Tidal Investments LLC lessened its holdings in shares of Cal-Maine Foods, Inc. (NASDAQ:CALM - Free Report) by 69.7% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 14,456 shares of the basic materials company's stock after selling 33,197 shares during the period. Tidal Investments LLC's holdings in Cal-Maine Foods were worth $1,488,000 at the end of the most recent quarter.

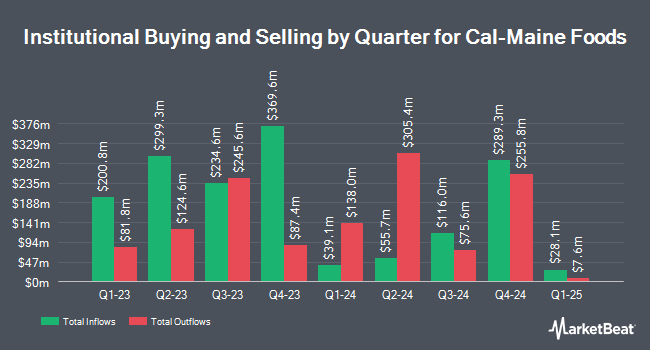

Several other institutional investors have also made changes to their positions in the stock. Smartleaf Asset Management LLC raised its holdings in Cal-Maine Foods by 339.1% in the 4th quarter. Smartleaf Asset Management LLC now owns 1,032 shares of the basic materials company's stock valued at $105,000 after acquiring an additional 797 shares in the last quarter. Daiwa Securities Group Inc. acquired a new position in Cal-Maine Foods in the fourth quarter valued at about $134,000. Nisa Investment Advisors LLC raised its stake in Cal-Maine Foods by 350.5% in the fourth quarter. Nisa Investment Advisors LLC now owns 1,437 shares of the basic materials company's stock valued at $148,000 after purchasing an additional 1,118 shares in the last quarter. KBC Group NV lifted its position in Cal-Maine Foods by 59.8% during the fourth quarter. KBC Group NV now owns 1,681 shares of the basic materials company's stock worth $173,000 after purchasing an additional 629 shares during the period. Finally, Colonial River Investments LLC acquired a new stake in Cal-Maine Foods during the fourth quarter worth about $203,000. 84.67% of the stock is currently owned by institutional investors.

Cal-Maine Foods Stock Up 0.7%

Shares of CALM stock traded up $0.63 on Thursday, reaching $94.08. The company had a trading volume of 284,937 shares, compared to its average volume of 749,927. The stock has a market capitalization of $4.61 billion, a PE ratio of 7.32 and a beta of 0.18. Cal-Maine Foods, Inc. has a one year low of $57.43 and a one year high of $116.41. The business's 50-day moving average is $93.84 and its 200 day moving average is $97.62.

Cal-Maine Foods (NASDAQ:CALM - Get Free Report) last announced its quarterly earnings results on Tuesday, April 8th. The basic materials company reported $10.38 earnings per share (EPS) for the quarter, topping the consensus estimate of $5.79 by $4.59. The company had revenue of $1.42 billion during the quarter, compared to the consensus estimate of $953.76 million. Cal-Maine Foods had a net margin of 20.39% and a return on equity of 33.69%. The company's revenue for the quarter was up 101.6% compared to the same quarter last year. During the same period in the prior year, the business earned $3.00 earnings per share. On average, sell-side analysts forecast that Cal-Maine Foods, Inc. will post 15.59 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on CALM shares. Stephens restated an "equal weight" rating and issued a $97.00 target price on shares of Cal-Maine Foods in a research report on Wednesday, April 23rd. Wall Street Zen raised shares of Cal-Maine Foods from a "buy" rating to a "strong-buy" rating in a research note on Saturday, May 24th. Finally, BMO Capital Markets upgraded Cal-Maine Foods to a "hold" rating in a research note on Tuesday, May 6th.

Get Our Latest Stock Report on Cal-Maine Foods

Insider Transactions at Cal-Maine Foods

In other Cal-Maine Foods news, insider Adolphus B. Baker sold 140,266 shares of Cal-Maine Foods stock in a transaction dated Thursday, April 17th. The stock was sold at an average price of $90.60, for a total transaction of $12,708,099.60. Following the transaction, the insider now directly owns 1,319,034 shares of the company's stock, valued at approximately $119,504,480.40. The trade was a 9.61% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Company insiders own 13.45% of the company's stock.

Cal-Maine Foods Company Profile

(

Free Report)

Cal-Maine Foods, Inc, together with its subsidiaries, produces, grades, packages, markets, and distributes shell eggs. The company offers specialty shell eggs, such as nutritionally enhanced, cage free, organic, free-range, pasture-raised, and brown eggs under the Egg-Land's Best, Land O' Lakes, Farmhouse Eggs, Sunups, Sunny Meadow, and 4Grain brand names.

Featured Stories

Before you consider Cal-Maine Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cal-Maine Foods wasn't on the list.

While Cal-Maine Foods currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.