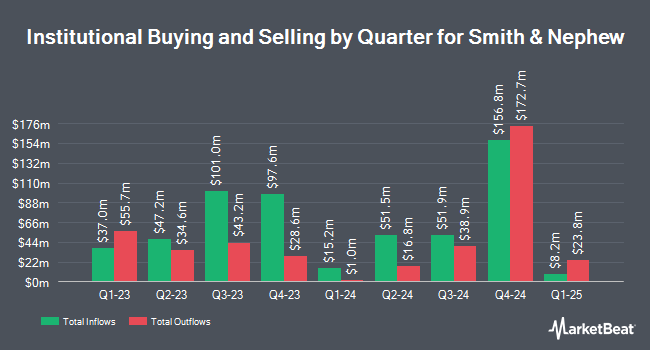

Tocqueville Asset Management L.P. lifted its stake in shares of Smith & Nephew SNATS, Inc. (NYSE:SNN - Free Report) by 91.6% in the first quarter, according to the company in its most recent filing with the SEC. The fund owned 251,563 shares of the medical equipment provider's stock after buying an additional 120,291 shares during the quarter. Tocqueville Asset Management L.P. owned about 0.06% of Smith & Nephew SNATS worth $7,137,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also bought and sold shares of the company. J. Goldman & Co LP bought a new position in shares of Smith & Nephew SNATS during the fourth quarter valued at $47,700,000. Clark Estates Inc. NY lifted its position in shares of Smith & Nephew SNATS by 6.3% during the 1st quarter. Clark Estates Inc. NY now owns 850,000 shares of the medical equipment provider's stock valued at $24,114,000 after acquiring an additional 50,000 shares during the period. Envestnet Asset Management Inc. boosted its position in shares of Smith & Nephew SNATS by 15.6% during the 1st quarter. Envestnet Asset Management Inc. now owns 618,691 shares of the medical equipment provider's stock worth $17,552,000 after purchasing an additional 83,341 shares in the last quarter. Northern Trust Corp increased its holdings in shares of Smith & Nephew SNATS by 169.9% during the fourth quarter. Northern Trust Corp now owns 508,392 shares of the medical equipment provider's stock valued at $12,496,000 after acquiring an additional 320,054 shares in the last quarter. Finally, New York State Common Retirement Fund grew its holdings in shares of Smith & Nephew SNATS by 19.5% during the first quarter. New York State Common Retirement Fund now owns 291,148 shares of the medical equipment provider's stock valued at $8,260,000 after buying an additional 47,567 shares during the last quarter. Institutional investors and hedge funds own 25.64% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have recently issued reports on the company. Canaccord Genuity Group raised their target price on Smith & Nephew SNATS from $28.00 to $36.00 and gave the company a "hold" rating in a research report on Monday. HSBC lowered shares of Smith & Nephew SNATS from a "buy" rating to a "hold" rating in a report on Friday, April 25th. Finally, Hsbc Global Res cut Smith & Nephew SNATS from a "strong-buy" rating to a "hold" rating in a report on Friday, April 25th. Six equities research analysts have rated the stock with a Hold rating, According to data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $36.00.

Get Our Latest Stock Report on Smith & Nephew SNATS

Smith & Nephew SNATS Stock Performance

SNN traded up $0.5850 during trading on Tuesday, hitting $36.8750. The company's stock had a trading volume of 727,862 shares, compared to its average volume of 1,001,689. The firm has a market cap of $16.15 billion, a PE ratio of 17.07, a P/E/G ratio of 1.00 and a beta of 0.68. The company has a quick ratio of 1.40, a current ratio of 3.00 and a debt-to-equity ratio of 0.60. The business's 50 day simple moving average is $31.51 and its 200-day simple moving average is $29.00. Smith & Nephew SNATS, Inc. has a one year low of $23.69 and a one year high of $36.89.

Smith & Nephew SNATS Cuts Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Friday, November 7th. Stockholders of record on Friday, October 3rd will be issued a $0.285 dividend. This represents a dividend yield of 210.0%. The ex-dividend date is Friday, October 3rd. Smith & Nephew SNATS's dividend payout ratio is presently 41.20%.

About Smith & Nephew SNATS

(

Free Report)

Smith & Nephew plc engages in the development, manufacture, marketing, and sale of medical devices. It operates through the following segments: Orthopaedics, Sports Medicine and ENT, and Advanced Wound Management. The Orthopaedics and Sports Medicine and ENT segment consists of the following businesses: knee implants, hip implants, other reconstruction, trauma, sports medicine joint repair, arthroscopic enabling technologies, and ENT.

Featured Stories

Before you consider Smith & Nephew SNATS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Smith & Nephew SNATS wasn't on the list.

While Smith & Nephew SNATS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.