Trivium Point Advisory LLC decreased its stake in shares of Anheuser-Busch InBev SA/NV (NYSE:BUD - Free Report) by 83.7% in the 2nd quarter, according to its most recent 13F filing with the SEC. The firm owned 4,258 shares of the consumer goods maker's stock after selling 21,792 shares during the period. Trivium Point Advisory LLC's holdings in Anheuser-Busch InBev SA/NV were worth $293,000 as of its most recent filing with the SEC.

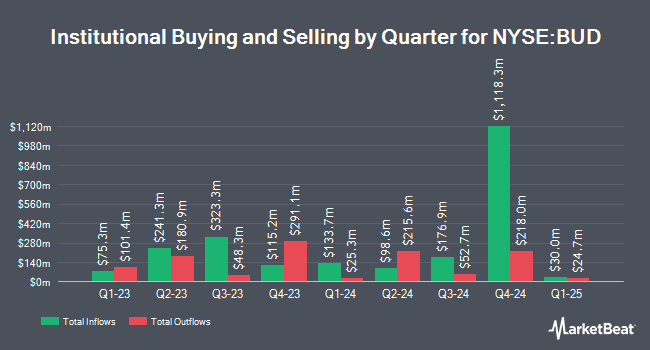

Other hedge funds and other institutional investors have also bought and sold shares of the company. ABC Arbitrage SA acquired a new stake in Anheuser-Busch InBev SA/NV in the 1st quarter worth about $1,731,000. Sequoia Financial Advisors LLC raised its stake in Anheuser-Busch InBev SA/NV by 224.7% in the 1st quarter. Sequoia Financial Advisors LLC now owns 25,254 shares of the consumer goods maker's stock worth $1,555,000 after purchasing an additional 17,476 shares in the last quarter. Merit Financial Group LLC raised its stake in Anheuser-Busch InBev SA/NV by 31.7% in the 1st quarter. Merit Financial Group LLC now owns 14,635 shares of the consumer goods maker's stock worth $901,000 after purchasing an additional 3,526 shares in the last quarter. Vident Advisory LLC acquired a new stake in Anheuser-Busch InBev SA/NV in the 1st quarter worth about $310,000. Finally, Pinnacle Financial Partners Inc acquired a new stake in Anheuser-Busch InBev SA/NV in the 1st quarter worth about $2,341,000. Institutional investors and hedge funds own 5.53% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have weighed in on BUD shares. JPMorgan Chase & Co. reiterated a "buy" rating on shares of Anheuser-Busch InBev SA/NV in a research note on Tuesday. Deutsche Bank Aktiengesellschaft reiterated a "buy" rating on shares of Anheuser-Busch InBev SA/NV in a research note on Tuesday. Sanford C. Bernstein restated a "buy" rating on shares of Anheuser-Busch InBev SA/NV in a research report on Tuesday. Berenberg Bank restated a "buy" rating on shares of Anheuser-Busch InBev SA/NV in a research report on Thursday, September 18th. Finally, The Goldman Sachs Group restated a "buy" rating on shares of Anheuser-Busch InBev SA/NV in a research report on Thursday, September 25th. Two investment analysts have rated the stock with a Strong Buy rating, nine have issued a Buy rating and one has given a Hold rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Buy" and a consensus target price of $71.00.

Check Out Our Latest Research Report on BUD

Anheuser-Busch InBev SA/NV Price Performance

Shares of NYSE:BUD opened at $59.54 on Thursday. The firm has a 50 day moving average of $61.13 and a 200-day moving average of $64.79. The stock has a market capitalization of $116.25 billion, a PE ratio of 16.72, a PEG ratio of 1.71 and a beta of 0.76. The company has a current ratio of 0.64, a quick ratio of 0.48 and a debt-to-equity ratio of 0.79. Anheuser-Busch InBev SA/NV has a 12 month low of $45.94 and a 12 month high of $72.13.

Anheuser-Busch InBev SA/NV (NYSE:BUD - Get Free Report) last released its quarterly earnings data on Thursday, July 31st. The consumer goods maker reported $0.98 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.94 by $0.04. Anheuser-Busch InBev SA/NV had a net margin of 12.16% and a return on equity of 16.21%. The business's quarterly revenue was down 2.1% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.90 earnings per share. On average, equities research analysts predict that Anheuser-Busch InBev SA/NV will post 3.37 EPS for the current fiscal year.

Anheuser-Busch InBev SA/NV Company Profile

(

Free Report)

Anheuser-Busch InBev SA/NV produces, distributes, exports, markets, and sells beer and beverages. It offers a portfolio of approximately 500 beer brands, which primarily include Budweiser, Corona, and Stella Artois; Beck's, Hoegaarden, Leffe, and Michelob Ultra; and Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol brands.

See Also

Want to see what other hedge funds are holding BUD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Anheuser-Busch InBev SA/NV (NYSE:BUD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.