Thornburg Investment Management Inc. lowered its position in Avantor, Inc. (NYSE:AVTR - Free Report) by 34.3% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 500,483 shares of the company's stock after selling 260,969 shares during the quarter. Thornburg Investment Management Inc. owned approximately 0.07% of Avantor worth $8,113,000 as of its most recent SEC filing.

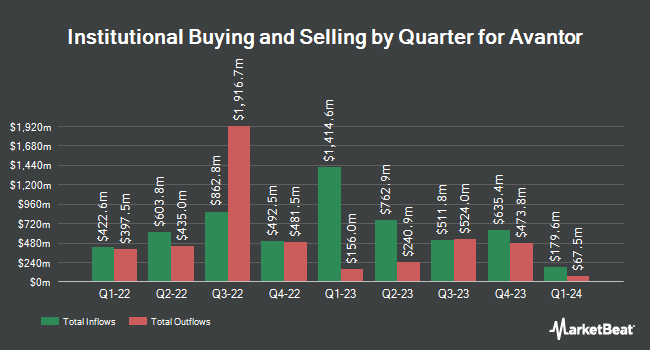

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. GSA Capital Partners LLP purchased a new stake in shares of Avantor during the 1st quarter worth approximately $553,000. Meeder Advisory Services Inc. purchased a new stake in shares of Avantor during the 1st quarter worth approximately $163,000. Mackenzie Financial Corp lifted its position in shares of Avantor by 157.1% during the 1st quarter. Mackenzie Financial Corp now owns 111,479 shares of the company's stock worth $1,807,000 after buying an additional 68,121 shares during the last quarter. LPL Financial LLC lifted its position in shares of Avantor by 50.1% during the 1st quarter. LPL Financial LLC now owns 209,166 shares of the company's stock worth $3,391,000 after buying an additional 69,772 shares during the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its position in shares of Avantor by 1.1% during the 1st quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 381,280 shares of the company's stock worth $6,181,000 after buying an additional 4,036 shares during the last quarter. Institutional investors and hedge funds own 95.08% of the company's stock.

Avantor Price Performance

NYSE AVTR traded down $2.07 during trading hours on Friday, reaching $11.37. The company's stock had a trading volume of 59,921,196 shares, compared to its average volume of 10,521,999. The stock has a market cap of $7.75 billion, a PE ratio of 10.93, a PEG ratio of 1.46 and a beta of 1.05. Avantor, Inc. has a fifty-two week low of $10.82 and a fifty-two week high of $27.83. The company's 50-day moving average is $13.40 and its two-hundred day moving average is $15.56. The company has a debt-to-equity ratio of 0.54, a quick ratio of 0.75 and a current ratio of 1.12.

Avantor (NYSE:AVTR - Get Free Report) last issued its quarterly earnings results on Friday, August 1st. The company reported $0.24 earnings per share for the quarter, missing the consensus estimate of $0.25 by ($0.01). The business had revenue of $1.68 billion during the quarter, compared to analyst estimates of $1.67 billion. Avantor had a net margin of 10.70% and a return on equity of 11.93%. The company's revenue was down 1.1% on a year-over-year basis. During the same quarter last year, the firm posted $0.25 earnings per share. Analysts forecast that Avantor, Inc. will post 1.06 EPS for the current year.

Analyst Ratings Changes

Several analysts recently commented on AVTR shares. Robert W. Baird upped their price target on shares of Avantor from $17.00 to $18.00 and gave the company an "outperform" rating in a research report on Monday. Morgan Stanley cut shares of Avantor from an "overweight" rating to an "equal weight" rating in a research note on Tuesday, April 29th. Jefferies Financial Group reissued a "hold" rating on shares of Avantor in a research note on Friday. Royal Bank Of Canada dropped their price objective on shares of Avantor from $24.00 to $20.00 and set an "outperform" rating on the stock in a research note on Monday, April 28th. Finally, Stifel Nicolaus cut shares of Avantor from a "buy" rating to a "hold" rating and lowered their price target for the stock from $26.00 to $14.00 in a research note on Monday, April 28th. Eight analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $18.23.

View Our Latest Analysis on Avantor

Insider Buying and Selling at Avantor

In related news, Director Gregory L. Summe acquired 30,000 shares of the business's stock in a transaction dated Friday, May 23rd. The shares were acquired at an average cost of $12.50 per share, for a total transaction of $375,000.00. Following the acquisition, the director directly owned 100,000 shares in the company, valued at approximately $1,250,000. The trade was a 42.86% increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at the SEC website. In the last 90 days, insiders have bought 75,000 shares of company stock worth $928,000. Corporate insiders own 1.20% of the company's stock.

Avantor Profile

(

Free Report)

Avantor, Inc engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa. The company offers materials and consumables, such as purity chemicals and reagents, lab products and supplies, formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, education and microbiology products, clinical trial kits, peristaltic pumps, and fluid handling tips.

Featured Stories

Before you consider Avantor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avantor wasn't on the list.

While Avantor currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.