Townsquare Capital LLC bought a new position in FirstCash Holdings, Inc. (NASDAQ:FCFS - Free Report) in the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor bought 6,850 shares of the company's stock, valued at approximately $824,000.

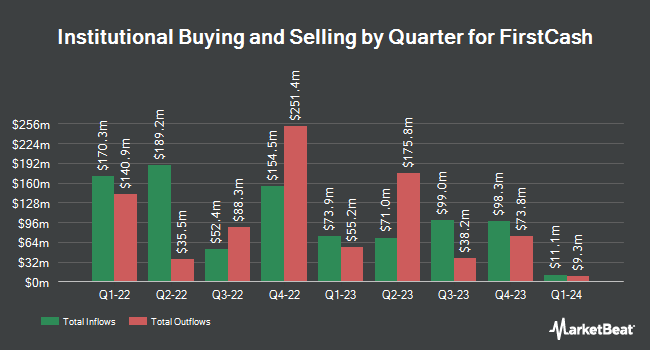

Several other hedge funds also recently bought and sold shares of the company. Earnest Partners LLC boosted its holdings in shares of FirstCash by 2.3% during the 4th quarter. Earnest Partners LLC now owns 2,338,671 shares of the company's stock valued at $242,286,000 after purchasing an additional 52,409 shares during the last quarter. Fiduciary Management Inc. WI boosted its holdings in shares of FirstCash by 76.1% during the 4th quarter. Fiduciary Management Inc. WI now owns 1,303,533 shares of the company's stock valued at $135,046,000 after purchasing an additional 563,265 shares during the last quarter. Dimensional Fund Advisors LP boosted its holdings in shares of FirstCash by 0.9% during the 4th quarter. Dimensional Fund Advisors LP now owns 1,043,531 shares of the company's stock valued at $108,107,000 after purchasing an additional 9,264 shares during the last quarter. Stephens Investment Management Group LLC boosted its holdings in shares of FirstCash by 14.5% during the 1st quarter. Stephens Investment Management Group LLC now owns 888,834 shares of the company's stock valued at $106,945,000 after purchasing an additional 112,349 shares during the last quarter. Finally, Vaughan Nelson Investment Management L.P. boosted its holdings in shares of FirstCash by 14.3% during the 1st quarter. Vaughan Nelson Investment Management L.P. now owns 640,521 shares of the company's stock valued at $77,067,000 after purchasing an additional 79,930 shares during the last quarter. Institutional investors own 80.30% of the company's stock.

FirstCash Trading Down 0.3%

Shares of NASDAQ:FCFS traded down $0.41 during trading on Thursday, reaching $138.70. The company's stock had a trading volume of 403,384 shares, compared to its average volume of 385,679. The company has a current ratio of 4.21, a quick ratio of 3.12 and a debt-to-equity ratio of 0.79. FirstCash Holdings, Inc. has a 12 month low of $100.24 and a 12 month high of $141.56. The firm's 50 day simple moving average is $132.98 and its two-hundred day simple moving average is $125.78. The stock has a market capitalization of $6.15 billion, a PE ratio of 21.31 and a beta of 0.68.

FirstCash (NASDAQ:FCFS - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The company reported $1.79 EPS for the quarter, beating analysts' consensus estimates of $1.66 by $0.13. FirstCash had a net margin of 8.61% and a return on equity of 16.63%. The firm had revenue of $830.62 million during the quarter, compared to the consensus estimate of $820.42 million. During the same quarter last year, the firm earned $1.37 EPS. The firm's revenue for the quarter was up .0% compared to the same quarter last year. On average, research analysts predict that FirstCash Holdings, Inc. will post 7.7 EPS for the current fiscal year.

FirstCash Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, August 29th. Investors of record on Friday, August 15th will be given a $0.42 dividend. This is an increase from FirstCash's previous quarterly dividend of $0.38. The ex-dividend date of this dividend is Friday, August 15th. This represents a $1.68 dividend on an annualized basis and a yield of 1.2%. FirstCash's dividend payout ratio is currently 25.81%.

Insider Buying and Selling

In related news, Director James H. Graves sold 6,000 shares of the stock in a transaction dated Monday, August 4th. The shares were sold at an average price of $134.56, for a total value of $807,360.00. Following the sale, the director directly owned 15,846 shares of the company's stock, valued at $2,132,237.76. This represents a 27.46% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Rick L. Wessel sold 30,976 shares of the stock in a transaction dated Thursday, August 21st. The stock was sold at an average price of $139.33, for a total transaction of $4,315,886.08. Following the completion of the sale, the chief executive officer directly owned 901,982 shares in the company, valued at $125,673,152.06. This trade represents a 3.32% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 109,900 shares of company stock valued at $15,193,007 in the last ninety days. 2.93% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

Several research analysts have commented on FCFS shares. Wall Street Zen downgraded shares of FirstCash from a "strong-buy" rating to a "buy" rating in a report on Saturday, July 12th. Capital One Financial set a $160.00 price objective on shares of FirstCash in a report on Tuesday, August 5th. Jefferies Financial Group raised shares of FirstCash to a "strong-buy" rating in a report on Monday. Finally, Cowen reissued a "buy" rating on shares of FirstCash in a report on Monday. One investment analyst has rated the stock with a Strong Buy rating and three have issued a Buy rating to the company. According to MarketBeat, the stock has an average rating of "Buy" and an average target price of $142.33.

Get Our Latest Stock Report on FCFS

FirstCash Company Profile

(

Free Report)

FirstCash Holdings, Inc, together with its subsidiaries, operates retail pawn stores in the United States, Mexico, and rest of Latin America. The company operates in three segments: U.S. Pawn, Latin America Pawn, and Retail POS Payment Solutions segments. Its pawn stores lend money on the collateral of pledged personal property, including jewelry, electronics, tools, appliances, sporting goods, and musical instruments; and retails merchandise acquired through collateral forfeitures on forfeited pawn loans and over-the-counter purchases of merchandise directly from customers.

See Also

Before you consider FirstCash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstCash wasn't on the list.

While FirstCash currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report