Hsbc Holdings PLC cut its stake in The Hartford Insurance Group, Inc. (NYSE:HIG - Free Report) by 4.7% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 998,302 shares of the insurance provider's stock after selling 49,406 shares during the period. Hsbc Holdings PLC owned 0.35% of The Hartford Insurance Group worth $123,427,000 as of its most recent filing with the Securities & Exchange Commission.

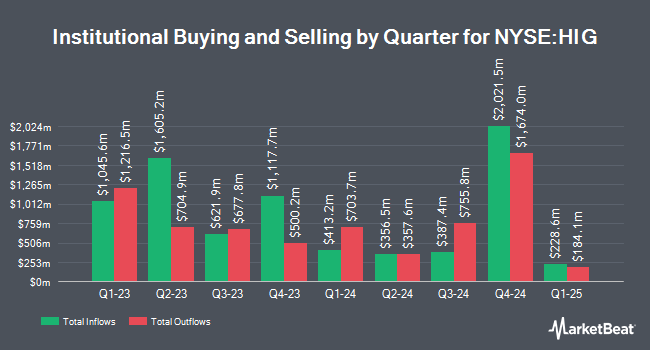

A number of other institutional investors also recently bought and sold shares of HIG. GAMMA Investing LLC boosted its stake in The Hartford Insurance Group by 14,049.5% in the 1st quarter. GAMMA Investing LLC now owns 1,424,009 shares of the insurance provider's stock worth $1,761,930,000 after purchasing an additional 1,413,945 shares in the last quarter. Ameriprise Financial Inc. boosted its stake in The Hartford Insurance Group by 48.1% in the 4th quarter. Ameriprise Financial Inc. now owns 2,264,397 shares of the insurance provider's stock worth $247,761,000 after purchasing an additional 735,170 shares in the last quarter. Nuveen LLC acquired a new stake in The Hartford Insurance Group in the 1st quarter worth approximately $87,516,000. Northern Trust Corp boosted its stake in The Hartford Insurance Group by 17.2% in the 4th quarter. Northern Trust Corp now owns 3,537,665 shares of the insurance provider's stock worth $387,021,000 after purchasing an additional 519,717 shares in the last quarter. Finally, Freestone Grove Partners LP acquired a new stake in The Hartford Insurance Group in the 4th quarter worth approximately $46,271,000. 93.42% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several analysts have commented on HIG shares. Wall Street Zen upgraded shares of The Hartford Insurance Group from a "hold" rating to a "buy" rating in a research note on Saturday, August 2nd. Keefe, Bruyette & Woods lifted their price objective on shares of The Hartford Insurance Group from $135.00 to $137.00 and gave the company an "outperform" rating in a research note on Monday, August 4th. Raymond James Financial restated an "outperform" rating and set a $140.00 price objective (up from $135.00) on shares of The Hartford Insurance Group in a research note on Friday, August 1st. Wells Fargo & Company lifted their price objective on shares of The Hartford Insurance Group from $138.00 to $139.00 and gave the company an "overweight" rating in a research note on Wednesday, July 30th. Finally, Barclays decreased their price objective on shares of The Hartford Insurance Group from $145.00 to $142.00 and set an "overweight" rating for the company in a research note on Monday, July 7th. Seven analysts have rated the stock with a Buy rating and seven have issued a Hold rating to the company's stock. Based on data from MarketBeat, The Hartford Insurance Group currently has a consensus rating of "Moderate Buy" and an average price target of $137.64.

Check Out Our Latest Stock Report on HIG

The Hartford Insurance Group Price Performance

NYSE:HIG opened at $131.6760 on Wednesday. The company has a debt-to-equity ratio of 0.25, a current ratio of 0.31 and a quick ratio of 0.31. The firm has a market cap of $37.02 billion, a price-to-earnings ratio of 11.94, a price-to-earnings-growth ratio of 1.26 and a beta of 0.67. The company has a 50 day moving average price of $125.13 and a 200-day moving average price of $122.07. The Hartford Insurance Group, Inc. has a 1-year low of $104.93 and a 1-year high of $132.09.

The Hartford Insurance Group (NYSE:HIG - Get Free Report) last posted its earnings results on Monday, July 28th. The insurance provider reported $3.41 earnings per share for the quarter, beating the consensus estimate of $2.83 by $0.58. The firm had revenue of $6.99 billion during the quarter, compared to analyst estimates of $7.02 billion. The Hartford Insurance Group had a net margin of 11.83% and a return on equity of 19.60%. The business's quarterly revenue was up 7.7% on a year-over-year basis. During the same period in the previous year, the firm earned $2.50 EPS. Equities research analysts forecast that The Hartford Insurance Group, Inc. will post 11.11 EPS for the current year.

The Hartford Insurance Group Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, October 2nd. Investors of record on Tuesday, September 2nd will be issued a $0.52 dividend. This represents a $2.08 annualized dividend and a yield of 1.6%. The ex-dividend date of this dividend is Tuesday, September 2nd. The Hartford Insurance Group's payout ratio is presently 18.86%.

Insider Buying and Selling

In related news, CFO Beth Ann Costello sold 35,340 shares of the business's stock in a transaction on Monday, August 4th. The shares were sold at an average price of $123.50, for a total value of $4,364,490.00. Following the completion of the sale, the chief financial officer owned 77,574 shares of the company's stock, valued at approximately $9,580,389. The trade was a 31.30% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 1.60% of the company's stock.

About The Hartford Insurance Group

(

Free Report)

The Hartford Financial Services Group, Inc, together with its subsidiaries, provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers insurance coverages, including workers' compensation, property, automobile, general and professional liability, package business, umbrella, fidelity and surety, marine, livestock, accident, health, and reinsurance through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers.

Further Reading

Want to see what other hedge funds are holding HIG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Hartford Insurance Group, Inc. (NYSE:HIG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider The Hartford Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hartford Insurance Group wasn't on the list.

While The Hartford Insurance Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report