Triata Capital Ltd grew its stake in shares of Qfin Holdings Inc. - Sponsored ADR (NASDAQ:QFIN - Free Report) by 71.9% in the first quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 106,131 shares of the company's stock after acquiring an additional 44,384 shares during the period. Qfin comprises 1.1% of Triata Capital Ltd's investment portfolio, making the stock its 12th biggest position. Triata Capital Ltd owned approximately 0.07% of Qfin worth $4,766,000 as of its most recent filing with the Securities & Exchange Commission.

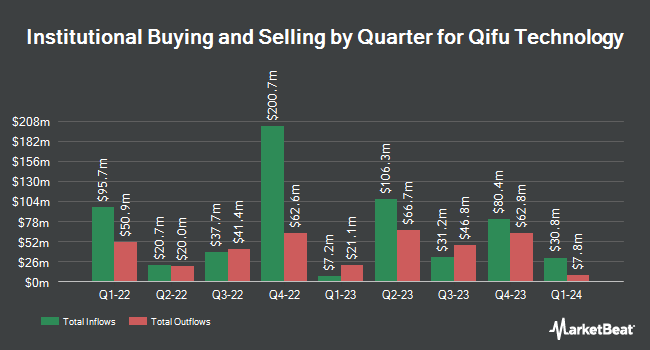

A number of other institutional investors and hedge funds have also recently modified their holdings of QFIN. HB Wealth Management LLC lifted its stake in shares of Qfin by 7.2% during the 1st quarter. HB Wealth Management LLC now owns 6,431 shares of the company's stock valued at $289,000 after buying an additional 431 shares in the last quarter. GeoWealth Management LLC purchased a new stake in shares of Qfin during the 4th quarter valued at approximately $26,000. HighTower Advisors LLC lifted its stake in shares of Qfin by 5.6% during the 1st quarter. HighTower Advisors LLC now owns 15,484 shares of the company's stock valued at $695,000 after buying an additional 823 shares in the last quarter. Nuveen Asset Management LLC lifted its stake in shares of Qfin by 0.5% during the 4th quarter. Nuveen Asset Management LLC now owns 242,000 shares of the company's stock valued at $9,288,000 after buying an additional 1,100 shares in the last quarter. Finally, Townsquare Capital LLC lifted its stake in shares of Qfin by 4.5% during the 1st quarter. Townsquare Capital LLC now owns 26,218 shares of the company's stock valued at $1,177,000 after buying an additional 1,120 shares in the last quarter. 74.81% of the stock is owned by institutional investors.

Qfin Price Performance

NASDAQ QFIN traded up $0.78 on Friday, hitting $31.45. The stock had a trading volume of 1,580,249 shares, compared to its average volume of 2,307,090. Qfin Holdings Inc. - Sponsored ADR has a 52-week low of $24.30 and a 52-week high of $48.94. The company has a debt-to-equity ratio of 0.20, a quick ratio of 3.08 and a current ratio of 3.48. The company has a market capitalization of $4.96 billion, a price-to-earnings ratio of 4.44, a price-to-earnings-growth ratio of 0.31 and a beta of 0.39. The firm has a 50-day moving average of $38.64 and a 200-day moving average of $40.73.

Qfin (NASDAQ:QFIN - Get Free Report) last posted its earnings results on Thursday, August 14th. The company reported $1.78 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.79 by ($0.01). Qfin had a return on equity of 30.74% and a net margin of 38.66%.The firm had revenue of $728.00 million during the quarter, compared to analysts' expectations of $4.68 billion. Equities analysts expect that Qfin Holdings Inc. - Sponsored ADR will post 5.71 EPS for the current year.

Qfin Increases Dividend

The company also recently announced a semi-annual dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Monday, September 8th will be paid a $0.76 dividend. The ex-dividend date is Monday, September 8th. This represents a yield of 440.0%. This is a boost from Qfin's previous semi-annual dividend of $0.70. Qfin's dividend payout ratio is currently 21.19%.

Analyst Ratings Changes

QFIN has been the topic of a number of recent research reports. Wall Street Zen cut shares of Qfin from a "buy" rating to a "hold" rating in a research note on Friday. JPMorgan Chase & Co. initiated coverage on shares of Qfin in a research note on Wednesday, July 2nd. They set an "overweight" rating and a $65.00 price target on the stock. Three analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the company has an average rating of "Buy" and a consensus price target of $51.73.

Read Our Latest Report on Qfin

Qfin Profile

(

Free Report)

Qifu Technology, Inc, through its subsidiaries, operates credit-tech platform under the 360 Jietiao brand in the People's Republic of China. It provides credit-driven services that matches borrowers with financial institutions to conduct customer acquisition, initial and credit screening, advanced risk assessment, credit assessment, fund matching, and other post-facilitation services; and platform services, including loan facilitation and post-facilitation services to financial institution partners under intelligence credit engine, referral services, and risk management software-as-a-service.

Further Reading

Before you consider Qfin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qfin wasn't on the list.

While Qfin currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.