Teza Capital Management LLC decreased its holdings in Harley-Davidson, Inc. (NYSE:HOG - Free Report) by 20.1% in the fourth quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 57,501 shares of the company's stock after selling 14,455 shares during the quarter. Teza Capital Management LLC's holdings in Harley-Davidson were worth $1,733,000 as of its most recent filing with the SEC.

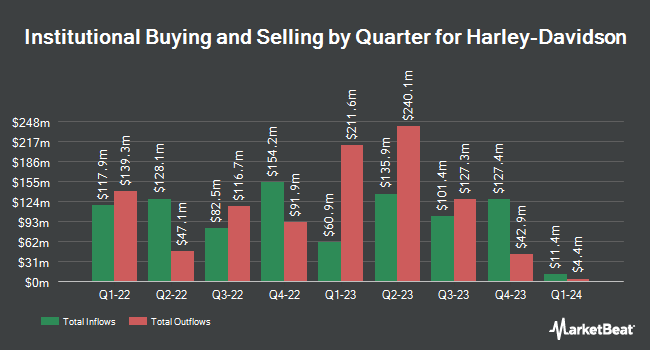

Several other institutional investors have also made changes to their positions in HOG. Venturi Wealth Management LLC boosted its stake in shares of Harley-Davidson by 172.0% in the 4th quarter. Venturi Wealth Management LLC now owns 876 shares of the company's stock valued at $26,000 after purchasing an additional 554 shares in the last quarter. Bessemer Group Inc. raised its stake in shares of Harley-Davidson by 237.9% in the fourth quarter. Bessemer Group Inc. now owns 1,301 shares of the company's stock valued at $39,000 after acquiring an additional 916 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. acquired a new position in shares of Harley-Davidson in the 4th quarter worth approximately $42,000. Global Retirement Partners LLC grew its position in Harley-Davidson by 84.3% during the 4th quarter. Global Retirement Partners LLC now owns 1,850 shares of the company's stock worth $56,000 after acquiring an additional 846 shares during the last quarter. Finally, National Bank of Canada FI grew its position in Harley-Davidson by 201.8% during the 4th quarter. National Bank of Canada FI now owns 1,889 shares of the company's stock worth $57,000 after acquiring an additional 1,263 shares during the last quarter. 85.10% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

HOG has been the subject of a number of research analyst reports. Citigroup dropped their target price on shares of Harley-Davidson from $29.00 to $28.00 and set a "neutral" rating for the company in a research note on Wednesday, April 2nd. Bank of America reduced their price objective on Harley-Davidson from $40.00 to $35.00 and set a "buy" rating on the stock in a report on Thursday, January 30th. Robert W. Baird lifted their target price on Harley-Davidson from $26.00 to $28.00 and gave the company a "neutral" rating in a research note on Wednesday, May 14th. UBS Group cut their price target on Harley-Davidson from $35.00 to $28.00 and set a "neutral" rating on the stock in a research note on Thursday, February 20th. Finally, DA Davidson reiterated a "buy" rating and issued a $31.00 price objective on shares of Harley-Davidson in a research report on Wednesday, April 9th. Six equities research analysts have rated the stock with a hold rating, one has assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Harley-Davidson currently has an average rating of "Hold" and a consensus price target of $30.17.

Read Our Latest Report on HOG

Harley-Davidson Trading Down 2.1%

Shares of HOG stock traded down $0.51 on Friday, reaching $24.25. The company had a trading volume of 536,735 shares, compared to its average volume of 1,918,915. The stock has a market cap of $2.95 billion, a PE ratio of 7.27, a PEG ratio of 0.38 and a beta of 1.30. The company has a 50-day moving average of $23.80 and a 200-day moving average of $27.48. The company has a current ratio of 1.40, a quick ratio of 1.19 and a debt-to-equity ratio of 1.41. Harley-Davidson, Inc. has a 12 month low of $20.45 and a 12 month high of $39.93.

Harley-Davidson (NYSE:HOG - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The company reported $1.07 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.80 by $0.27. Harley-Davidson had a net margin of 9.25% and a return on equity of 13.64%. The company had revenue of $315.24 million during the quarter, compared to analyst estimates of $1.12 billion. During the same quarter in the previous year, the business earned $1.72 EPS. The firm's revenue was down 23.2% on a year-over-year basis. On average, equities analysts forecast that Harley-Davidson, Inc. will post 3.44 earnings per share for the current year.

Harley-Davidson Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, June 18th. Shareholders of record on Monday, June 2nd will be issued a $0.18 dividend. The ex-dividend date of this dividend is Monday, June 2nd. This represents a $0.72 annualized dividend and a dividend yield of 2.97%. Harley-Davidson's dividend payout ratio (DPR) is currently 26.87%.

About Harley-Davidson

(

Free Report)

Harley-Davidson, Inc manufactures and sells motorcycles in the United States and internationally. The company operates in three segments: Harley-Davidson Motor Company, LiveWire, and Harley-Davidson Financial Services. The Harley-Davidson Motor Company segment designs, manufactures, and sells motorcycles, including cruiser, trike, touring, standard, sportbike, adventure, and dual sport, as well as motorcycle parts, accessories, and apparel, as well as licenses its trademarks and related services.

See Also

Before you consider Harley-Davidson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harley-Davidson wasn't on the list.

While Harley-Davidson currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.