TFB Advisors LLC boosted its position in shares of Blackstone Inc. (NYSE:BX - Free Report) by 35.1% in the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 8,876 shares of the asset manager's stock after purchasing an additional 2,304 shares during the quarter. TFB Advisors LLC's holdings in Blackstone were worth $1,241,000 as of its most recent SEC filing.

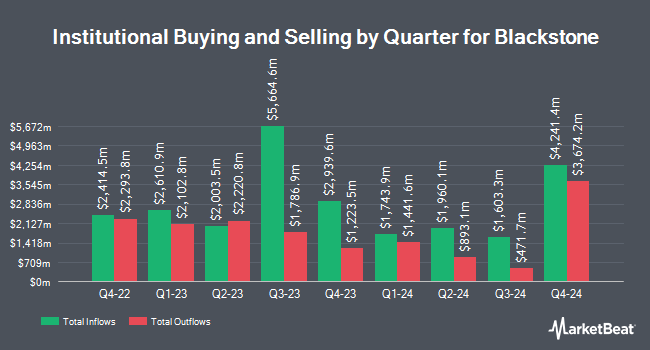

Other institutional investors have also recently bought and sold shares of the company. Bernard Wealth Management Corp. acquired a new position in Blackstone during the fourth quarter valued at approximately $34,000. Putney Financial Group LLC acquired a new position in Blackstone during the fourth quarter valued at approximately $34,000. von Borstel & Associates Inc. acquired a new position in Blackstone during the first quarter valued at approximately $28,000. Vision Financial Markets LLC acquired a new position in shares of Blackstone in the first quarter valued at approximately $35,000. Finally, Garde Capital Inc. acquired a new position in shares of Blackstone in the first quarter valued at approximately $36,000. Institutional investors and hedge funds own 70.00% of the company's stock.

Analysts Set New Price Targets

Several research analysts have recently weighed in on BX shares. Piper Sandler upped their price target on shares of Blackstone from $157.00 to $181.00 and gave the company a "neutral" rating in a report on Monday, July 28th. The Goldman Sachs Group reissued a "neutral" rating on shares of Blackstone in a research report on Friday, July 25th. Deutsche Bank Aktiengesellschaft boosted their price objective on shares of Blackstone from $170.00 to $192.00 and gave the stock a "buy" rating in a research report on Friday, July 25th. Barclays boosted their price objective on shares of Blackstone from $168.00 to $181.00 and gave the stock an "equal weight" rating in a research report on Friday, July 25th. Finally, Dbs Bank raised shares of Blackstone to a "moderate buy" rating in a research report on Tuesday, August 12th. Nine research analysts have rated the stock with a Buy rating and nine have issued a Hold rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $170.12.

Check Out Our Latest Report on BX

Insider Activity

In other Blackstone news, CAO David Payne sold 9,400 shares of the stock in a transaction dated Thursday, August 7th. The shares were sold at an average price of $169.97, for a total transaction of $1,597,718.00. Following the sale, the chief accounting officer directly owned 54,488 shares in the company, valued at $9,261,325.36. This represents a 14.71% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, major shareholder Bx Buzz Ml-1 Gp Llc sold 16,689,884 shares of the stock in a transaction dated Wednesday, August 13th. The stock was sold at an average price of $6.26, for a total transaction of $104,478,673.84. The disclosure for this sale can be found here. Over the last three months, insiders acquired 1,189,806 shares of company stock valued at $30,046,627 and sold 16,850,134 shares valued at $131,641,986. Corporate insiders own 1.00% of the company's stock.

Blackstone Stock Performance

Shares of BX stock traded up $6.8030 on Friday, hitting $170.2430. The company's stock had a trading volume of 5,187,162 shares, compared to its average volume of 3,648,507. The company has a debt-to-equity ratio of 0.61, a quick ratio of 0.74 and a current ratio of 0.74. The stock's 50 day moving average is $161.69 and its 200-day moving average is $149.76. Blackstone Inc. has a fifty-two week low of $115.66 and a fifty-two week high of $200.96. The company has a market capitalization of $125.48 billion, a PE ratio of 45.76, a PEG ratio of 1.33 and a beta of 1.71.

Blackstone (NYSE:BX - Get Free Report) last released its quarterly earnings results on Thursday, July 24th. The asset manager reported $1.21 EPS for the quarter, beating the consensus estimate of $1.10 by $0.11. The business had revenue of $3.07 billion for the quarter, compared to the consensus estimate of $2.77 billion. Blackstone had a net margin of 20.83% and a return on equity of 20.47%. Blackstone's revenue was up 32.7% compared to the same quarter last year. During the same period in the prior year, the company posted $0.98 earnings per share. Equities research analysts expect that Blackstone Inc. will post 5.87 earnings per share for the current fiscal year.

Blackstone Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, August 11th. Shareholders of record on Monday, August 4th were paid a dividend of $1.03 per share. The ex-dividend date was Monday, August 4th. This is a positive change from Blackstone's previous quarterly dividend of $0.93. This represents a $4.12 dividend on an annualized basis and a yield of 2.4%. Blackstone's dividend payout ratio is currently 110.75%.

About Blackstone

(

Free Report)

Blackstone Inc is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies. The firm typically invests in early-stage companies. It also provide capital markets services.

Recommended Stories

Before you consider Blackstone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone wasn't on the list.

While Blackstone currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.