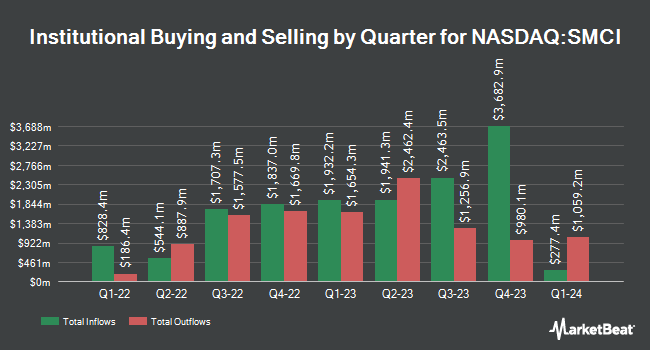

Thoroughbred Financial Services LLC raised its holdings in Super Micro Computer, Inc. (NASDAQ:SMCI - Free Report) by 137.8% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 51,238 shares of the company's stock after buying an additional 29,692 shares during the period. Thoroughbred Financial Services LLC's holdings in Super Micro Computer were worth $1,754,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other large investors have also recently made changes to their positions in SMCI. Eastern Bank bought a new position in shares of Super Micro Computer in the first quarter valued at $29,000. Bernard Wealth Management Corp. bought a new position in shares of Super Micro Computer in the fourth quarter valued at $33,000. Quarry LP bought a new position in shares of Super Micro Computer in the fourth quarter valued at $34,000. Central Pacific Bank Trust Division bought a new position in shares of Super Micro Computer in the first quarter valued at $34,000. Finally, IMG Wealth Management Inc. raised its holdings in shares of Super Micro Computer by 90.7% in the first quarter. IMG Wealth Management Inc. now owns 1,051 shares of the company's stock valued at $36,000 after purchasing an additional 500 shares during the last quarter. 84.06% of the stock is owned by institutional investors.

Super Micro Computer Stock Performance

NASDAQ:SMCI traded down $0.12 on Thursday, reaching $46.67. 43,781,361 shares of the company's stock were exchanged, compared to its average volume of 43,750,792. The company has a debt-to-equity ratio of 0.74, a current ratio of 5.32 and a quick ratio of 3.95. The firm has a market cap of $27.85 billion, a price-to-earnings ratio of 28.11, a P/E/G ratio of 2.28 and a beta of 1.46. Super Micro Computer, Inc. has a 52 week low of $17.25 and a 52 week high of $66.44. The stock has a fifty day simple moving average of $48.51 and a 200-day simple moving average of $41.43.

Super Micro Computer (NASDAQ:SMCI - Get Free Report) last issued its earnings results on Tuesday, August 5th. The company reported $0.41 earnings per share for the quarter, missing analysts' consensus estimates of $0.44 by ($0.03). The business had revenue of $5.76 billion for the quarter, compared to the consensus estimate of $5.88 billion. Super Micro Computer had a return on equity of 17.14% and a net margin of 4.77%. Super Micro Computer's revenue for the quarter was up 8.5% compared to the same quarter last year. During the same quarter in the prior year, the business earned $6.25 EPS. As a group, sell-side analysts predict that Super Micro Computer, Inc. will post 1.86 earnings per share for the current year.

Insider Activity

In other news, CEO Charles Liang sold 300,000 shares of the firm's stock in a transaction that occurred on Wednesday, June 18th. The shares were sold at an average price of $45.00, for a total value of $13,500,000.00. Following the completion of the transaction, the chief executive officer directly owned 66,903,640 shares in the company, valued at approximately $3,010,663,800. This trade represents a 0.45% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CFO David E. Weigand sold 67,000 shares of the firm's stock in a transaction that occurred on Tuesday, May 20th. The shares were sold at an average price of $44.02, for a total transaction of $2,949,340.00. Following the completion of the transaction, the chief financial officer owned 88,599 shares of the company's stock, valued at $3,900,127.98. This trade represents a 43.06% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 1,067,000 shares of company stock worth $53,949,340. 17.60% of the stock is owned by company insiders.

Analysts Set New Price Targets

Several brokerages have recently commented on SMCI. The Goldman Sachs Group increased their target price on shares of Super Micro Computer from $24.00 to $27.00 and gave the company a "sell" rating in a report on Wednesday. Wedbush reiterated a "neutral" rating and issued a $30.00 target price on shares of Super Micro Computer in a report on Monday. Mizuho increased their target price on shares of Super Micro Computer from $40.00 to $47.00 and gave the company a "neutral" rating in a report on Thursday, July 3rd. Citigroup reiterated a "neutral" rating and issued a $52.00 target price (up previously from $37.00) on shares of Super Micro Computer in a report on Friday, July 11th. Finally, Needham & Company LLC increased their target price on shares of Super Micro Computer from $39.00 to $60.00 and gave the company a "buy" rating in a report on Wednesday. Three equities research analysts have rated the stock with a sell rating, eight have issued a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, Super Micro Computer presently has an average rating of "Hold" and an average target price of $44.75.

Check Out Our Latest Report on Super Micro Computer

About Super Micro Computer

(

Free Report)

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Featured Articles

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.