Townsquare Capital LLC acquired a new position in Option Care Health, Inc. (NASDAQ:OPCH - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 19,812 shares of the company's stock, valued at approximately $692,000.

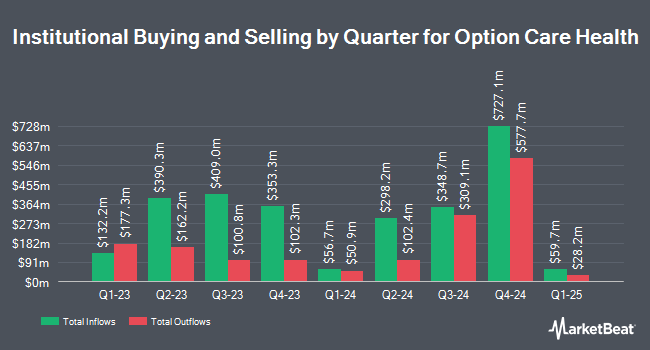

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the business. Public Employees Retirement System of Ohio grew its holdings in Option Care Health by 21.6% during the 4th quarter. Public Employees Retirement System of Ohio now owns 1,870 shares of the company's stock valued at $43,000 after buying an additional 332 shares in the last quarter. Johnson Financial Group Inc. purchased a new position in shares of Option Care Health in the 4th quarter worth approximately $47,000. Bessemer Group Inc. lifted its stake in shares of Option Care Health by 62.3% during the 1st quarter. Bessemer Group Inc. now owns 1,560 shares of the company's stock worth $54,000 after acquiring an additional 599 shares during the last quarter. Wealthquest Corp bought a new stake in shares of Option Care Health during the 1st quarter worth approximately $66,000. Finally, Farther Finance Advisors LLC raised its position in Option Care Health by 434.8% during the 1st quarter. Farther Finance Advisors LLC now owns 1,920 shares of the company's stock valued at $67,000 after purchasing an additional 1,561 shares in the last quarter. Institutional investors own 98.05% of the company's stock.

Option Care Health Price Performance

OPCH stock traded up $0.36 during mid-day trading on Tuesday, reaching $28.55. 1,260,285 shares of the company's stock were exchanged, compared to its average volume of 1,836,289. The company has a market cap of $4.63 billion, a price-to-earnings ratio of 22.84, a price-to-earnings-growth ratio of 1.79 and a beta of 0.79. The stock's 50 day moving average is $30.22 and its 200 day moving average is $31.84. The company has a debt-to-equity ratio of 0.81, a current ratio of 1.52 and a quick ratio of 1.00. Option Care Health, Inc. has a 12-month low of $21.39 and a 12-month high of $35.53.

Option Care Health (NASDAQ:OPCH - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The company reported $0.41 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.40 by $0.01. The company had revenue of $1.42 billion for the quarter, compared to the consensus estimate of $1.35 billion. Option Care Health had a return on equity of 17.53% and a net margin of 3.93%.Option Care Health's revenue for the quarter was up 15.4% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.30 earnings per share. Option Care Health has set its FY 2025 guidance at 1.650-1.720 EPS. On average, research analysts expect that Option Care Health, Inc. will post 1.22 EPS for the current year.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on the company. Citigroup reaffirmed an "outperform" rating on shares of Option Care Health in a research report on Thursday, July 31st. Barrington Research reaffirmed an "outperform" rating and set a $38.00 target price on shares of Option Care Health in a research report on Thursday, July 10th. UBS Group upgraded Option Care Health from a "neutral" rating to a "buy" rating and boosted their price target for the company from $38.00 to $40.00 in a research note on Wednesday, April 30th. Finally, JMP Securities boosted their price target on Option Care Health from $36.00 to $38.00 and gave the company a "market outperform" rating in a research note on Thursday, July 31st. Eight analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $35.75.

Check Out Our Latest Stock Analysis on Option Care Health

About Option Care Health

(

Free Report)

Option Care Health, Inc offers home and alternate site infusion services in the United States. The company provides anti-infective therapies; home infusion services to treat heart failures; home parenteral nutrition and enteral nutrition support services for numerous acute and chronic conditions, such as stroke, cancer, and gastrointestinal diseases; immunoglobulin infusion therapies for the treatment of immune deficiencies; and treatments for chronic inflammatory disorders, including crohn's disease, plaque psoriasis, psoriatic arthritis, rheumatoid arthritis, ulcerative colitis, and other chronic inflammatory disorders.

Recommended Stories

Before you consider Option Care Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Option Care Health wasn't on the list.

While Option Care Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.