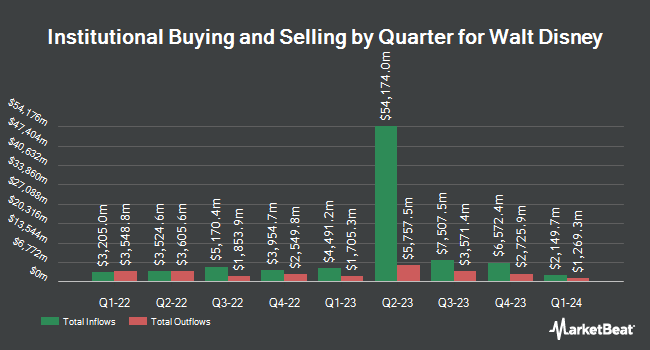

Joel Isaacson & Co. LLC increased its stake in The Walt Disney Company (NYSE:DIS - Free Report) by 9.1% in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 32,130 shares of the entertainment giant's stock after acquiring an additional 2,672 shares during the period. Joel Isaacson & Co. LLC's holdings in Walt Disney were worth $3,984,000 at the end of the most recent reporting period.

Other institutional investors have also recently added to or reduced their stakes in the company. J. Safra Sarasin Holding AG boosted its stake in Walt Disney by 8.1% during the first quarter. J. Safra Sarasin Holding AG now owns 222,747 shares of the entertainment giant's stock valued at $21,983,000 after buying an additional 16,781 shares in the last quarter. Planning Directions Inc. bought a new stake in Walt Disney during the first quarter worth approximately $326,000. Kingstone Capital Partners Texas LLC acquired a new position in Walt Disney in the second quarter worth approximately $4,220,599,000. Wedge Capital Management L L P NC increased its holdings in shares of Walt Disney by 8,744.0% in the second quarter. Wedge Capital Management L L P NC now owns 320,329 shares of the entertainment giant's stock valued at $39,724,000 after buying an additional 316,707 shares in the last quarter. Finally, WoodTrust Financial Corp increased its holdings in shares of Walt Disney by 6.7% in the first quarter. WoodTrust Financial Corp now owns 96,158 shares of the entertainment giant's stock valued at $9,491,000 after buying an additional 6,047 shares in the last quarter. 65.71% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

DIS has been the subject of several research reports. Weiss Ratings reissued a "hold (c+)" rating on shares of Walt Disney in a research note on Saturday, September 27th. Wall Street Zen lowered Walt Disney from a "buy" rating to a "hold" rating in a research report on Friday. Raymond James Financial reissued a "neutral" rating on shares of Walt Disney in a research note on Monday, August 11th. Citigroup upped their price objective on shares of Walt Disney from $125.00 to $140.00 and gave the company a "buy" rating in a research note on Wednesday, July 9th. Finally, Keefe, Bruyette & Woods reissued a "market perform" rating on shares of Walt Disney in a research report on Monday, August 11th. Nineteen analysts have rated the stock with a Buy rating and nine have given a Hold rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $131.18.

View Our Latest Stock Report on DIS

Walt Disney Trading Up 0.3%

Shares of NYSE:DIS opened at $112.83 on Tuesday. The Walt Disney Company has a 12-month low of $80.10 and a 12-month high of $124.69. The company has a quick ratio of 0.66, a current ratio of 0.72 and a debt-to-equity ratio of 0.32. The firm has a market capitalization of $202.86 billion, a P/E ratio of 17.68, a price-to-earnings-growth ratio of 1.48 and a beta of 1.54. The firm has a fifty day moving average of $115.97 and a two-hundred day moving average of $110.19.

Walt Disney (NYSE:DIS - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The entertainment giant reported $1.61 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.45 by $0.16. Walt Disney had a return on equity of 9.67% and a net margin of 12.22%.The firm had revenue of $23.65 billion during the quarter, compared to analysts' expectations of $23.69 billion. During the same quarter last year, the firm earned $1.39 earnings per share. The business's revenue for the quarter was up 2.1% on a year-over-year basis. On average, equities analysts expect that The Walt Disney Company will post 5.47 EPS for the current fiscal year.

About Walt Disney

(

Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.