Trexquant Investment LP raised its position in Topgolf Callaway Brands Corp. (NYSE:MODG - Free Report) by 120.1% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 470,060 shares of the company's stock after acquiring an additional 256,503 shares during the period. Trexquant Investment LP owned about 0.26% of Topgolf Callaway Brands worth $3,098,000 as of its most recent SEC filing.

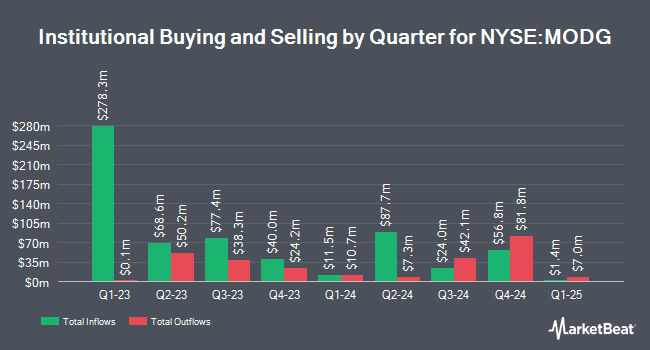

Several other large investors have also recently added to or reduced their stakes in MODG. Raymond James Financial Inc. acquired a new position in Topgolf Callaway Brands in the 4th quarter valued at approximately $380,000. Marshall Wace LLP acquired a new position in shares of Topgolf Callaway Brands in the 4th quarter worth approximately $135,000. Stifel Financial Corp acquired a new position in shares of Topgolf Callaway Brands in the 4th quarter worth approximately $83,000. Hsbc Holdings PLC raised its holdings in shares of Topgolf Callaway Brands by 82.6% in the 4th quarter. Hsbc Holdings PLC now owns 33,238 shares of the company's stock worth $261,000 after buying an additional 15,032 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD raised its holdings in shares of Topgolf Callaway Brands by 10.8% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 96,124 shares of the company's stock worth $756,000 after buying an additional 9,369 shares in the last quarter. Institutional investors and hedge funds own 84.69% of the company's stock.

Topgolf Callaway Brands Trading Up 0.2%

MODG traded up $0.02 during mid-day trading on Monday, reaching $9.25. The stock had a trading volume of 524,470 shares, compared to its average volume of 2,904,368. The stock has a market capitalization of $1.70 billion, a P/E ratio of -1.14 and a beta of 1.25. The company has a debt-to-equity ratio of 0.48, a quick ratio of 1.25 and a current ratio of 1.85. The firm's fifty day simple moving average is $9.25 and its two-hundred day simple moving average is $7.61. Topgolf Callaway Brands Corp. has a 52 week low of $5.42 and a 52 week high of $11.28.

Topgolf Callaway Brands (NYSE:MODG - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The company reported $0.24 EPS for the quarter, beating analysts' consensus estimates of $0.03 by $0.21. The firm had revenue of $1.11 billion for the quarter, compared to analyst estimates of $1.08 billion. Topgolf Callaway Brands had a positive return on equity of 0.37% and a negative net margin of 36.08%.The business's quarterly revenue was down 4.1% compared to the same quarter last year. During the same period last year, the company earned $0.42 EPS. On average, equities analysts predict that Topgolf Callaway Brands Corp. will post 0.16 EPS for the current year.

Analyst Ratings Changes

A number of equities analysts have recently issued reports on the company. Cfra reissued a "hold" rating and issued a $9.00 target price on shares of Topgolf Callaway Brands in a report on Friday, July 11th. B. Riley reissued a "neutral" rating and issued a $9.50 target price (up from $7.00) on shares of Topgolf Callaway Brands in a report on Monday, August 11th. Morgan Stanley initiated coverage on Topgolf Callaway Brands in a research report on Friday, July 18th. They set an "equal weight" rating and a $9.50 price target on the stock. Wall Street Zen upgraded Topgolf Callaway Brands from a "sell" rating to a "hold" rating in a research report on Saturday, August 9th. Finally, JPMorgan Chase & Co. decreased their price target on Topgolf Callaway Brands from $8.00 to $7.00 and set a "neutral" rating on the stock in a research report on Tuesday, May 27th. Three equities research analysts have rated the stock with a Buy rating and seven have assigned a Hold rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $10.00.

Get Our Latest Stock Analysis on Topgolf Callaway Brands

Insider Activity

In related news, Director Adebayo O. Ogunlesi purchased 38,782 shares of the business's stock in a transaction dated Tuesday, June 10th. The shares were bought at an average price of $7.59 per share, with a total value of $294,355.38. Following the purchase, the director directly owned 845,284 shares in the company, valued at $6,415,705.56. This trade represents a 4.81% increase in their position. The acquisition was disclosed in a filing with the SEC, which is available at this link. Also, Director Erik J. Anderson sold 25,704 shares of the stock in a transaction on Friday, August 8th. The shares were sold at an average price of $9.25, for a total value of $237,762.00. Following the completion of the transaction, the director directly owned 20,607 shares in the company, valued at approximately $190,614.75. This trade represents a 55.50% decrease in their position. The disclosure for this sale can be found here. 2.40% of the stock is currently owned by company insiders.

About Topgolf Callaway Brands

(

Free Report)

Topgolf Callaway Brands Corp. designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally. The Topgolf segment operates Topgolf venues equipped with technology-enabled hitting bays, bars, dining areas, and event spaces, as well as Toptracer ball-flight tracking technology; and World Golf Tour digital golf game.

Featured Articles

Before you consider Topgolf Callaway Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Topgolf Callaway Brands wasn't on the list.

While Topgolf Callaway Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.