Trexquant Investment LP grew its holdings in shares of Primerica, Inc. (NYSE:PRI - Free Report) by 36.6% in the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 47,622 shares of the financial services provider's stock after purchasing an additional 12,752 shares during the period. Trexquant Investment LP owned approximately 0.14% of Primerica worth $13,550,000 as of its most recent SEC filing.

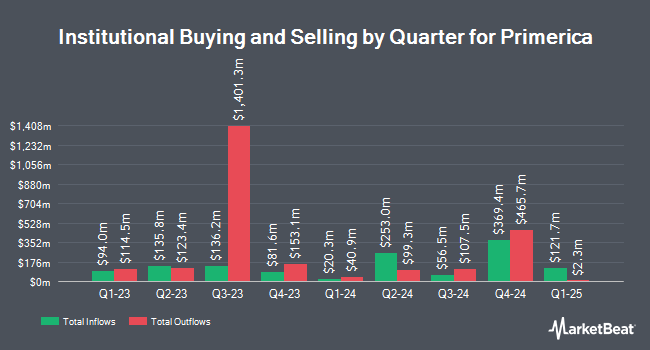

Several other large investors have also recently made changes to their positions in PRI. Nuveen LLC bought a new stake in shares of Primerica during the first quarter valued at approximately $156,019,000. GAMMA Investing LLC raised its stake in Primerica by 39,199.5% during the 1st quarter. GAMMA Investing LLC now owns 443,298 shares of the financial services provider's stock valued at $126,132,000 after purchasing an additional 442,170 shares during the period. AQR Capital Management LLC raised its stake in Primerica by 254.5% during the 4th quarter. AQR Capital Management LLC now owns 116,271 shares of the financial services provider's stock valued at $31,558,000 after purchasing an additional 83,477 shares during the period. Cubist Systematic Strategies LLC boosted its holdings in shares of Primerica by 2,508.8% during the 4th quarter. Cubist Systematic Strategies LLC now owns 57,499 shares of the financial services provider's stock valued at $15,606,000 after purchasing an additional 55,295 shares during the last quarter. Finally, Northern Trust Corp boosted its holdings in shares of Primerica by 15.6% during the 4th quarter. Northern Trust Corp now owns 347,040 shares of the financial services provider's stock valued at $94,194,000 after purchasing an additional 46,935 shares during the last quarter. 90.88% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several analysts have recently issued reports on PRI shares. Jefferies Financial Group decreased their target price on shares of Primerica from $293.00 to $283.00 and set a "hold" rating on the stock in a research report on Monday, August 11th. Keefe, Bruyette & Woods raised their target price on shares of Primerica from $315.00 to $320.00 and gave the stock a "market perform" rating in a research report on Monday, August 11th. Finally, Morgan Stanley increased their price objective on shares of Primerica from $292.00 to $308.00 and gave the company an "equal weight" rating in a research note on Monday, August 18th. Two investment analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company. According to data from MarketBeat.com, Primerica currently has a consensus rating of "Hold" and a consensus price target of $315.29.

Get Our Latest Stock Report on PRI

Insider Activity

In other news, CEO Glenn J. Williams sold 2,500 shares of Primerica stock in a transaction dated Tuesday, August 12th. The shares were sold at an average price of $262.20, for a total value of $655,500.00. Following the sale, the chief executive officer owned 36,392 shares in the company, valued at $9,541,982.40. This trade represents a 6.43% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 0.61% of the stock is currently owned by company insiders.

Primerica Stock Performance

Shares of Primerica stock traded down $2.79 during trading on Tuesday, hitting $266.55. 79,998 shares of the company's stock were exchanged, compared to its average volume of 168,819. The business has a 50-day simple moving average of $266.53 and a 200-day simple moving average of $269.14. Primerica, Inc. has a 52-week low of $230.98 and a 52-week high of $307.91. The stock has a market capitalization of $8.63 billion, a price-to-earnings ratio of 13.15 and a beta of 1.00.

Primerica (NYSE:PRI - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The financial services provider reported $5.46 earnings per share for the quarter, beating analysts' consensus estimates of $5.18 by $0.28. Primerica had a net margin of 21.48% and a return on equity of 32.42%. The company had revenue of $796.02 million during the quarter, compared to analysts' expectations of $790.99 million. During the same quarter in the previous year, the company earned $4.71 earnings per share. The firm's revenue for the quarter was up .3% on a year-over-year basis. On average, equities analysts anticipate that Primerica, Inc. will post 20.6 earnings per share for the current fiscal year.

Primerica Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, August 22nd will be given a $1.04 dividend. The ex-dividend date is Friday, August 22nd. This represents a $4.16 annualized dividend and a dividend yield of 1.6%. Primerica's dividend payout ratio (DPR) is 20.55%.

About Primerica

(

Free Report)

Primerica, Inc, together with its subsidiaries, provides financial products and services to middle-income households in the United States and Canada. The company operates in four segments: Term Life Insurance; Investment and Savings Products; Senior Health; and Corporate and Other Distributed Products.

Featured Articles

Before you consider Primerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Primerica wasn't on the list.

While Primerica currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.