had a net margin of 6.54% and a return on equity of 7.98%. The company had revenue of $22.50 billion during the quarter, compared to analysts' expectations of $23.18 billion. During the same period in the prior year, the business posted $0.52 earnings per share. The company's quarterly revenue was down 11.8% compared to the same quarter last year. As a group, sell-side analysts predict that Tesla, Inc. will post 2.56 earnings per share for the current year.

Tesla Profile

(

Free Report)

Tesla, Inc designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services.

Recommended Stories

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report