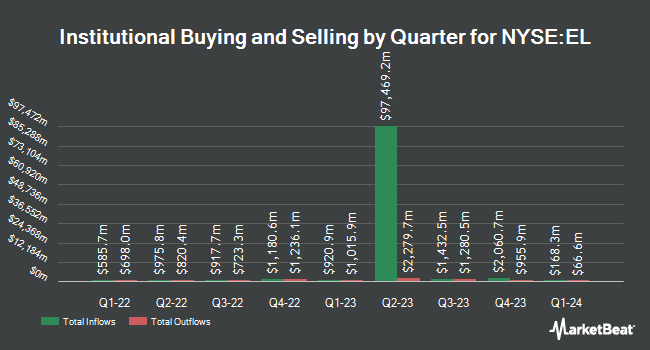

Fayez Sarofim & Co lessened its holdings in shares of The Estee Lauder Companies Inc. (NYSE:EL - Free Report) by 5.4% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 418,578 shares of the company's stock after selling 23,728 shares during the quarter. Fayez Sarofim & Co owned about 0.12% of Estee Lauder Companies worth $27,626,000 at the end of the most recent quarter.

A number of other large investors have also recently modified their holdings of EL. Annis Gardner Whiting Capital Advisors LLC lifted its position in Estee Lauder Companies by 1,182.1% in the 1st quarter. Annis Gardner Whiting Capital Advisors LLC now owns 500 shares of the company's stock worth $33,000 after buying an additional 461 shares during the last quarter. Winthrop Capital Management LLC lifted its position in Estee Lauder Companies by 2,240.0% in the 1st quarter. Winthrop Capital Management LLC now owns 585 shares of the company's stock worth $39,000 after buying an additional 560 shares during the last quarter. Golden State Wealth Management LLC lifted its position in Estee Lauder Companies by 57.3% in the 1st quarter. Golden State Wealth Management LLC now owns 626 shares of the company's stock worth $41,000 after buying an additional 228 shares during the last quarter. CVA Family Office LLC increased its stake in Estee Lauder Companies by 116.2% in the 1st quarter. CVA Family Office LLC now owns 668 shares of the company's stock worth $44,000 after purchasing an additional 359 shares during the period. Finally, Farther Finance Advisors LLC increased its stake in Estee Lauder Companies by 41.0% in the 1st quarter. Farther Finance Advisors LLC now owns 787 shares of the company's stock worth $53,000 after purchasing an additional 229 shares during the period. Institutional investors own 55.15% of the company's stock.

Analyst Ratings Changes

A number of brokerages have commented on EL. UBS Group lifted their price target on Estee Lauder Companies from $62.00 to $93.00 and gave the stock a "neutral" rating in a research note on Thursday, July 17th. JPMorgan Chase & Co. raised Estee Lauder Companies from a "neutral" rating to an "overweight" rating and boosted their target price for the company from $62.00 to $101.00 in a research note on Friday, July 25th. Royal Bank Of Canada reduced their target price on Estee Lauder Companies from $100.00 to $90.00 and set an "outperform" rating on the stock in a research note on Friday, May 2nd. B. Riley reaffirmed a "neutral" rating and issued a $60.00 price target (down from $70.00) on shares of Estee Lauder Companies in a research note on Friday, May 2nd. Finally, Deutsche Bank Aktiengesellschaft raised Estee Lauder Companies from a "hold" rating to a "buy" rating and boosted their target price for the stock from $71.00 to $95.00 in a report on Monday, June 23rd. Thirteen analysts have rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $84.50.

Check Out Our Latest Stock Analysis on EL

Estee Lauder Companies Price Performance

Shares of EL stock traded down $0.80 during mid-day trading on Monday, hitting $89.90. The company had a trading volume of 1,195,841 shares, compared to its average volume of 4,115,710. The Estee Lauder Companies Inc. has a 52-week low of $48.37 and a 52-week high of $103.44. The stock's 50 day moving average price is $82.47 and its 200-day moving average price is $71.51. The company has a debt-to-equity ratio of 1.68, a current ratio of 1.41 and a quick ratio of 1.02. The company has a market capitalization of $32.34 billion, a P/E ratio of -37.15, a P/E/G ratio of 6.47 and a beta of 1.18.

Estee Lauder Companies Profile

(

Free Report)

The Estée Lauder Companies Inc manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide. It offers skin care products, including moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, and sun care products; and makeup products, such as lipsticks, lip glosses, mascaras, foundations, eyeshadows, and powders, as well as compacts, brushes, and other makeup tools.

See Also

Before you consider Estee Lauder Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Estee Lauder Companies wasn't on the list.

While Estee Lauder Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.